- Power BI forums

- Updates

- News & Announcements

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Power Platform Integration - Better Together!

- Power Platform Integrations (Read-only)

- Power Platform and Dynamics 365 Integrations (Read-only)

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Community Connections & How-To Videos

- COVID-19 Data Stories Gallery

- Themes Gallery

- Data Stories Gallery

- R Script Showcase

- Webinars and Video Gallery

- Quick Measures Gallery

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas

- Issues

- Issues

- Events

- Upcoming Events

- Community Blog

- Power BI Community Blog

- Custom Visuals Community Blog

- Community Support

- Community Accounts & Registration

- Using the Community

- Community Feedback

Register now to learn Fabric in free live sessions led by the best Microsoft experts. From Apr 16 to May 9, in English and Spanish.

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- Rolling XIRR Calculation

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rolling XIRR Calculation

Hello there,

I am trying to build a rolling IRR calculation for an investment return report. No mater what I try, I cannot seem to get PBI to return a value for my formula. Can anyone help.

ROLLING IRR = CALCULATE(

XIRR('INVESTMENT RETURNS','INVESTMENT RETURNS'[FREE CASHFLOW FOR PERIOD],'INVESTMENT RETURNS'[DATE])

,FILTER('INVESTMENT RETURNS',EARLIER('INVESTMENT RETURNS'[Index])>='INVESTMENT RETURNS'[Index]))There are six rows in my test table as follows:

| Index | FREE CASHFLOW FOR PERIOD | DATE |

| 42 | - 7,531,293.00 | 30/06/2013 |

| 43 | 859,425.00 | 30/06/2014 |

| 44 | 901,305.00 | 30/06/2015 |

| 45 | 951,189.00 | 30/06/2016 |

| 46 | 7,742,641.00 | 30/06/2017 |

| 47 | 1,498,289.00 | 30/06/2018 |

Any help would be greatly appreciated.

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @v-ljerr-msft,

Thank you very much for your help!

The formula works great, although I have made a few tweaks to include:

- a terminal value (from the [equity repayment/(investment) on sale] column) to be calculated at the end of each period and calculated in the XIRR calc (i.e. if I sold the investment now, what would my XIRR be), and

- a check to ensure that there is at least one positive cashflow (another requirement of the XIRR formula along with the first periof being negative).

see my code as follows fyi....

ROLLING XIRR =

VAR countpos =

CALCULATE(

COUNT('INVESTMENT RETURNS'[totalcashflow]),

FILTER(ALL('INVESTMENT RETURNS'), 'INVESTMENT RETURNS'[totalcashflow]>0 && EARLIER ('INVESTMENT RETURNS'[Index] ) >= 'INVESTMENT RETURNS'[Index] && 'INVESTMENT RETURNS'[Name] = EARLIER ( 'INVESTMENT RETURNS'[Name] )

)

)

VAR minIndex =

CALCULATE (

MIN ( 'INVESTMENT RETURNS'[Index] ),

FILTER (

ALL ( 'INVESTMENT RETURNS' ),

'INVESTMENT RETURNS'[Name] = EARLIER ( 'INVESTMENT RETURNS'[Name] )

)

)

VAR firstValue =

CALCULATE (

MIN ( 'INVESTMENT RETURNS'[FREE CASHFLOW FOR PERIOD (excl. sale)] ),

FILTER (

ALL ( 'INVESTMENT RETURNS' ),

'INVESTMENT RETURNS'[Name] = EARLIER ( 'INVESTMENT RETURNS'[Name] )

&& 'INVESTMENT RETURNS'[Index] = minIndex

)

)

RETURN

IF (

'INVESTMENT RETURNS'[Index] > minIndex

&& firstValue < 0

&& countpos >= 1 ,

XIRR (

UNION(

SUMMARIZE(

FILTER(ALL ( 'INVESTMENT RETURNS' ), EARLIER ('INVESTMENT RETURNS'[Index] ) >= 'INVESTMENT RETURNS'[Index] && 'INVESTMENT RETURNS'[Name] = EARLIER ( 'INVESTMENT RETURNS'[Name] ))

,'INVESTMENT RETURNS'[Index],

"DATE1",MAX('INVESTMENT RETURNS'[DATE]),

"CASHFLOW",MAX('INVESTMENT RETURNS'[FREE CASHFLOW FOR PERIOD (excl. sale)])

