- Power BI forums

- Updates

- News & Announcements

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Power Platform Integration - Better Together!

- Power Platform Integrations (Read-only)

- Power Platform and Dynamics 365 Integrations (Read-only)

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Community Connections & How-To Videos

- COVID-19 Data Stories Gallery

- Themes Gallery

- Data Stories Gallery

- R Script Showcase

- Webinars and Video Gallery

- Quick Measures Gallery

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas

- Issues

- Issues

- Events

- Upcoming Events

- Community Blog

- Power BI Community Blog

- Custom Visuals Community Blog

- Community Support

- Community Accounts & Registration

- Using the Community

- Community Feedback

Register now to learn Fabric in free live sessions led by the best Microsoft experts. From Apr 16 to May 9, in English and Spanish.

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- Stock prices return graph

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stock prices return graph

Hello, begginer user here!

I want to create a line chart with the every day returns of stock prices, the problem for me is that I want it to by dynamic, being able to chose the initial and the end date of analysis.

The chart in excel and data prices look like this:

| F | GM | FCHA.MI | |

| Timestamp | Trade Close | Trade Close | Trade Close |

| 04/07/2018 | 10.99 | 38.97 | 16.21 |

| 03/07/2018 | 10.99 | 38.97 | 16.33 |

| 02/07/2018 | 11.10 | 39.50 | 16.34 |

| 01/07/2018 | 11.07 | 39.40 | 16.33 |

| 30/06/2018 | 11.07 | 39.40 | 16.33 |

| 29/06/2018 | 11.07 | 39.40 | 16.33 |

| 28/06/2018 | 11.28 | 40.52 | 16.04 |

| 27/06/2018 | 11.42 | 40.37 | 16.62 |

| 26/06/2018 | 11.52 | 41.01 | 16.44 |

| 25/06/2018 | 11.50 | 40.61 | 15.99 |

| 24/06/2018 | 11.65 | 41.25 | 16.50 |

| 23/06/2018 | 11.65 | 41.25 | 16.50 |

Thanks!

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @CharlesRondo,

In your scenario, you may need three or more date tables due to the start dates are different and independent. Please check out the demo in the attachment. Three measures are like below. (Please note: only F and GM are the same with your requirements here. You can adjust the FCA yourself.)

F =

VAR minDate =

CALCULATE ( MIN ( Table1[Timestamp] ), ALLSELECTED ( Table1[Timestamp] ) )

RETURN

IF (

MIN ( Table1[Timestamp] ) = minDate,

0,

DIVIDE (

SUM ( Table1[Trade Close] ),

CALCULATE ( SUM ( Table1[Trade Close] ), 'Table1'[Timestamp] = minDate )

)

- 1

)

GM =

VAR minDate =

CALCULATE ( MIN ( 'Calendar'[Date] ), ALLSELECTED ( 'Calendar'[Date] ) )

RETURN

IF (

MIN ( Table1[Timestamp] ) <= minDate,

0,

DIVIDE (

SUM ( Table1[Trade Close .1] ),

CALCULATE ( SUM ( Table1[Trade Close .1] ), 'Table1'[Timestamp] = minDate )

)

- 1

)

FCA =

VAR minDate =

CALCULATE ( MIN ( Table1[Timestamp] ), ALLSELECTED ( Table1[Timestamp] ) )

RETURN

IF (

MIN ( Table1[Timestamp] ) = minDate,

0,

DIVIDE (

SUM ( Table1[Trade Close .2] ),

CALCULATE ( SUM ( Table1[Trade Close .2] ), 'Table1'[Timestamp] = minDate )

)

- 1

)

Best Regards,

Dale

If this post helps, then please consider Accept it as the solution to help the other members find it more quickly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

