- Power BI forums

- Updates

- News & Announcements

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Power Platform Integration - Better Together!

- Power Platform Integrations (Read-only)

- Power Platform and Dynamics 365 Integrations (Read-only)

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Community Connections & How-To Videos

- COVID-19 Data Stories Gallery

- Themes Gallery

- Data Stories Gallery

- R Script Showcase

- Webinars and Video Gallery

- Quick Measures Gallery

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas

- Issues

- Issues

- Events

- Upcoming Events

- Community Blog

- Power BI Community Blog

- Custom Visuals Community Blog

- Community Support

- Community Accounts & Registration

- Using the Community

- Community Feedback

Register now to learn Fabric in free live sessions led by the best Microsoft experts. From Apr 16 to May 9, in English and Spanish.

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- Dynamic column calculation for return of trading s...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dynamic column calculation for return of trading strategy

Hi all

We would like to visualize our trading strategy. We have column 1 with a reference index (Dow Jones). The second column (column 2) contains a trading signal (1 for being invested in the Dow Jones; 0 for not being invested in the Dow Jones). In the third column (column 3), we would like to calculate the return of the trading strategy. We assume an initial investment of 100.

Is it possible to calculate column3 (Trading Strategy) directly in Power BI as a measure (DAX).

Example

| Dow Jones | Trading Signal | Trading Strategy |

| 20941 | 100.00 | |

| 20981 | 1 | 100.19 |

| 20975 | 0 | 100.19 |

| 20996 | 1 | 100.30 |

| 20764 | 0 | 100.30 |

| 20548 | 1 | 99.25 |

In Excel we would use the following excel formula for calculating the trading strategy.

| Excel Formula |

| 100 |

| =IF(B3=1;C2*A3/A2;C2) |

| =IF(B4=1;C3*A4/A3;C3) |

| =IF(B5=1;C4*A5/A4;C4) |

| =IF(B6=1;C5*A6/A5;C5) |

| =IF(B7=1;C6*A7/A6;C6) |

Thanks for any help!

B&L

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

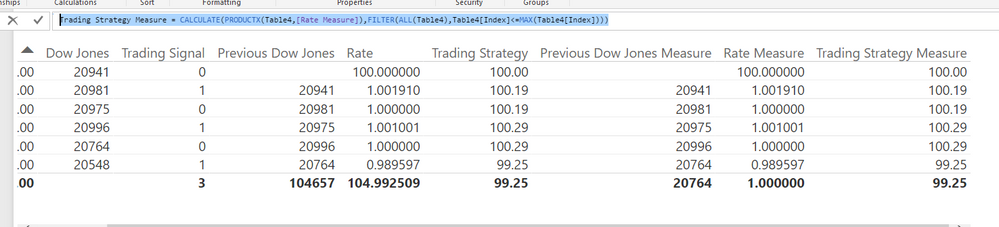

For this scenario, you need to build your Previous Dow Jones into a measure:

Previous Dow Jones Measure = Var CurrentIndex = CALCULATE( MAX( Table4[Index] ) ) return CALCULATE( SUM( Table4[Dow Jones] ), FILTER( ALLSELECTED( Table4 ), Table4[Index] = CurrentIndex - 1 ))

Then create a Rate into a measure as well:

Rate Measure = IF([Previous Dow Jones Measure]=BLANK(),100,(IF(SUM(Table4[Trading Signal])=1,SUM(Table4[Dow Jones])/[Previous Dow Jones Measure],1)))

Now you Trading Strategy should based on above Rate measure.

Trading Strategy Measure = CALCULATE(PRODUCTX(Table4,[Rate Measure]),FILTER(ALL(Table4),Table4[Index]<=MAX(Table4[Index])))

Regards,

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

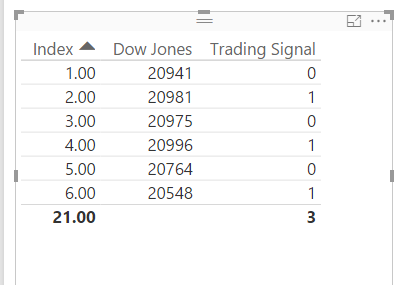

In this scenario, you just need to add a column to get the previous Dow Jones indexes and calculate the rate. Then we can use Product() function to calculate the trending. I assume your Dow Jones indexes is daily, I use an index column in my sample.

