- Power BI forums

- Updates

- News & Announcements

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Power Platform Integration - Better Together!

- Power Platform Integrations (Read-only)

- Power Platform and Dynamics 365 Integrations (Read-only)

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Community Connections & How-To Videos

- COVID-19 Data Stories Gallery

- Themes Gallery

- Data Stories Gallery

- R Script Showcase

- Webinars and Video Gallery

- Quick Measures Gallery

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas

- Issues

- Issues

- Events

- Upcoming Events

- Community Blog

- Power BI Community Blog

- Custom Visuals Community Blog

- Community Support

- Community Accounts & Registration

- Using the Community

- Community Feedback

Register now to learn Fabric in free live sessions led by the best Microsoft experts. From Apr 16 to May 9, in English and Spanish.

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- calculate the difference between the stocks buy-pr...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

calculate the difference between the stocks buy-price and the sale-price with DAX

Hi all,

I have a pretty complicated DAX question. It's possible that it's too much to ask for when it comes to DAX, so I'll accept this kind of answer as well.

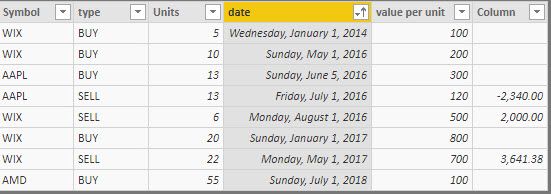

I have a table with all of the transactions in my investment portfolio.

I am trying to calculate the difference between the stocks buy-price and the sale-price.

In order to do so, I'll have to check (for each symbol), how many stocks and in how many times I bought before the first sale.

Here is how I would do it:

Table:

| Symbol | type | Units | date | value per unit |

| wix | buy | 5 | 01/01/2014 | 100 |

| wix | buy | 10 | 01/05/2016 | 200 |

| AMD | buy | 55 | 01/07/2018 | 100 |

| AAPL | buy | 13 | 05/06/2016 | 300 |

| wix | sell | 6 | 01/08/2016 | 500 |

| AAPL | sell | 13 | 01/07/2016 | 120 |

| wix | buy | 20 | 01/01/2017 | 800 |

| wix | sell | 22 | 01/05/2017 | 700 |

For each symbol, I would sum the stocks I got before the first sale. Let's take wix for example.

I check the dates for rows of wix + buy:

| wix + buy: | wix+sell: | |

| 01/01/2014 | < | 01/08/2016 |

yes -->

x+=units*value per unit

| 01/05/2016 | < | 01/08/2016 |

yes -->

x+=units*value per unit

| 01/05/2017 | < | 01/08/2016 |

no, return the sell units * value per unit from 01/08/2016 minus x (which provides you the buy vs. sell difference).

Then I'll have to keep checking against the next sale date:

| 01/01/2017 | < | 01/05/2017 |

yes --> x+=value

and so on...

That's basically what I'm looking for:

(just to explain better the solution I'm looking for-

the value of the stock over time:

| symbol | new units | new value per unit | |

| 1 | wix | 5 | 100 |

| 2 | wix | 15 | 166.6666667 |

| 3 | wix | 9 | 166.6666667 |

| 4 | wix | 29 | 603.4482759 |

| 1. | ||

| sell | 6*500 = | 3000 |

| own | 6*(2500/15)= | -1000 |

| Margin | 2000 |

| 2. | ||

| sell | 22*700 = | 15400 |

| own | 22*(new value #4)= | -13275.86207 |

| Margin | 2124.137931 |

That's the value I'd like to return: 2124.137931

What do you guys think? too complicated?

Thanks!