),

SUMMARIZE(

FILTER(ALL ( 'INVESTMENT RETURNS' ), EARLIER ('INVESTMENT RETURNS'[Index] ) = 'INVESTMENT RETURNS'[Index] ),

'INVESTMENT RETURNS'[Index],

"DATE1",MAX('INVESTMENT RETURNS'[DATE]),

"CASHFLOW",MAX('INVESTMENT RETURNS'[EQUITY REPAYMENT/(INVESTMENT) ON SALE])

)

),

[CASHFLOW],

[DATE1]

)

)Thanks again for all your help. Much appreciated.

MJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @mjfigg,

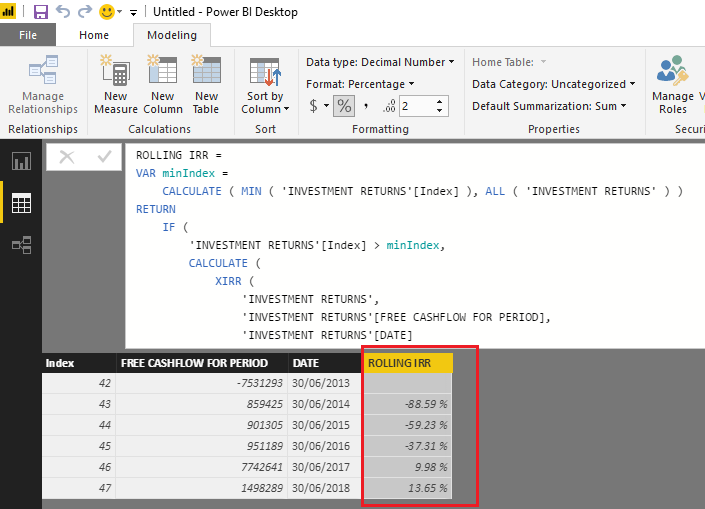

Based on my test, you should be able to use the formula below to build a rolling IRR in your scenario. ![]()

ROLLING IRR =

VAR minIndex =

CALCULATE ( MIN ( 'INVESTMENT RETURNS'[Index] ), ALL ( 'INVESTMENT RETURNS' ) )

RETURN

IF (

'INVESTMENT RETURNS'[Index] > minIndex,

CALCULATE (

XIRR (

'INVESTMENT RETURNS',

'INVESTMENT RETURNS'[FREE CASHFLOW FOR PERIOD],

'INVESTMENT RETURNS'[DATE]

),

FILTER (

'INVESTMENT RETURNS',

EARLIER ( 'INVESTMENT RETURNS'[Index] ) >= 'INVESTMENT RETURNS'[Index]

)

)

)

Regards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hey there!

Thanks, the code worked great. However, I just realised that I will actually need another filter on the table for company name, as there will be multiple companies that an XIRR will need to be calculated for. See updated data below. Could you still help me?

| Name | Index | FREE CASHFLOW FOR PERIOD | DATE |

| Company A | 42 | -7,531,293.00 | 30/06/2013 |

| Company A | 43 | 859,425.00 | 30/06/2014 |

| Company A | 44 | 901,305.00 | 30/06/2015 |

| Company A | 45 | 951,189.00 | 30/06/2016 |

| Company A | 46 | 7,742,641.00 | 30/06/2017 |

| Company A | 47 | 1,498,289.00 | 30/06/2018 |

| Company B | 48 | -8401918 | 30/06/2014 |

| Company B | 49 | 949747 | 30/06/2015 |

| Company B | 50 | 942388 | 30/06/2016 |

| Company B | 51 | 943756 | 30/06/2017 |

| Company B | 52 | 1049089 | 30/06/2018 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

