- Power BI forums

- Updates

- News & Announcements

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Power Platform Integration - Better Together!

- Power Platform Integrations (Read-only)

- Power Platform and Dynamics 365 Integrations (Read-only)

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Community Connections & How-To Videos

- COVID-19 Data Stories Gallery

- Themes Gallery

- Data Stories Gallery

- R Script Showcase

- Webinars and Video Gallery

- Quick Measures Gallery

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas

- Issues

- Issues

- Events

- Upcoming Events

- Community Blog

- Power BI Community Blog

- Custom Visuals Community Blog

- Community Support

- Community Accounts & Registration

- Using the Community

- Community Feedback

Register now to learn Fabric in free live sessions led by the best Microsoft experts. From Apr 16 to May 9, in English and Spanish.

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- Rolling portfolio returns with customizable window...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rolling portfolio returns with customizable window size and step size

Hi Community!

I have in my Power BI model a long table with multiple portfolios and their monthly returns, in the following format (which I don't mind adjusting):

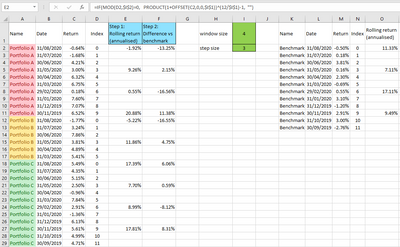

Excel link & snapshot image:

See column A, B & C: (2 Parameters in column I)

In Step 1, I need the output in column E: annualized rolling returns based on a window size (eg 4 months), calculated as Product(1+monthly returns in rolling window)^(12/window size)-1)

(a ctrl+shift+enter array formula in Excel)

I need to aggregate it by stepping a certain number of months, different from the window size, which leads to column F: the difference between the portfolio and the benchmark's annualized rolling return for the same stepped period.

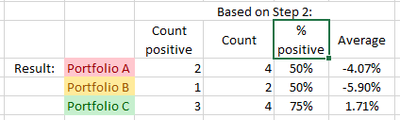

In the end, I want to calculate

i) the % of positive numbers in column F, and

ii) the average of column F - aggregated per portfolio.

I'm not sure whether to use DAX measures or columns or both.

To calculate the rolling returns for all months, I've successfully used the following measure:

(note that Return_Fund1 is a column with the return column + 1, not ideal, but I couldn't do the +1 inside Product like I could in Excel - any advice on this welcome!)

Rolling Returnss Annualized =

var windowSize = SUM(RollingWindowSize[RollingWindowSize])

return

CALCULATE(

PRODUCT(testReturns[Return_Fund1]) , DATESINPERIOD(testReturns[Return Date], LASTDATE(testReturns[Return Date]) , - windowSize , MONTH)

)

^ (12 / windowSize) - 1

I can then identify which dates to use for the step size by using the following DAX column:

Steps _should calculate =

IF( MOD( DATEDIFF(testReturns[Return Date], LASTDATE(WindowEndDate[WindowEndDate]), MONTH) , SUM(RollingWindowSize[RollingWindowSize]) ) = 0 , 1, 0)

The big challenge is getting column E only for the months identified where the above column =1. I tried the following but I just get all the values without the required gaps:

Rolling Returns SteppingX =

var stepSize = SUM(RollingStepSize[RollingStepSize])

return

CALCULATE(

testReturns[Rolling Returnss Annualized] , DATESINPERIOD(testReturns[Return Date] , LASTDATE(testReturns[Return Date]) , -stepSize, MONTH) )

(I set up a table in the report view with Portfolio names & Dates as columns, together with the measures / columns I calculated)

I recently started learning DAX, but can't seem to wrap my head around how to aggregate and use the dates properly for this problem.

Note that I have 450k rows, so the solution should be as efficient as possible.

Help is much appreciated!

Ruan

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Anonymous,

AFAIK, power bi data model tables do not contain row/column index that you can direct extract specific cell value, Dax functions also not contains offset, I'd like to suggest you calculate the rolling return at the excel side and import them to power bi for the following operations.

Steps:

1. Add calculate column diff to table1 to compare between two tables rolling return.

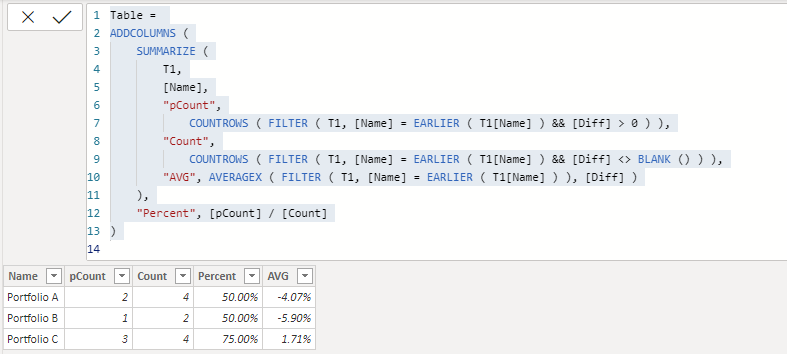

Diff = [Rolling Return]- LOOKUPVALUE(T2[Rolling return],T2[Index],T1[Index])2. Write a calculated table to summarize table records to output the expected result that you wanted.

Table =

ADDCOLUMNS (

SUMMARIZE (

T1,

[Name],

"pCount",

COUNTROWS ( FILTER ( T1, [Name] = EARLIER ( T1[Name] ) && [Diff] > 0 ) ),

"Count",

COUNTROWS ( FILTER ( T1, [Name] = EARLIER ( T1[Name] ) && [Diff] <> BLANK () ) ),

"AVG", AVERAGEX ( FILTER ( T1, [Name] = EARLIER ( T1[Name] ) ), [Diff] )

),

"Percent", [pCount] / [Count]

)

Regards,

Xiaoxin Sheng

If this post helps, please consider accept as solution to help other members find it more quickly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Anonymous,

AFAIK, power bi data model tables do not contain row/column index that you can direct extract specific cell value, Dax functions also not contains offset, I'd like to suggest you calculate the rolling return at the excel side and import them to power bi for the following operations.

Steps:

1. Add calculate column diff to table1 to compare between two tables rolling return.

Diff = [Rolling Return]- LOOKUPVALUE(T2[Rolling return],T2[Index],T1[Index])2. Write a calculated table to summarize table records to output the expected result that you wanted.

Table =

ADDCOLUMNS (

SUMMARIZE (

T1,

[Name],

"pCount",

COUNTROWS ( FILTER ( T1, [Name] = EARLIER ( T1[Name] ) && [Diff] > 0 ) ),

"Count",

COUNTROWS ( FILTER ( T1, [Name] = EARLIER ( T1[Name] ) && [Diff] <> BLANK () ) ),

"AVG", AVERAGEX ( FILTER ( T1, [Name] = EARLIER ( T1[Name] ) ), [Diff] )

),

"Percent", [pCount] / [Count]

)

Regards,

Xiaoxin Sheng

If this post helps, please consider accept as solution to help other members find it more quickly.

Helpful resources

Microsoft Fabric Learn Together

Covering the world! 9:00-10:30 AM Sydney, 4:00-5:30 PM CET (Paris/Berlin), 7:00-8:30 PM Mexico City

Power BI Monthly Update - April 2024

Check out the April 2024 Power BI update to learn about new features.

| User | Count |

|---|---|

| 114 | |

| 99 | |

| 83 | |

| 70 | |

| 61 |

| User | Count |

|---|---|

| 149 | |

| 114 | |

| 107 | |

| 89 | |

| 67 |