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

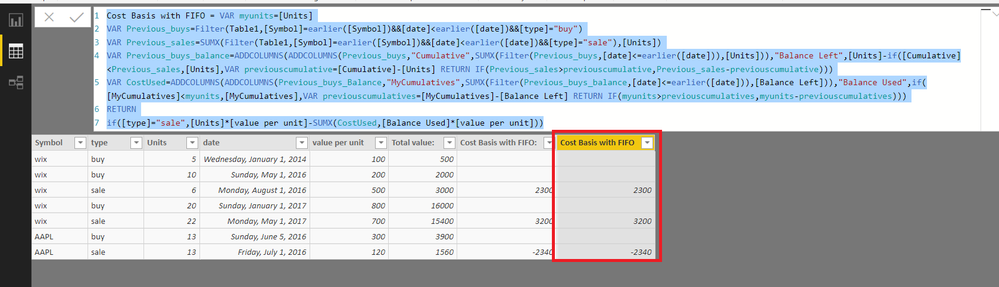

I think this calculated column will be close

It works with sample data ![]()

Cost Basis with FIFO =

VAR myunits = [Units]

VAR Previous_buys =

FILTER (

Table1,

[Symbol] = EARLIER ( [Symbol] )

&& [date] < EARLIER ( [date] )

&& [type] = "buy"

)

VAR Previous_sales =

SUMX (

FILTER (

Table1,

[Symbol] = EARLIER ( [Symbol] )

&& [date] < EARLIER ( [date] )

&& [type] = "sale"

),

[Units]

)

VAR Previous_buys_balance =

ADDCOLUMNS (

ADDCOLUMNS (

Previous_buys,

"Cumulative", SUMX ( FILTER ( Previous_buys, [date] <= EARLIER ( [date] ) ), [Units] )

),

"Balance Left", [Units]

- IF (

[Cumulative] < Previous_sales,

[Units],

VAR previouscumulative = [Cumulative] - [Units]

RETURN

IF ( Previous_sales > previouscumulative, Previous_sales - previouscumulative )

)

)

VAR CostUsed =

ADDCOLUMNS (

ADDCOLUMNS (

Previous_buys_Balance,

"MyCumulatives", SUMX (

FILTER ( Previous_buys_balance, [date] <= EARLIER ( [date] ) ),

[Balance Left]

)

),

"Balance Used", IF (

[MyCumulatives] < myunits,

[MyCumulatives],

VAR previouscumulatives = [MyCumulatives] - [Balance Left]

RETURN

IF ( myunits > previouscumulatives, myunits - previouscumulatives )

)

)

RETURN

IF (

[type] = "sale",

[Units] * [value per unit]

- SUMX ( CostUsed, [Balance Used] * [value per unit] )

)

Regards

Zubair

Please try my custom visuals

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help on an additional scenario

1) Multiple 'buys' or 'sells' on the same day

2) 'Buy' and 'Sell' on the day - intraday transaction

Please suggest how would I do that?

Thanks in advance

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Could you tell me how are you calculating the avg price of 603.4482759 in #4

On my side I have:

| 534.4828 |

Did I answer your question correctly? Mark my answer as a solution!

Proud to be a Datanaut!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After the first sale I was left with 9 until, each worth 166.666667.

Afterwards, I bought another 20 for 800 each.

Therefore, the new balance and average price is:

(9*166.666667+20*800)/29= 603.44

Hope that makes sense.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@bk11 Have you tried anything so far?

When do you want to calculate this? On data load?

If it is on data load, I think it can be done with M. Is this an option?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Anonymous and @LivioLanzo, thank you for your help!

I am loading this data from excel. I can calculate it during load time or afterwards, it doesn't really matter.

I am also open to see new ways to calculate the average price. In fact, if I could find a way to return the sum of stocks I bought before the sale date it would be enough because then I could do some independent calculations using measures to find the average.

So just a way to return for wix for example:

buy: (5*100 + 10*200) = 2500 (before the first sale) so I can afterwards put it in a matrix next to the sale and then calculate the difference.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @bk11

I am assuming you want to calculate the realized gain from a sale base on the avg pride of the security ?