1. Create a previous Dow Jones column.

Previous Dow Jones =

CALCULATE (

SUM ( Table4[Dow Jones] ),

FILTER ( Table4, Table4[Index] = EARLIER ( Table4[Index] ) - 1 )

)

2. Create a Rate column.

Rate =

IF (

ISBLANK ( Table4[Previous Dow Jones] ),

100,

IF (

Table4[Trading Signal] = 1,

Table4[Dow Jones] / Table4[Previous Dow Jones],

1

)

)

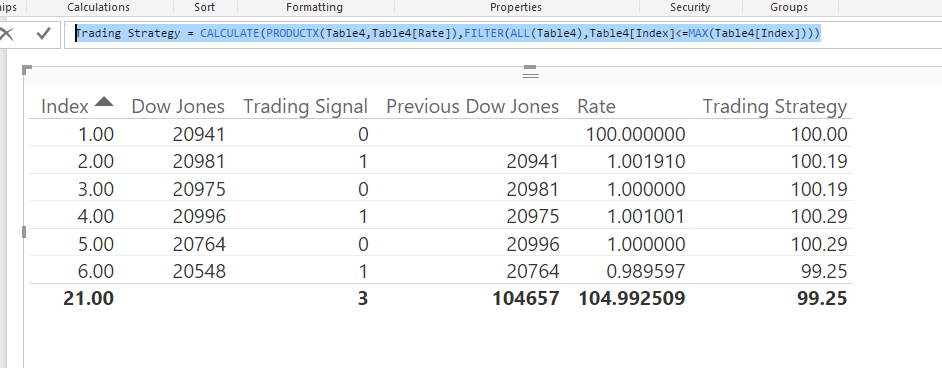

3. Then create a Trending measure.

Trading Strategy =

CALCULATE (

PRODUCTX ( Table4, Table4[Rate] ),

FILTER ( ALL ( Table4 ), Table4[Index] <= MAX ( Table4[Index] ) )

)

Regards,

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Great support, Simon. Many thanks.

Just one follow-up question:is it possible to get that all done in a measure as we would like to make the strategy dynamic, meaning that if we chose a certain date, the calculation runs from this date and normalizes the first date at 100.

Many thanks

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For this scenario, you need to build your Previous Dow Jones into a measure:

Previous Dow Jones Measure = Var CurrentIndex = CALCULATE( MAX( Table4[Index] ) ) return CALCULATE( SUM( Table4[Dow Jones] ), FILTER( ALLSELECTED( Table4 ), Table4[Index] = CurrentIndex - 1 ))

Then create a Rate into a measure as well:

Rate Measure = IF([Previous Dow Jones Measure]=BLANK(),100,(IF(SUM(Table4[Trading Signal])=1,SUM(Table4[Dow Jones])/[Previous Dow Jones Measure],1)))

Now you Trading Strategy should based on above Rate measure.

Trading Strategy Measure = CALCULATE(PRODUCTX(Table4,[Rate Measure]),FILTER(ALL(Table4),Table4[Index]<=MAX(Table4[Index])))

Regards,

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Great support, Simon!

It worked out. However, we had to adjust the formula slighty:

Trading Strategy Measure = CALCULATE(PRODUCTX(Table4,[Rate Measure]),FILTER(ALLSELECTED(Table4),Table4[Index]<=MAX(Table4[Index])))

Instead of

Trading Strategy Measure = CALCULATE(PRODUCTX(Table4,[Rate Measure]),FILTER(ALL(Table4),Table4[Index]<=MAX(Table4[Index])))

Cheers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I would not call that scenario a particularly strong use case for Power BI, that is much more an Excel problem. That being said, I would start with a running total calculation and then see if you could apply your on/off logic.

http://www.daxpatterns.com/cumulative-total/

Will try to noodle on a way to solve your problem.

@ me in replies or I'll lose your thread!!!

Instead of a Kudo, please vote for this idea

Become an expert!: Enterprise DNA

External Tools: MSHGQM

YouTube Channel!: Microsoft Hates Greg

Latest book!: The Definitive Guide to Power Query (M)

DAX is easy, CALCULATE makes DAX hard...

Helpful resources

Microsoft Fabric Learn Together

Covering the world! 9:00-10:30 AM Sydney, 4:00-5:30 PM CET (Paris/Berlin), 7:00-8:30 PM Mexico City

Power BI Monthly Update - April 2024

Check out the April 2024 Power BI update to learn about new features.

| User | Count |

|---|---|

| 105 | |

| 97 | |

| 80 | |

| 66 | |

| 62 |

| User | Count |

|---|---|

| 145 | |

| 111 | |

| 104 | |

| 84 | |

| 64 |