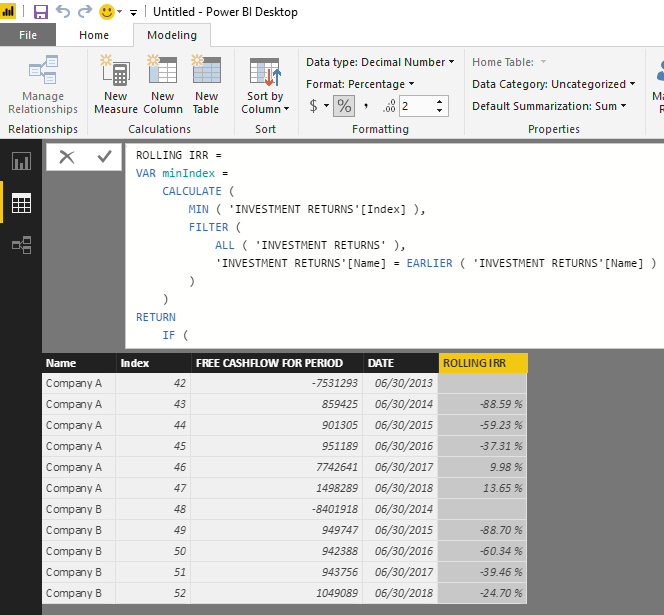

Hi @mjfigg,

Sure! The formula below should work in this new scenario. ![]()

ROLLING IRR =

VAR minIndex =

CALCULATE (

MIN ( 'INVESTMENT RETURNS'[Index] ),

FILTER (

ALL ( 'INVESTMENT RETURNS' ),

'INVESTMENT RETURNS'[Name] = EARLIER ( 'INVESTMENT RETURNS'[Name] )

)

)

RETURN

IF (

'INVESTMENT RETURNS'[Index] > minIndex,

CALCULATE (

XIRR (

'INVESTMENT RETURNS',

'INVESTMENT RETURNS'[FREE CASHFLOW FOR PERIOD],

'INVESTMENT RETURNS'[DATE]

),

FILTER (

'INVESTMENT RETURNS',

EARLIER ( 'INVESTMENT RETURNS'[Index] ) >= 'INVESTMENT RETURNS'[Index]

&& 'INVESTMENT RETURNS'[Name] = EARLIER ( 'INVESTMENT RETURNS'[Name] )

)

)

)

Regards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @v-ljerr-msft,

Apologies to keep on bothering you... however I cannot seem to get your formula to work on my actual data set. I have copied this below so we can see if you have any issues either. Thanks so much.

MJ

| Name | FINANCIAL YEAR | DISTRIBUTIONS | EQUITYtemp | EQUITY BALANCE | ROI | NET ASSET VALUE ON SALE | Index | ACTUAL EQUITY MOVEMENTS | EQUITY REPAYMENT/(INVESTMENT) ON SALE | FREE CASHFLOW FOR PERIOD | DATE |

| Company A | 2012 | 220,000.00 | 9629572 | 9,629,572 | 2.30% | 8,544,134.21 | 0 | -9,629,572 | -1,085,438 | -9,409,572 | 30/06/2012 |

| Company A | 2013 | 1,309,598.00 | 9,629,572 | 13.60% | 8,279,143.54 | 1 | 0 | -1,350,428 | 1,309,598 | 30/06/2013 | |

| Company A | 2014 | 1,748,073.00 | 9,629,572 | 18.20% | 8,250,943.49 | 2 | 0 | -1,378,629 | 1,748,073 | 30/06/2014 | |

| Company A | 2015 | 2,865,402.00 | ############ | 11,450,400 | 25.00% | 25,753,143.93 | 3 | -1,820,828 | 14,302,744 | 1,044,574 | 30/06/2015 |

| Company A | 2016 | 3,627,947.00 | 9,629,572 | 37.70% | 26,247,601.43 | 4 | 1,820,828 | 16,618,029 | 5,448,775 | 30/06/2016 | |

| Company A | 2017 | 3,326,656.00 | 9,629,572 | 34.50% | 65,531,598.87 | 5 | 0 | 55,902,027 | 3,326,656 | 30/06/2017 | |

| Company A | 2018 | 4,336,035.00 | 9,629,572 | 45.00% | 65,463,524.70 | 6 | 0 | 55,833,953 | 4,336,035 | 30/06/2018 | |

| Company A | 2019 | 4,618,150.00 | 9,629,572 | 48.00% | 65,473,159.83 | 7 | 0 | 55,843,588 | 4,618,150 | 30/06/2019 | |

| Company A | 2020 | 5,275,995.00 | 9,629,572 | 54.80% | 65,471,361.84 | 8 | 0 | 55,841,790 | 5,275,995 | 30/06/2020 | |