This could be done either in a calculated column but also dynamically in a measure.

Did I answer your question correctly? Mark my answer as a solution!

Proud to be a Datanaut!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @LivioLanzo,

Yes, that's what I'm trying to do based on the table I included in my original question.

How would you do it with a measure/ calculated table so it will dynamically reflect the profit in each sale?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

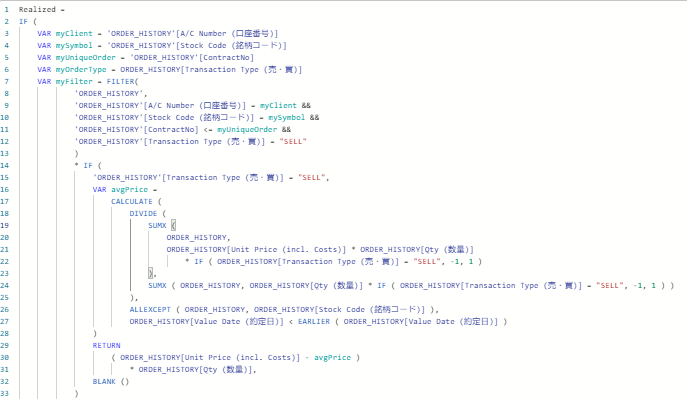

You can do it like this in a calculated column: @bk11

assuming no short positions

Realized =

IF (

Trades[type] = "SELL",

VAR avgPrice =

CALCULATE (

DIVIDE (

SUMX (

Trades,

Trades[value per unit] * Trades[Units]

* IF ( Trades[type] = "SELL", -1, 1 )

),

SUMX ( Trades, Trades[Units] * IF ( Trades[type] = "SELL", -1, 1 ) )

),

ALLEXCEPT ( Trades, Trades[Symbol] ),

Trades[date] < EARLIER ( Trades[date] )

)

RETURN

( Trades[value per unit] - avgPrice )

* [Units],

BLANK ()

)

Did I answer your question correctly? Mark my answer as a solution!

Proud to be a Datanaut!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

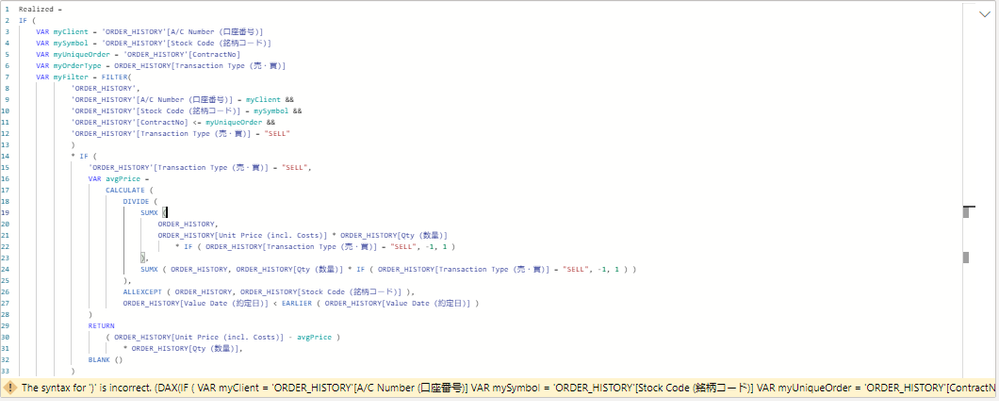

Hi @LivioLanzo ,

I am using your formula as a base, and trying to add a filter to calculate separately for each client. (As your formula is for individual use)

My transaction data includes all clients' daily transactions, so I would have to filter and calculate by each client.

The error says "The syntax for ')' is incorrect".

Could you please point out the errors from the formula below, and tell me how to correct? Thank you in advance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @LivioLanzo,

Thank you for your response.

I think that I haven't described my request in the right way. I did some more research and understood exactly how I should calculate my stock profit using the Average Cost Basis Method or FIFO Cost Basis Method.

