- Power BI forums

- Updates

- News & Announcements

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Power Platform Integration - Better Together!

- Power Platform Integrations (Read-only)

- Power Platform and Dynamics 365 Integrations (Read-only)

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Community Connections & How-To Videos

- COVID-19 Data Stories Gallery

- Themes Gallery

- Data Stories Gallery

- R Script Showcase

- Webinars and Video Gallery

- Quick Measures Gallery

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas

- Issues

- Issues

- Events

- Upcoming Events

- Community Blog

- Power BI Community Blog

- Custom Visuals Community Blog

- Community Support

- Community Accounts & Registration

- Using the Community

- Community Feedback

Register now to learn Fabric in free live sessions led by the best Microsoft experts. From Apr 16 to May 9, in English and Spanish.

- Power BI forums

- Forums

- Get Help with Power BI

- DAX Commands and Tips

- Require help to calculate Cumulative Recognised Re...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Require help to calculate Cumulative Recognised Revenue until prior month

Hi,

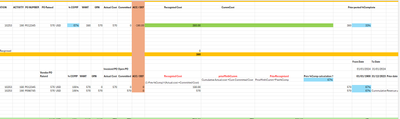

I'm seeking assistance with a DAX issue where I'm attempting to incorporate previously recognized revenues in the current month's report. Specifically, when a user is selecting January dates from date slicer having start date and end date, the following cumulative calculations need to be added up in the current month's calculations :

- Prior Cumulative % Complete (highlighted in sky blue in the attached Excel, 67%)

- Prior Month Cumulative Cost (Actual + Committed Cost)

- Prior Month Recognized Cost (PriorMnthCumm*Prev%Comp that is point 1* 2)

- Current Month Recognized Cost ((1-Prev %Comp)*(Actual cost +Committed Cost)

In essence, I'm looking to create measures that capture the calculations mentioned. Points 3 and 4 involve deriving results from measures created for points 1 and 2, so the primary focus is on developing measures for the calculations related to 1 and 2.

Any prompt help or guidance would be greatly appreciated. Thank you!

Note: Unfortunately, I couldn't attach the Excel sheet, so I've included a screenshot instead. The data above the orange line represents the prior month's data, while the data below the orange line pertains to the current month. I hope this visual aid proves helpful!

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Here's a general approach to creating these measures:

Prior Cumulative % Complete (Point 1):

- This measure calculates the cumulative percentage complete until the end of the previous month.

- You can use DAX functions like TOTALYTD or DATESYTD to calculate the cumulative total.

Prior Month Cumulative Cost (Actual + Committed Cost):

- Create a measure that sums up the Actual and Committed costs for the prior month.

Prior Month Recognized Cost (PriorMnthCumm * Prev % Comp):

- Multiply the Prior Month Cumulative Cost by the Prior Cumulative % Complete.

Current Month Recognized Cost ((1 - Prev % Comp) * (Actual cost + Committed Cost)):

- Calculate the remaining portion of the current month's costs based on the percentage complete for the current month.

Here's how you might implement these measures in DAX:

Prior Cumulative % Complete =

CALCULATE(

[Cumulative % Complete],

FILTER(

ALL('Date'[Date]),

'Date'[Date] <= MAX('Date'[Date]) - 1

)

)

Prior Month Cumulative Cost =

CALCULATE(

[Actual Cost] + [Committed Cost],

FILTER(

ALL('Date'[Date]),

'Date'[Date] >= STARTOFMONTH(MAX('Date'[Date])) - 1 &&

'Date'[Date] < STARTOFMONTH(MAX('Date'[Date]))

)

)

Prior Month Recognized Cost = [Prior Month Cumulative Cost] * [Prior Cumulative % Complete]

Current Month Recognized Cost =

(

1 - [Prior Cumulative % Complete]

) * (

[Actual Cost] + [Committed Cost]

)

Please adjust the measures according to your data model and requirements. Ensure that you have the necessary date and cost columns in your data model to perform these calculations effectively.

If this post helps, then please consider Accepting it as the solution to help the other members find it more quickly.