| Company A | 2021 | 5,323,785.00 | 9,629,572 | 55.30% | 65,471,209.61 | 9 | 0 | 55,841,638 | 5,323,785 | 30/06/2021 | |

| Company A | 2022 | 4,949,933.00 | 9,629,572 | 51.40% | 65,471,339.58 | 10 | 0 | 55,841,768 | 4,949,933 | 30/06/2022 | |

| Company B | 2011 | - | 19/02/9566 | 2,800,000 | 0.00% | 2,668,345.50 | 11 | -2,800,000 | -131,655 | -2,800,000 | 30/06/2011 |

| Company B | 2012 | 266,730.00 | 2,800,000 | 9.50% | 2,646,045.08 | 12 | 0 | -153,955 | 266,730 | 30/06/2012 | |

| Company B | 2013 | 267,272.00 | 2,800,000 | 9.50% | 2,846,349.35 | 13 | 0 | 46,349 | 267,272 | 30/06/2013 | |

| Company B | 2014 | 301,676.00 | 2,800,000 | 10.80% | 2,868,516.18 | 14 | 0 | 68,516 | 301,676 | 30/06/2014 | |

| Company B | 2015 | 320,209.00 | 2,800,000 | 11.40% | 3,711,889.98 | 15 | 0 | 911,890 | 320,209 | 30/06/2015 | |

| Company B | 2016 | 422,263.00 | 2,800,000 | 15.10% | 3,724,043.17 | 16 | 0 | 924,043 | 422,263 | 30/06/2016 | |

| Company B | 2017 | 441,096.00 | 2,800,000 | 15.80% | 3,691,333.20 | 17 | 0 | 891,333 | 441,096 | 30/06/2017 | |

| Company B | 2018 | 261,140.00 | 2800000 | 2,800,000 | 9.30% | 5,966,728.35 | 18 | 0 | 3,166,728 | 261,140 | 30/06/2018 |

| Company B | 2019 | 189,619.00 | 2800000 | 2,800,000 | 6.80% | 6,156,209.63 | 19 | 0 | 3,356,210 | 189,619 | 30/06/2019 |

| Company B | 2020 | 20,898.00 | 2800000 | 2,800,000 | 0.70% | 6,306,108.41 | 20 | 0 | 3,506,108 | 20,898 | 30/06/2020 |

| Company B | 2022 | 500,000.00 | 2800000 | 2,800,000 | 17.90% | 6,242,283.16 | 21 | 0 | 3,442,283 | 500,000 | 30/06/2022 |

| Company C | 2011 | 659,079.00 | 100 | 100 | 659079.00% | 9,331,458.81 | 22 | -100 | 9,331,359 | 658,979 | 30/06/2011 |

| Company C | 2012 | 540,616.00 | 100 | 540616.00% | 9,277,099.06 | 23 | 0 | 9,276,999 | 540,616 | 30/06/2012 | |

| Company C | 2013 | 742,004.00 | 159820 | 159,820 | 464.30% | 9,258,662.81 | 24 | -159,720 | 9,098,843 | 582,284 | 30/06/2013 |

| Company C | 2014 | 845,771.00 | 100 | 845771.00% | 9,265,568.34 | 25 | 159,720 | 9,265,468 | 1,005,491 | 30/06/2014 | |

| Company C | 2015 | 1,073,678.00 | 100 | 1073678.00% | 11,398,818.49 | 26 | 0 | 11,398,718 | 1,073,678 | 30/06/2015 | |

| Company C | 2016 | 1,121,581.00 | 100 | 1121581.00% | 11,434,088.18 | 27 | 0 | 11,433,988 | 1,121,581 | 30/06/2016 | |

| Company C | 2017 | 1,316,995.00 | 100 | 1316995.00% | 11,394,817.59 | 28 | 0 | 11,394,718 | 1,316,995 | 30/06/2017 | |

| Company C | 2018 | 1,557,526.00 | 100 | 100 | 1557526.50% | 11,396,678.18 | 29 | 0 | 11,396,578 | 1,557,526 | 30/06/2018 |

| Company D | 2013 | 68,707.00 | 7600000 | 7,600,000 | 0.90% | 7,292,257.58 | 42 | -7,600,000 | -307,742 | -7,531,293 | 30/06/2013 |

