- Power BI forums

- Updates

- News & Announcements

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Power Platform Integration - Better Together!

- Power Platform Integrations (Read-only)

- Power Platform and Dynamics 365 Integrations (Read-only)

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Community Connections & How-To Videos

- COVID-19 Data Stories Gallery

- Themes Gallery

- Data Stories Gallery

- R Script Showcase

- Webinars and Video Gallery

- Quick Measures Gallery

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas

- Issues

- Issues

- Events

- Upcoming Events

- Community Blog

- Power BI Community Blog

- Custom Visuals Community Blog

- Community Support

- Community Accounts & Registration

- Using the Community

- Community Feedback

Register now to learn Fabric in free live sessions led by the best Microsoft experts. From Apr 16 to May 9, in English and Spanish.

- Power BI forums

- Forums

- Get Help with Power BI

- DAX Commands and Tips

- Poor performance of SUMX and Calculate measure

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Poor performance of SUMX and Calculate measure

Hi Community

After computing some custom time intelligence measures my report performance went really bad. Due to not following a Gregorian calendar i have based my measures on the article by SQLBI gents: https://www.daxpatterns.com/custom-time-related-calculations/

Since I'm utilizing their measures, I suspect that the performance issues may stem from my general Sales measure, which is not straightforward due to the need to incorporate currency conversion. I attempted to analyze this using DAX Studio, but I believe my limited DAX knowledge is hindering the solution.

Here is my Sales measure DAX expression:

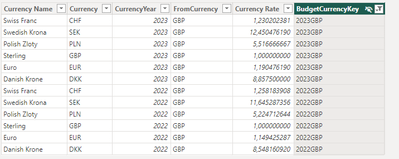

I have a Many-to-Many relationship between FactSales and DimCurrency, and the relevant columns are as follows:

| Currency Name | Currency | CurrencyYear | FromCurrency | Currency Rate | CurrencyKey |

| Swiss Franc | CHF | 2021 | ALL | 0,008601457 | 2021ALL |

| Swiss Franc | CHF | 2021 | CNY | 0,138102169 | 2021CNY |

| Swiss Franc | CHF | 2021 | MXN | 0,045118218 | 2021MXN |

| Swiss Franc | CHF | 2021 | QAR | 0,265412088 | 2021QAR |

I'm unsure whether using SUMX is the most optimal approach and how to best apply the Currency Rate in this scenario..

Thanks in advance

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Considering the data set you provided, it appears to be many-to-one. To illustrate a many-to-many relationship, we can extend the example with more data. Let's also clarify whether the 'DimCurrency' table represents a time-dependent or pegged exchange rate structure for the current year.

If we want to demonstrate a many-to-many relationship, we might introduce additional columns and data points in both 'FactSales' and 'DimCurrency' tables. We could add a 'TransactionDate' column to 'FactSales' to represent when the transactions occurred and associate these dates with different exchange rates in 'DimCurrency.' This would illustrate a situation where there could be multiple exchange rates for different dates in 'DimCurrency.'

Regarding 'DimCurrency,' it depends on your specific business requirements. If it's meant to represent time-dependent exchange rates, you would have a different exchange rate for each currency for each time period (e.g., days, months). If it's pegged to the current year, you might only have one exchange rate for each currency for the entire year.

Additionally, you can create a calculated group to handle the currency conversion logic:

- Retrieve the selected reporting currency, which corresponds to the currency column in the 'DimCurrency' table.

- Multiply the selected measure by the exchange rate selected from 'DimCurrency,' filtering by 'Currency' with the 'SelectedReportingCurrency.' Ensure there is an active relationship between the fact and dim tables.

Here's how you can create the calculated group for currency conversion:

CurrencyConversion =

VAR SelectedReportingCurrency = SELECTEDVALUE('DimCurrency'[Currency])

RETURN

SUMX(

FILTER(

'DimCurrency',

'DimCurrency'[Currency] = SelectedReportingCurrency

),

CALCULATE(

SELECTEDMEASURE() * MIN('DimCurrency'[ExchangeRate]) -- You can use Max as well, it needs to return one value related to the fact

)

)

Lastly, apply this calculated group to your 'FactSales' measure to calculate the converted value:

Fact Sales = CALCULATE([Sales], 'CalculatedGroupName'[Option] = "CurrencyConversion")

This approach uses the "CurrencyConversion" calculated item within the "CalculatedGroupName" calculated group to convert your 'FactSales' measure into the selected reporting currency. Please adapt the actual table and column names to match your specific data model.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Considering the data set you provided, it appears to be many-to-one. To illustrate a many-to-many relationship, we can extend the example with more data. Let's also clarify whether the 'DimCurrency' table represents a time-dependent or pegged exchange rate structure for the current year.