I looked everywhere online and couldn't find a dynamic way to solve this issue:

So for the first table, I described in the first post:

| Symbol | type | Units | date | value per unit |

| wix | buy | 5 | 01/01/2014 | 100 |

| wix | buy | 10 | 01/05/2016 | 200 |

| AMD | buy | 55 | 01/07/2018 | 100 |

| AAPL | buy | 13 | 05/06/2016 | 300 |

| wix | sale | 6 | 01/08/2016 | 500 |

| AAPL | sale | 13 | 01/07/2016 | 120 |

| wix | buy | 20 | 01/01/2017 | 800 |

| wix | sale | 22 | 01/05/2017 | 700 |

I want to calculate the profit made during each sale, using the FIFO method like that:

| Symbol | type | Units | date | value per unit | Total value: | Cost Basis with FIFO: |

| wix | buy | 5 | 01/01/2014 | 100 | 500 | |

| wix | buy | 10 | 01/05/2016 | 200 | 2000 | |

| wix | sale | 6 | 01/08/2016 | 500 | 3000 | 2300 |

| wix | buy | 20 | 01/01/2017 | 800 | 16000 | |

| wix | sale | 22 | 01/05/2017 | 700 | 15400 | 3200 |

| AAPL | buy | 13 | 05/06/2016 | 300 | 3900 | |

| AAPL | sale | 13 | 01/07/2016 | 120 | 1560 | -2340 |

I calculated the Cost Basis with FIFO like this:

2300=(6*500)-(5*100+1*200)

3200=15400-(9*200+13*800)

-2340=1560-3900

The real challenge would be taking what's left from each group of shares which were bought on the same date and subtract it from couple (or more) sales respectively.

Thanks for the help again!

Ben

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The solution i provided returns the realized gain & loss based on the AVG price. Is it not what you were after?

Did I answer your question correctly? Mark my answer as a solution!

Proud to be a Datanaut!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @LivioLanzo,

Thank you for your help! I researched a bit more what is the most common way to calculate the profit and mainly for tax reasons I'll have to use fifo and not average...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi,

This seems like a tough one to oslve with DAX. I have a solution using regular Excel formulas though. You may refer to my solution - Valuing Closing Stock using FIFO method of Accounting.

Hope this helps.

Regards,

Ashish Mathur

http://www.ashishmathur.com

https://www.linkedin.com/in/excelenthusiasts/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I think this calculated column will be close

It works with sample data ![]()

Cost Basis with FIFO =

VAR myunits = [Units]

VAR Previous_buys =

FILTER (

Table1,

[Symbol] = EARLIER ( [Symbol] )

&& [date] < EARLIER ( [date] )

&& [type] = "buy"

)

VAR Previous_sales =

SUMX (

FILTER (

Table1,

[Symbol] = EARLIER ( [Symbol] )

&& [date] < EARLIER ( [date] )

&& [type] = "sale"

),

[Units]

)

VAR Previous_buys_balance =

ADDCOLUMNS (

ADDCOLUMNS (

Previous_buys,

"Cumulative", SUMX ( FILTER ( Previous_buys, [date] <= EARLIER ( [date] ) ), [Units] )

),

"Balance Left", [Units]

- IF (

[Cumulative] < Previous_sales,

[Units],

VAR previouscumulative = [Cumulative] - [Units]

RETURN

IF ( Previous_sales > previouscumulative, Previous_sales - previouscumulative )

)

)

VAR CostUsed =

ADDCOLUMNS (

ADDCOLUMNS (

Previous_buys_Balance,

"MyCumulatives", SUMX (

FILTER ( Previous_buys_balance, [date] <= EARLIER ( [date] ) ),

[Balance Left]

)

),

"Balance Used", IF (

[MyCumulatives] < myunits,

[MyCumulatives],

VAR previouscumulatives = [MyCumulatives] - [Balance Left]