| Company D | 2014 | 859,425.00 | 7,600,000 | 11.30% | 7,345,734.20 | 43 | 0 | -254,266 | 859,425 | 30/06/2014 | |

| Company D | 2015 | 901,305.00 | 7,600,000 | 11.90% | 7,375,734.52 | 44 | 0 | -224,265 | 901,305 | 30/06/2015 | |

| Company D | 2016 | 951,189.00 | 7,600,000 | 12.50% | 9,588,364.56 | 45 | 0 | 1,988,365 | 951,189 | 30/06/2016 | |

| Company D | 2017 | 4,428,202.00 | 4285561 | 4,285,561 | 103.30% | 3,997,812.72 | 46 | 3,314,439 | -287,748 | 7,742,641 | 30/06/2017 |

| Company D | 2018 | 1,498,289.00 | 4,285,561 | 35.00% | 0 | 47 | 0 | -4,285,561 | 1,498,289 | 30/06/2018 | |

| Company E | 2014 | 273,082.00 | 8675000 | 8,675,000 | 3.10% | 8,398,839.45 | 48 | -8,675,000 | -276,161 | -8,401,918 | 30/06/2014 |

| Company E | 2015 | 949,747.00 | 8,675,000 | 10.90% | 8,642,316.32 | 49 | 0 | -32,684 | 949,747 | 30/06/2015 | |

| Company E | 2016 | 942,388.00 | 8,675,000 | 10.90% | 8,846,768.55 | 50 | 0 | 171,769 | 942,388 | 30/06/2016 | |

| Company E | 2017 | 943,756.00 | 8,675,000 | 10.90% | 9,870,640.33 | 51 | 0 | 1,195,640 | 943,756 | 30/06/2017 | |

| Company E | 2018 | 1,049,089.00 | 8675000 | 8,675,000 | 12.10% | 12,085,226.38 | 52 | 0 | 3,410,226 | 1,049,089 | 30/06/2018 |

| Company E | 2019 | 1,119,677.00 | 8675000 | 8,675,000 | 12.90% | 11,969,884.17 | 53 | 0 | 3,294,884 | 1,119,677 | 30/06/2019 |

| Company E | 2020 | 625,193.00 | 8675000 | 8,675,000 | 7.20% | 11,849,969.14 | 54 | 0 | 3,174,969 | 625,193 | 30/06/2020 |

| Company E | 2021 | 871,440.00 | 8675000 | 8,675,000 | 10.00% | 11,702,695.72 | 55 | 0 | 3,027,696 | 871,440 | 30/06/2021 |

| Company E | 2022 | 1,069,488.00 | 8675000 | 8,675,000 | 12.30% | 11,515,814.91 | 56 | 0 | 2,840,815 | 1,069,488 | 30/06/2022 |

| Company F | 2015 | 218,605.00 | 3736500 | 3,736,500 | 5.90% | 4,251,481.98 | 57 | -3,736,500 | 514,982 | -3,517,895 | 30/06/2015 |

| Company F | 2016 | 160,000.00 | 3,736,500 | 4.30% | 4,677,717.90 | 58 | 0 | 941,218 | 160,000 | 30/06/2016 | |

| Company F | 2017 | 190,000.00 | 3,736,500 | 5.10% | 4,840,240.82 | 59 | 0 | 1,103,741 | 190,000 | 30/06/2017 | |

| Company F | 2018 | - | 3736500 | 3,736,500 | 0.00% | 5,545,139.51 | 60 | 0 | 1,808,640 | 0 | 30/06/2018 |

| Company F | 2019 | 253,741.00 | 3736500 | 3,736,500 | 6.80% | 5,544,110.50 | 61 | 0 | 1,807,610 | 253,741 | 30/06/2019 |

| Company F | 2020 | 578,817.00 | 3736500 | 3,736,500 | 15.50% | 5,543,677.06 | 62 | 0 | 1,807,177 | 578,817 | 30/06/2020 |

| Company F | 2021 | 606,588.00 | 3736500 | 3,736,500 | 16.20% | 5,543,616.03 | 63 | 0 | 1,807,116 | 606,588 | 30/06/2021 |

| Company F | 2022 | 640,160.00 | 3736500 | 3,736,500 | 17.10% | 5,543,546.62 | 64 | 0 | 1,807,047 | 640,160 | 30/06/2022 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @mjfigg,

The value is calculated as the rate that satisfies the following function:

The series of cash flow values must contain at least one positive number and one negative number.

