- Power BI forums

- Updates

- News & Announcements

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Power Platform Integration - Better Together!

- Power Platform Integrations (Read-only)

- Power Platform and Dynamics 365 Integrations (Read-only)

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Community Connections & How-To Videos

- COVID-19 Data Stories Gallery

- Themes Gallery

- Data Stories Gallery

- R Script Showcase

- Webinars and Video Gallery

- Quick Measures Gallery

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas

- Issues

- Issues

- Events

- Upcoming Events

- Community Blog

- Power BI Community Blog

- Custom Visuals Community Blog

- Community Support

- Community Accounts & Registration

- Using the Community

- Community Feedback

Register now to learn Fabric in free live sessions led by the best Microsoft experts. From Apr 16 to May 9, in English and Spanish.

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- Re: Need Help with Half on Half and Year on Year M...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need Help with Half on Half and Year on Year Movements with Financial Data

Hi Community,

I am very new to Power BI. I just completed my Power BI Beginners and Intermediate courses 3 weeks ago and taking on a small project within my team to convert one report from excel to Power BI. I am the first person in my wider team to use Power BI and really in need of some guidance.

My data has half year and full year results for few companies and I want to build some smarts in my dashboard where users can filter to different periods and see the movements between those selected periods.

For example:

They can select 1H18 v 1H19 or 1H18 v 2H19 and ablet to see the movement between this period.

Below is a sample data of what my data looks like.

| Category | Company | Period | Name | Value |

| Earnings and Returns | A | 1H18 | Cash earnings | 1,200 |

| Earnings and Returns | A | 1H19 | Cash earnings | 2,300 |

| Earnings and Returns | A | 2H18 | Cash earnings | 1,108 |

| Earnings and Returns | A | 2H19 | Cash earnings | 2,208 |

| Earnings and Returns | A | FY18 | Cash earnings | 2,308 |

| Earnings and Returns | A | FY19 | Cash earnings | 4,508 |

| Earnings and Returns | C | 1H18 | Cash earnings | 121 |

| Earnings and Returns | C | 1H19 | Cash earnings | 209 |

| Earnings and Returns | C | 2H18 | Cash earnings | 56 |

| Earnings and Returns | C | 2H19 | Cash earnings | 269 |

| Earnings and Returns | C | FY18 | Cash earnings | 177 |

| Earnings and Returns | C | FY19 | Cash earnings | 478 |

| Earnings and Returns | E | 1H18 | Cash earnings | 1,251 |

| Earnings and Returns | E | 1H19 | Cash earnings | 2,586 |

| Earnings and Returns | E | 2H18 | Cash earnings | 2,834 |

| Earnings and Returns | E | 2H19 | Cash earnings | 2,968 |

| Earnings and Returns | E | FY18 | Cash earnings | 4,085 |

| Earnings and Returns | E | FY19 | Cash earnings | 5,554 |

| Revenues | A | 1H18 | Net Interest Income | 5,000 |

| Revenues | A | 1H19 | Net Interest Income | 6,200 |

| Revenues | A | 2H18 | Net Interest Income | 5,212 |

| Revenues | A | 2H19 | Net Interest Income | 6,225 |

| Revenues | A | FY18 | Net Interest Income | 10,212 |

| Revenues | A | FY19 | Net Interest Income | 12,425 |

| Revenues | C | 1H18 | Net Interest Income | 321 |

| Revenues | C | 1H19 | Net Interest Income | 569 |

| Revenues | C | 2H18 | Net Interest Income | 321 |

| Revenues | C | 2H19 | Net Interest Income | 520 |

| Revenues | C | FY18 | Net Interest Income | 642 |

| Revenues | C | FY19 | Net Interest Income | 1,089 |

| Revenues | E | 1H18 | Net Interest Income | 7,215 |

| Revenues | E | 1H19 | Net Interest Income | 6,958 |

| Revenues | E | 2H18 | Net Interest Income | 7,023 |

| Revenues | E | 2H19 | Net Interest Income | 6,213 |

| Revenues | E | FY18 | Net Interest Income | 14,238 |

| Revenues | E | FY19 | Net Interest Income | 13,171 |

| Expenses | A | 1H18 | Total Operating Expenses | -2,554 |

| Expenses | A | 1H19 | Total Operating Expenses | -2,431 |

| Expenses | A | 2H18 | Total Operating Expenses | -2,727 |

| Expenses | A | 2H19 | Total Operating Expenses | -2,518 |

| Expenses | A | FY18 | Total Operating Expenses | -5,281 |

| Expenses | A | FY19 | Total Operating Expenses | -4,949 |

| Expenses | C | 1H18 | Total Operating Expenses | -621 |

| Expenses | C | 1H19 | Total Operating Expenses | -325 |

| Expenses | C | 2H18 | Total Operating Expenses | -423 |

| Expenses | C | 2H19 | Total Operating Expenses | -369 |

| Expenses | C | FY18 | Total Operating Expenses | -1,044 |

| Expenses | C | FY19 | Total Operating Expenses | -694 |

| Expenses | E | 1H18 | Total Operating Expenses | -4,215 |

| Expenses | E | 1H19 | Total Operating Expenses | -4,689 |

| Expenses | E | 2H18 | Total Operating Expenses | -3,689 |

| Expenses | E | 2H19 | Total Operating Expenses | -4,578 |

| Expenses | E | FY18 | Total Operating Expenses | -7,904 |

| Expenses | E | FY19 | Total Operating Expenses | -9,267 |

I totally appreciate your help.

