- Power BI forums

- Updates

- News & Announcements

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Power Platform Integration - Better Together!

- Power Platform Integrations (Read-only)

- Power Platform and Dynamics 365 Integrations (Read-only)

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Community Connections & How-To Videos

- COVID-19 Data Stories Gallery

- Themes Gallery

- Data Stories Gallery

- R Script Showcase

- Webinars and Video Gallery

- Quick Measures Gallery

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas

- Issues

- Issues

- Events

- Upcoming Events

- Community Blog

- Power BI Community Blog

- Custom Visuals Community Blog

- Community Support

- Community Accounts & Registration

- Using the Community

- Community Feedback

Register now to learn Fabric in free live sessions led by the best Microsoft experts. From Apr 16 to May 9, in English and Spanish.

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- Need help with circular reference calculation usin...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with circular reference calculation using varying percentages

Need experts help here as have been banging my head against this for awhile. Tried using @OwenAuger s circular reference calculation but was unable to as my issue has percentages. Here is the issue i need to do a simple amortization of a balance.

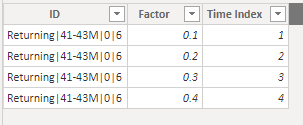

i have one table containing the amortization in percetages with a time index. See below:

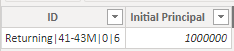

I have another table with the balance:

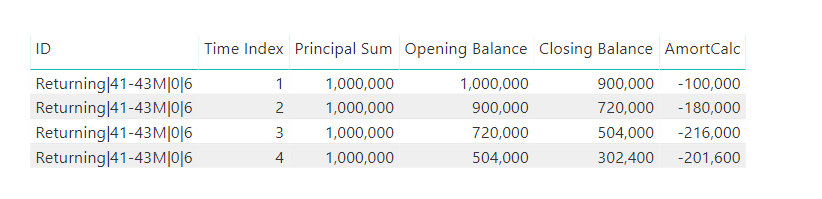

All i want is to apply -.1*1,000,000=900,000 for the first time period then for the second time period start with 900,000 and multiply that by -0.2.

Here is what i can come up with, as you can see it's not working right.

The Amort measure is as below:

Closing Balance calculation is as below:

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Anonymous

Attached is an example of how I would handle this.

The main requirement is to calculate the Closing Balance first by taking a cumulative product of (1-Factor) multiplied by the Initial Principal.

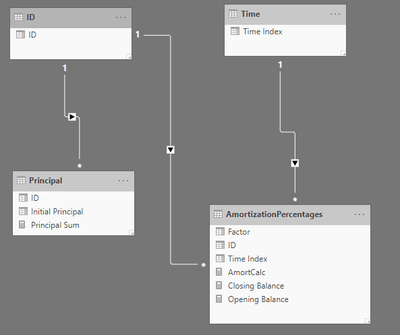

- I set up data model like this:

- Created these measures:

Principal Sum = SUM ( Principal[Initial Principal] ) Closing Balance = VAR MaxTime = MAX ( 'Time'[Time Index] ) RETURN SUMX ( 'ID', VAR PrincipalSum = [Principal Sum] VAR ClosingBalance = PrincipalSum * CALCULATE ( PRODUCTX ( AmortizationPercentages, (1 - AmortizationPercentages[Factor] ) ), 'Time'[Time Index] <= MaxTime, ALL ( 'Time' ) ) RETURN ClosingBalance ) Opening Balance = VAR MaxTime = MAX ( 'Time'[Time Index] ) VAR OpeningBalance = IF ( MaxTime = 1, [Principal Sum], CALCULATE ( [Closing Balance], ALL ( 'Time' ), 'Time'[Time Index] = MaxTime - 1 ) ) RETURN OpeningBalance AmortCalc = [Closing Balance] - [Opening Balance] - Then you can visualize similar to what you posted:

The above measures should aggregate correctly across multiple IDs but I haven't tested that.

Hopefully that's some help 🙂

Regards,

Owen

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Anonymous

Attached is an example of how I would handle this.

The main requirement is to calculate the Closing Balance first by taking a cumulative product of (1-Factor) multiplied by the Initial Principal.

- I set up data model like this:

- Created these measures:

Principal Sum = SUM ( Principal[Initial Principal] ) Closing Balance = VAR MaxTime = MAX ( 'Time'[Time Index] ) RETURN SUMX ( 'ID', VAR PrincipalSum = [Principal Sum] VAR ClosingBalance = PrincipalSum * CALCULATE ( PRODUCTX ( AmortizationPercentages, (1 - AmortizationPercentages[Factor] ) ), 'Time'[Time Index] <= MaxTime, ALL ( 'Time' ) ) RETURN ClosingBalance ) Opening Balance = VAR MaxTime = MAX ( 'Time'[Time Index] ) VAR OpeningBalance = IF ( MaxTime = 1, [Principal Sum], CALCULATE ( [Closing Balance], ALL ( 'Time' ), 'Time'[Time Index] = MaxTime - 1 ) ) RETURN OpeningBalance AmortCalc = [Closing Balance] - [Opening Balance] - Then you can visualize similar to what you posted:

The above measures should aggregate correctly across multiple IDs but I haven't tested that.

Hopefully that's some help 🙂

Regards,

Owen

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wow amazing! Let me try this out today and work it out. Am sure it will work. Thanks for your help @OwenAuger !!

Helpful resources

Microsoft Fabric Learn Together

Covering the world! 9:00-10:30 AM Sydney, 4:00-5:30 PM CET (Paris/Berlin), 7:00-8:30 PM Mexico City

Power BI Monthly Update - April 2024

Check out the April 2024 Power BI update to learn about new features.

| User | Count |

|---|---|

| 109 | |

| 98 | |

| 77 | |

| 66 | |

| 54 |

| User | Count |

|---|---|

| 144 | |

| 104 | |

| 101 | |

| 86 | |

| 64 |