After I a few test, I find the issue is with your data of Company C(there are only positive numbers, but no nagative number).

So you may need to correct your data, or use the the formula below to make it work. ![]()

ROLLING IRR =

VAR minIndex =

CALCULATE (

MIN ( 'INVESTMENT RETURNS'[Index] ),

FILTER (

ALL ( 'INVESTMENT RETURNS' ),

'INVESTMENT RETURNS'[Name] = EARLIER ( 'INVESTMENT RETURNS'[Name] )

)

)

VAR firstValue =

CALCULATE (

MIN ( 'INVESTMENT RETURNS'[FREE CASHFLOW FOR PERIOD] ),

FILTER (

ALL ( 'INVESTMENT RETURNS' ),

'INVESTMENT RETURNS'[Name] = EARLIER ( 'INVESTMENT RETURNS'[Name] )

&& 'INVESTMENT RETURNS'[Index] = minIndex

)

)

RETURN

IF (

'INVESTMENT RETURNS'[Index] > minIndex

&& firstValue < 0,

CALCULATE (

XIRR (

'INVESTMENT RETURNS',

'INVESTMENT RETURNS'[FREE CASHFLOW FOR PERIOD],

'INVESTMENT RETURNS'[DATE]

),

FILTER (

ALL ( 'INVESTMENT RETURNS' ),

EARLIER ( 'INVESTMENT RETURNS'[Index] ) >= 'INVESTMENT RETURNS'[Index]

&& 'INVESTMENT RETURNS'[Name] = EARLIER ( 'INVESTMENT RETURNS'[Name] )

)

)

)

Regards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @v-ljerr-msft and @mjfigg

I evaluated this post, and I think the solution would work for my purposes with one slight tweak that I can't seem to figure out. My data is in a PBIX table that is CROSSJOINED, so has, out of necessity, blanks or 0 values and I think the XIRR function is having trouble because of the blanks.

Link to sample excel data: https://www.dropbox.com/s/hc3qx9y9jvs4n4k/Rolling%20XIRR.xlsx?dl=0

Essentially my data looks like this (from Excel and the desired Rolling XIRR column, as calculated in Excel, is shown).

| Asset ID | Period | Cash Flow | Month | Rolling IRR |

| X | 0 | -1000 | 4/30/2019 | |

| X | 1 | 130 | 5/31/2019 | |

| X | 2 | 130 | 6/30/2019 | -100.0% |

| X | 3 | 130 | 7/31/2019 | -99.5% |

| X | 4 | 130 | 8/31/2019 | -94.7% |

| X | 5 | 525 | 9/30/2019 | 15.0% |

| X | 6 | 10/31/2019 | 15.0% | |

| X | 7 | 11/30/2019 | 15.0% | |

| X | 8 | 12/31/2019 | 15.0% | |

| X | 9 | 1/31/2020 | 15.0% | |

| Y | 0 | -2000 | 5/31/2019 | |

| Y | 1 | 250 | 6/30/2019 | |

| Y | 2 | 250 | 7/31/2019 | -100.0% |

| Y | 3 | 250 | 8/31/2019 | -99.6% |

| Y | 4 | 250 | 9/30/2019 | -95.6% |

| Y | 5 | 250 | 10/31/2019 | -83.2% |

| Y | 6 | 250 | 11/30/2019 | -61.4% |

| Y | 7 | 250 | 12/31/2019 | -32.5% |

| Y | 8 | 250 | 1/31/2020 | 0.0% |

| Y | 9 | 125 | 2/29/2020 | 16.6% |

| Z | 0 | -1500 | 6/30/2019 | |

| Z | 1 | 175 | 7/31/2019 | |

| Z | 2 | 175 | 8/31/2019 | -100.0% |

| Z | 3 | 175 | 9/30/2019 | -99.7% |

| Z | 4 | 175 | 10/31/2019 | -96.6% |

| Z | 5 | 175 | 11/30/2019 | -86.8% |

| Z | 6 | 175 | 12/31/2019 | -68.8% |

| Z | 7 | 550 | 1/31/2020 | 17.8% |

| Z | 8 | 2/29/2020 | 17.8% | |

| Z | 9 | 3/31/2020 | 17.8% |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hey @mrothschild ,