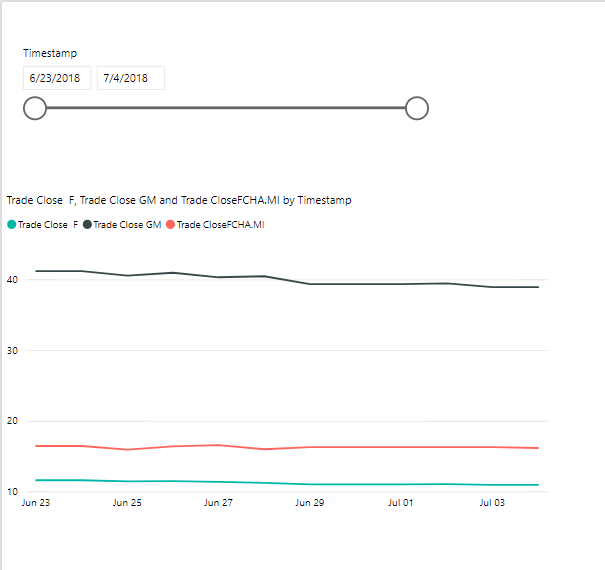

Hi,

You can use a Date Slicer that will help you dynamically get the Dates of interest

Like the one below?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @CharlesRondo,

You can use a Slicer with date field. Please refer to the snapshot below.

Best Regards,

Dale

If this post helps, then please consider Accept it as the solution to help the other members find it more quickly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thanks for the reply... but, well that's just part of the process, the real issue is that I need to get the returns depending on what I put on the slicer, in other words, if I'd like to graph, lets say one day of returns, what we would do in excel is=

% Return of X in date 1= (Trade Close Price at date 1 / Trade Close Price previous day) -1

Then you graph:

Return at date X0= 0 % (First number to graph is alway cero)

Return at date X+1= (Trade Close Price at X+1 / Trade Close Price at date X0 ) - 1

Return at date 2= (Trade Close Price at date X+2 / Trade Close Price at date X0 ) - 1

Return at date 3= (Trade Close Price at date X+3 / Trade Close Price at date X0 ) - 1

And so on...

Note that the base price is always fixed, and I need to be able to chose that with the slicer because it can start at any date.

The following table shows daily returns at a specific date or price base... and then I need graph this ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @CharlesRondo,

In your scenario, you may need three or more date tables due to the start dates are different and independent. Please check out the demo in the attachment. Three measures are like below. (Please note: only F and GM are the same with your requirements here. You can adjust the FCA yourself.)

F =

VAR minDate =

CALCULATE ( MIN ( Table1[Timestamp] ), ALLSELECTED ( Table1[Timestamp] ) )

RETURN

IF (

MIN ( Table1[Timestamp] ) = minDate,

0,

DIVIDE (

SUM ( Table1[Trade Close] ),

CALCULATE ( SUM ( Table1[Trade Close] ), 'Table1'[Timestamp] = minDate )

)

- 1

)

GM =

VAR minDate =

CALCULATE ( MIN ( 'Calendar'[Date] ), ALLSELECTED ( 'Calendar'[Date] ) )

RETURN

IF (

MIN ( Table1[Timestamp] ) <= minDate,

0,

DIVIDE (

SUM ( Table1[Trade Close .1] ),

CALCULATE ( SUM ( Table1[Trade Close .1] ), 'Table1'[Timestamp] = minDate )

)

- 1

)

FCA =

VAR minDate =

CALCULATE ( MIN ( Table1[Timestamp] ), ALLSELECTED ( Table1[Timestamp] ) )

RETURN

IF (

MIN ( Table1[Timestamp] ) = minDate,

0,

DIVIDE (

SUM ( Table1[Trade Close .2] ),

CALCULATE ( SUM ( Table1[Trade Close .2] ), 'Table1'[Timestamp] = minDate )

)

- 1

)

Best Regards,

Dale

If this post helps, then please consider Accept it as the solution to help the other members find it more quickly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

OMG! That´s it!, works perfectly!...I need to study all the logic with the language behind since I'm more used to excel functions. Thanks!

Helpful resources

Microsoft Fabric Learn Together

Covering the world! 9:00-10:30 AM Sydney, 4:00-5:30 PM CET (Paris/Berlin), 7:00-8:30 PM Mexico City

Power BI Monthly Update - April 2024

Check out the April 2024 Power BI update to learn about new features.

| User | Count |

|---|---|

| 112 | |

| 97 | |

| 85 | |

| 67 | |

| 59 |

| User | Count |

|---|---|

| 150 | |

| 120 | |

| 100 | |

| 87 | |

| 68 |