In case there is still a problem, please feel free and explain your issue in detail, It will be my pleasure to assist you in any way I can.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Sunila ,

If I understand correctly, the issue is that you want to calculate recognized revenue until prior month. Please try the following methods and check if they can solve your problem:

1.Create a measure that sums the percentage of the previous month.

Prior Cumulative % Complete =

CALCULATE (

SUM ( Table1[Cost] ) / SUM ( Table1[Revenue] ),

FILTER (

ALLSELECTED ( Table1[Date] ),

Table1[Date] <= MIN ( Table1[Date] )

)

)

2.For the cumulative cost of the prior month, use the following DAX formula.

Prior Month Cumulative Cost =

CALCULATE (

SUM ( Table1[Cost] ),

FILTER (

ALLSELECTED ( Table1[Date] ),

Table1[Date] >= EOMONTH ( MIN ( Table1[Date] ), -1 ) &&

Table1[Date] < MIN ( Table1[Date] )

)

)

3.For the Prior Month recognized cost, use the following DAX formula.

Prior Month Recognized Cost =

[Prior Month Cumulative Cost] * [Prior Cumulative % Complete]

4.For the current month recognized cost, use the following DAX formula.

Current Month Recognized Cost =

(

1 - [Prior Cumulative % Complete]

) * (

SUM ( Table1[Cost] ) + SUM ( Table1[Committed Cost] )

)

Best Regards,

Wisdom Wu

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculating Delivered Rev based on your suggested dAX for cost, unfortunately, does not provide the expected results

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Here's a general approach to creating these measures:

Prior Cumulative % Complete (Point 1):

- This measure calculates the cumulative percentage complete until the end of the previous month.

- You can use DAX functions like TOTALYTD or DATESYTD to calculate the cumulative total.

Prior Month Cumulative Cost (Actual + Committed Cost):

- Create a measure that sums up the Actual and Committed costs for the prior month.

Prior Month Recognized Cost (PriorMnthCumm * Prev % Comp):

- Multiply the Prior Month Cumulative Cost by the Prior Cumulative % Complete.

Current Month Recognized Cost ((1 - Prev % Comp) * (Actual cost + Committed Cost)):

- Calculate the remaining portion of the current month's costs based on the percentage complete for the current month.

Here's how you might implement these measures in DAX:

Prior Cumulative % Complete =

CALCULATE(

[Cumulative % Complete],

FILTER(

ALL('Date'[Date]),

'Date'[Date] <= MAX('Date'[Date]) - 1

)

)

Prior Month Cumulative Cost =

CALCULATE(

[Actual Cost] + [Committed Cost],

FILTER(

ALL('Date'[Date]),

'Date'[Date] >= STARTOFMONTH(MAX('Date'[Date])) - 1 &&

'Date'[Date] < STARTOFMONTH(MAX('Date'[Date]))

)

)

Prior Month Recognized Cost = [Prior Month Cumulative Cost] * [Prior Cumulative % Complete]

Current Month Recognized Cost =

(

1 - [Prior Cumulative % Complete]

) * (

[Actual Cost] + [Committed Cost]

)

Please adjust the measures according to your data model and requirements. Ensure that you have the necessary date and cost columns in your data model to perform these calculations effectively.

If this post helps, then please consider Accepting it as the solution to help the other members find it more quickly.

In case there is still a problem, please feel free and explain your issue in detail, It will be my pleasure to assist you in any way I can.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am focusing on calculating cost for now. I did try substituting your DAX cost, but unfortunatley it does not seem to be working as expected. Please see my above comment.

Helpful resources

Microsoft Fabric Learn Together

Covering the world! 9:00-10:30 AM Sydney, 4:00-5:30 PM CET (Paris/Berlin), 7:00-8:30 PM Mexico City

Power BI Monthly Update - April 2024

Check out the April 2024 Power BI update to learn about new features.

| User | Count |

|---|---|

| 45 | |

| 25 | |

| 19 | |

| 16 | |

| 8 |

| User | Count |

|---|---|

| 70 | |

| 48 | |

| 45 | |

| 19 | |

| 16 |