I managed to get it working for you!

see file here: MJFIGG Updated file

What I did was just use my original code which has two key differences to yours:

- Index - which I have found to be easier when using the EARLIER function, and

- Free Cashflow Capital - This is an optional column and is not strictly needed. For my purposes it was important because I needed to distinguish between Free Cashflow before Capital and potential capital payments. In your case I have just set this to 0 for all months. Essentially you now have two cashflow columns if you ever need it.

I could rewrite the code to remove the Free Cashflow Capital column, but I preferred to just get it finished for you.

Hopefully this helps!!

All the best,

MJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thank you so much!

One question I have is that my actual table, as opposed to the sample data I posted, is calculated using CROSSJOIN, so doesn't actually show up in PowerQuery editor. As a result, there's no easy way to create the Index column you used. I'll search the forums for how to create this, but if you have any ideas without using PowerQuery, that would be the final piece.

Regardless, thanks again!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I updated the file again if you want to download it agin. I had a quick read online and it seems quite difficult to get an index in DAX rather than PowerQuery. I managed to come up with a very rough work around though for your case. Essentially arbitrarily allocating a greatly ascending value to your AssetID then multiplying that number by the period value. The result in this case being that each row has a unique value to it and then the RANK function can order them as an index would.

This solution works now but may not work for every instance of data that you want to report on ![]() . Only other thing I can suggest at the moment is to try and play around with your query so you can manipulate it in powerquery. Let me know if you need some help with that...

. Only other thing I can suggest at the moment is to try and play around with your query so you can manipulate it in powerquery. Let me know if you need some help with that...

All the best...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Really appreciate your help. I tried to start with simple data and was triangulating to a solution as a result, but when I applied to the larger dataset, I'm getting an error that XIRR can't find a solution. Again, I'm assuming it has to do with blank cells and I'm respectful of your time, so if this is overwhelming or I'm crazy to try to do this in its current form, let me know and I'll try a different path.

Here's the link to the larger dataset that has your programming contained only changed by my attempt to create the calcualted DAX index.

https://www.dropbox.com/s/lo8m59ach4v3bf8/Rolling%20XIRR%20-%20new%20.pbix?dl=0

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

** Update **

I think what you did was this?

zzNew_Portfolio_Outputs[Period] + RANKX(zzNew_Portfolio_Outputs,zzNew_Portfolio_Outputs[Asset ID])

which creates an arbitrary index column.

Apologies and maybe I made a mistake, but the updated file (to me) looks like the original and I don't see a calculated index column or anything resembling RANK or transformation of Asset ID. Again, error is likely mine, but I think I'm missing something significant.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting closer, but still have a grouping issue.

Here's the link to the sampel PBIX file: https://www.dropbox.com/s/gkz6x35x7xg79xq/Rolling%20XIRR.pbix?dl=0

The following code provides a result, and I think it's something close to the Weighted Average XIRR by asset (weighted by Period 0 negative cash flow):

zzXIRR 1 =

CALCULATE(

XIRR(GROUPBY(zzNew_Portfolio_Outputs,zzNew_Portfolio_Outputs[Asset ID],zzNew_Portfolio_Outputs[Cash Flow after Debt Service],zzNew_Portfolio_Outputs[Month]),

zzNew_Portfolio_Outputs[Cash Flow after Debt Service],zzNew_Portfolio_Outputs[Month]),

FILTER(zzNew_Portfolio_Outputs,NOT(ISBLANK(zzNew_Portfolio_Outputs[Cash Flow after Debt Service]))),

FILTER(zzNew_Portfolio_Outputs,zzNew_Portfolio_Outputs[Month]<=

CALCULATE(

MAXX(GROUPBY(zzNew_Portfolio_Outputs,zzNew_Portfolio_Outputs[Asset ID],zzNew_Portfolio_Outputs[Month]),zzNew_Portfolio_Outputs[Month]),

FILTER(zzNew_Portfolio_Outputs,zzNew_Portfolio_Outputs[Asset ID]=EARLIER(zzNew_Portfolio_Outputs[Asset ID])

)

)

)

)

The result from this formula is 16.72% but applies as a column to all three assets. In excel, the WAVG is 16.65%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @v-ljerr-msft,

Thank you very much for your help!