RETURN

IF ( myunits > previouscumulatives, myunits - previouscumulatives )

)

)

RETURN

IF (

[type] = "sale",

[Units] * [value per unit]

- SUMX ( CostUsed, [Balance Used] * [value per unit] )

)

Regards

Zubair

Please try my custom visuals

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

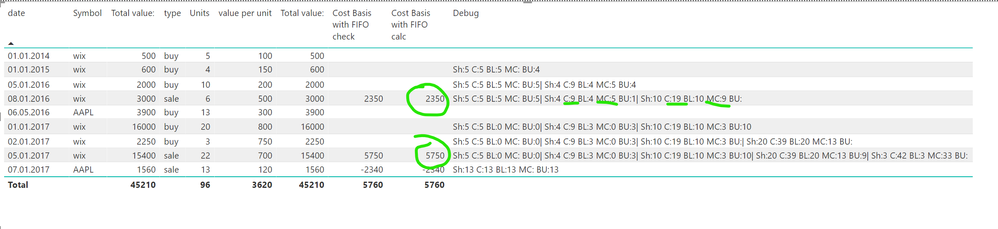

Hi,

There is small error in calculation of Balance Used (it counted cumulative).

Also to correctly process multiple trades in a day use timestamp instead of transaction date, or if absent, sort them using {date, type} during loading - buys before sells and add artificial index column, then use this instead of date.

The corrected version:

Cost Basis with FIFO =

VAR myunits=[Units]

VAR Previous_buys =

FILTER(

Table1,

[Symbol] = EARLIER([Symbol])

&& [date] < EARLIER([date])

&& [type] = "buy"

)

VAR Previous_sales =

SUMX(

FILTER(

Table1,

[Symbol] = EARLIER([Symbol])

&& [date] < EARLIER([date])

&&[type] = "sale"

),

[Units]

)

VAR Previous_buys_balance =

ADDCOLUMNS(

ADDCOLUMNS(

Previous_buys,

"Cumulative",

SUMX(

FILTER(

Previous_buys,

[date] <= EARLIER([date])

),

[Units]

)

),

"Balance Left",

[Units] - IF(

[Cumulative] < Previous_sales,

[Units],

VAR previouscumulative = [Cumulative]-[Units]

RETURN IF (Previous_sales > previouscumulative, Previous_sales - previouscumulative)

)

)

VAR CostUsed =

ADDCOLUMNS(

ADDCOLUMNS(

Previous_buys_Balance,

"MyCumulatives",

SUMX(

FILTER(

Previous_buys_balance,

[date] < EARLIER([date])

),

[Balance Left]

)

),

"Balance Used",

IF(

[Balance Left] <= myunits - [MyCumulatives],

[Balance Left],

IF ( myunits > [MyCumulatives], myunits -[MyCumulatives])

)

)

RETURN

IF ( [type] = "sale",

[Units] * [value per unit] - SUMX( CostUsed, [Balance Used] * [value per unit]))

Results:

And the pbix test:

For some weird reason this doesn't work correctly in PowerPivot for Excel... Compiles, just calculates wrong....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I see what you mean now, but I am not sure that is the correct way to get the average price. Unless you are using the FIFO method,? but I guess even then we would not match

Did I answer your question correctly? Mark my answer as a solution!

Proud to be a Datanaut!

Helpful resources

Microsoft Fabric Learn Together

Covering the world! 9:00-10:30 AM Sydney, 4:00-5:30 PM CET (Paris/Berlin), 7:00-8:30 PM Mexico City

Power BI Monthly Update - April 2024

Check out the April 2024 Power BI update to learn about new features.

| User | Count |

|---|---|

| 114 | |

| 99 | |

| 82 | |

| 70 | |

| 61 |

| User | Count |

|---|---|

| 149 | |

| 114 | |

| 107 | |

| 89 | |

| 67 |