If we want to demonstrate a many-to-many relationship, we might introduce additional columns and data points in both 'FactSales' and 'DimCurrency' tables. We could add a 'TransactionDate' column to 'FactSales' to represent when the transactions occurred and associate these dates with different exchange rates in 'DimCurrency.' This would illustrate a situation where there could be multiple exchange rates for different dates in 'DimCurrency.'

Regarding 'DimCurrency,' it depends on your specific business requirements. If it's meant to represent time-dependent exchange rates, you would have a different exchange rate for each currency for each time period (e.g., days, months). If it's pegged to the current year, you might only have one exchange rate for each currency for the entire year.

Additionally, you can create a calculated group to handle the currency conversion logic:

- Retrieve the selected reporting currency, which corresponds to the currency column in the 'DimCurrency' table.

- Multiply the selected measure by the exchange rate selected from 'DimCurrency,' filtering by 'Currency' with the 'SelectedReportingCurrency.' Ensure there is an active relationship between the fact and dim tables.

Here's how you can create the calculated group for currency conversion:

CurrencyConversion =

VAR SelectedReportingCurrency = SELECTEDVALUE('DimCurrency'[Currency])

RETURN

SUMX(

FILTER(

'DimCurrency',

'DimCurrency'[Currency] = SelectedReportingCurrency

),

CALCULATE(

SELECTEDMEASURE() * MIN('DimCurrency'[ExchangeRate]) -- You can use Max as well, it needs to return one value related to the fact

)

)

Lastly, apply this calculated group to your 'FactSales' measure to calculate the converted value:

Fact Sales = CALCULATE([Sales], 'CalculatedGroupName'[Option] = "CurrencyConversion")

This approach uses the "CurrencyConversion" calculated item within the "CalculatedGroupName" calculated group to convert your 'FactSales' measure into the selected reporting currency. Please adapt the actual table and column names to match your specific data model.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @_elbpower Thanks for your detailed answer

The relationship between FactSales and DimCurrency is Many-to-Many, as it is required to be able to convert to multiple currencies. See below:

DimCurrency' represents a yearly pegged exchange rate structure.

In this case, what solution do you think would be the most optimal?

Again, thanks a lot - really appricate it

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Certainly, the proposed solution remains effective regardless of whether you have a many-to-one or many-to-many relationship in your data model.

The approach involving a slicer that leverages the 'DimCurrency[Currency]' column in your report allows users to choose their desired reporting currency. This practice streamlines the process, reducing unnecessary operations, and dynamically adapts data to the user's currency selection. It ensures that users can view data in their preferred currency, promoting a more user-friendly experience.

If your aim is to display converted values based on the user's choice (one currency at a time), this slicer-based method is well-suited. Users can simply pick a currency from the slicer, and the measures will automatically recalculate values in the chosen currency. This approach caters to user preferences without cluttering the report with multiple conversions simultaneously.

Moreover, it's worth noting that the calculated group approach remains robust, even in scenarios with a many-to-many relationship. While many-to-many relationships may introduce additional intricacies related to intermediary tables or filter propagation, the calculated group method still offers a solution that abstracts the complexity of currency conversion logic. It seamlessly aligns with the relationships you've established in your data model, ensuring that your measures correctly adjust to the user's selected reporting currency, irrespective of the specific relationship type in place.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

All "X" functions should be used with care, as they don't scale well. Iterating over an entire fact table is always a bad idea. I had a simular issue years ago, also with currencies and a fact table without a straightforward relationship with currency rates.

You are probably better of doing this:

- create a simple currency dimension with only the currency code, name, description (dimCurrency)

- save the rates in a different table (factCurrencyRates)

- Create relationships from dimCurrency to both factSalaes and factCurrencyRates

- Your measure should start with SUMX(VALUES(dimCurrency[CurrencyCode]), CALCULATE(SUM(FacctSales) ......

Iterating over hand full of currencies will not e an issue.

Helpful resources

Microsoft Fabric Learn Together

Covering the world! 9:00-10:30 AM Sydney, 4:00-5:30 PM CET (Paris/Berlin), 7:00-8:30 PM Mexico City

Power BI Monthly Update - April 2024

Check out the April 2024 Power BI update to learn about new features.

| User | Count |

|---|---|

| 43 | |

| 26 | |

| 20 | |

| 14 | |

| 8 |

| User | Count |

|---|---|

| 75 | |

| 50 | |

| 47 | |

| 17 | |

| 17 |