The formula works great, although I have made a few tweaks to include:

- a terminal value (from the [equity repayment/(investment) on sale] column) to be calculated at the end of each period and calculated in the XIRR calc (i.e. if I sold the investment now, what would my XIRR be), and

- a check to ensure that there is at least one positive cashflow (another requirement of the XIRR formula along with the first periof being negative).

see my code as follows fyi....

ROLLING XIRR =

VAR countpos =

CALCULATE(

COUNT('INVESTMENT RETURNS'[totalcashflow]),

FILTER(ALL('INVESTMENT RETURNS'), 'INVESTMENT RETURNS'[totalcashflow]>0 && EARLIER ('INVESTMENT RETURNS'[Index] ) >= 'INVESTMENT RETURNS'[Index] && 'INVESTMENT RETURNS'[Name] = EARLIER ( 'INVESTMENT RETURNS'[Name] )

)

)

VAR minIndex =

CALCULATE (

MIN ( 'INVESTMENT RETURNS'[Index] ),

FILTER (

ALL ( 'INVESTMENT RETURNS' ),

'INVESTMENT RETURNS'[Name] = EARLIER ( 'INVESTMENT RETURNS'[Name] )

)

)

VAR firstValue =

CALCULATE (

MIN ( 'INVESTMENT RETURNS'[FREE CASHFLOW FOR PERIOD (excl. sale)] ),

FILTER (

ALL ( 'INVESTMENT RETURNS' ),

'INVESTMENT RETURNS'[Name] = EARLIER ( 'INVESTMENT RETURNS'[Name] )

&& 'INVESTMENT RETURNS'[Index] = minIndex

)

)

RETURN

IF (

'INVESTMENT RETURNS'[Index] > minIndex

&& firstValue < 0

&& countpos >= 1 ,

XIRR (

UNION(

SUMMARIZE(

FILTER(ALL ( 'INVESTMENT RETURNS' ), EARLIER ('INVESTMENT RETURNS'[Index] ) >= 'INVESTMENT RETURNS'[Index] && 'INVESTMENT RETURNS'[Name] = EARLIER ( 'INVESTMENT RETURNS'[Name] ))

,'INVESTMENT RETURNS'[Index],

"DATE1",MAX('INVESTMENT RETURNS'[DATE]),

"CASHFLOW",MAX('INVESTMENT RETURNS'[FREE CASHFLOW FOR PERIOD (excl. sale)])

),

SUMMARIZE(

FILTER(ALL ( 'INVESTMENT RETURNS' ), EARLIER ('INVESTMENT RETURNS'[Index] ) = 'INVESTMENT RETURNS'[Index] ),

'INVESTMENT RETURNS'[Index],

"DATE1",MAX('INVESTMENT RETURNS'[DATE]),

"CASHFLOW",MAX('INVESTMENT RETURNS'[EQUITY REPAYMENT/(INVESTMENT) ON SALE])

)

),

[CASHFLOW],

[DATE1]

)

)Thanks again for all your help. Much appreciated.

MJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi,

I am trying to get the IRR (rolling or final) depending on a cutoff date which I included as a filter (different table containing all dates of my table). The cutoff date is a measure from a calcualted table which include calendar dates will 2050

the table looks like this: there could be various assets and various value (entities)

Hope you can help,

Best,

Dyana

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there a way to modify the code so that it works on Power Pivot as well?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We figured it out. The code needs to be entered as a calculated column not a measure on both Power BI and Power Pivot

Helpful resources

Microsoft Fabric Learn Together

Covering the world! 9:00-10:30 AM Sydney, 4:00-5:30 PM CET (Paris/Berlin), 7:00-8:30 PM Mexico City

Power BI Monthly Update - April 2024

Check out the April 2024 Power BI update to learn about new features.

| User | Count |

|---|---|

| 113 | |

| 97 | |

| 85 | |

| 70 | |

| 61 |

| User | Count |

|---|---|

| 151 | |

| 121 | |

| 104 | |

| 87 | |

| 67 |