Warm regards,

HagenHawke

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

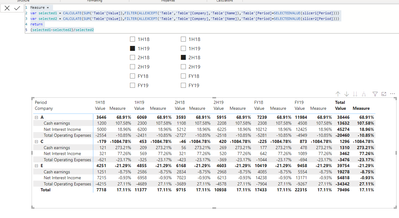

Hi @HagenHawke ,

If you want it be dynemic, you will need to create two slicer tables as below:

slicer1 = DISTINCT('Table'[Period])

slicer2 = DISTINCT('Table'[Period])Then create a measure like below:

Measure =

var selected1 = CALCULATE(SUM('Table'[Value]),FILTER(ALLEXCEPT('Table','Table'[Company],'Table'[Name]),'Table'[Period]=SELECTEDVALUE(slicer1[Period])))

var selected2 = CALCULATE(SUM('Table'[Value]),FILTER(ALLEXCEPT('Table','Table'[Company],'Table'[Name]),'Table'[Period]=SELECTEDVALUE(slicer2[Period])))

return

(selected1-selected2)/selected2Since it's a measure, it will be generated under each column if you put it into value field.

Then you could turn off the text wrap and hide the extra columns

Best Regards,

Jay

If this post helps, then please consider Accept it as the solution to help the other members find it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @HagenHawke ,

If you want it be dynemic, you will need to create two slicer tables as below:

slicer1 = DISTINCT('Table'[Period])

slicer2 = DISTINCT('Table'[Period])Then create a measure like below:

Measure =

var selected1 = CALCULATE(SUM('Table'[Value]),FILTER(ALLEXCEPT('Table','Table'[Company],'Table'[Name]),'Table'[Period]=SELECTEDVALUE(slicer1[Period])))

var selected2 = CALCULATE(SUM('Table'[Value]),FILTER(ALLEXCEPT('Table','Table'[Company],'Table'[Name]),'Table'[Period]=SELECTEDVALUE(slicer2[Period])))

return

(selected1-selected2)/selected2Since it's a measure, it will be generated under each column if you put it into value field.

Then you could turn off the text wrap and hide the extra columns

Best Regards,

Jay

If this post helps, then please consider Accept it as the solution to help the other members find it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thank you so much for taking your time to show me this. This is very helpful for a Power BI Beginner like me. I totally appreciate it.

Kind regards,

M

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

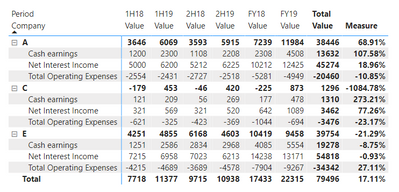

The out put would look something like below:

User would select different periods like the ones highlighted in 'orange' to see the growth between periods.

| Company | Name | 1H18 | 1H19 | 2H18 | 2H19 | FY18 | FY19 | 1H19 v 2H18 | 1H19 v 1H18 | 2H19 v 1H19 | 2H19 v 2H18 | FY19 v FY18 |

| A | Cash earnings | 1,200 | 2,300 | 1,108 | 2,208 | 2,308 | 4,508 | 107.6% | 91.7% | -4.0% | 99.3% | 95.3% |

| A | Net Interest Income | 5,000 | 6,200 | 5,212 | 6,225 | 10,212 | 12,425 | 19.0% | 24.0% | 0.4% | 19.4% | 21.7% |

| A | Total Operating Expenses | - 2,554 | - 2,431 | - 2,727 | - 2,518 | - 5,281 | - 4,949 | -10.9% | -4.8% | 3.6% | -7.7% | -6.3% |

| C | Cash earnings | 121 | 209 | 56 | 269 | 177 | 478 | 273.2% | 72.7% | 28.7% | 380.4% | 170.1% |

| C | Net Interest Income | 321 | 569 | 321 | 520 | 642 | 1,089 | 77.3% | 77.3% | -8.6% | 62.0% | 69.6% |

| C | Total Operating Expenses | - 621 | - 325 | - 423 | - 369 | - 1,044 | - 694 | -23.2% | -47.7% | 13.5% | -12.8% | -33.5% |

| E | Cash earnings | 1,251 | 2,586 | 2,834 | 2,968 | 4,085 | 5,554 | -8.8% | 106.7% | 14.8% | 4.7% | 36.0% |

| E | Net Interest Income | 7,215 | 6,958 | 7,023 | 6,213 | 14,238 | 13,171 | -0.9% | -3.6% | -10.7% | -11.5% | -7.5% |

| E | Total Operating Expenses | - 4,215 | - 4,689 | - 3,689 | - 4,578 | - 7,904 | - 9,267 | 27.1% | 11.2% | -2.4% | 24.1% | 17.2% |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @HagenHawke ,

I am not sure what you mean by movements but you can certainly create a measure that will get the difference between two periods. Please refer to the this pbix -Difference Between Two Periods that are not Date Time Keys

Did I answer your question? Mark my post as a solution!

Proud to be a Super User!

"Tell me and I’ll forget; show me and I may remember; involve me and I’ll understand."

Need Power BI consultation, get in touch with me on LinkedIn or hire me on UpWork.

Learn with me on YouTube @DAXJutsu or follow my page on Facebook @DAXJutsuPBI.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @HagenHawke

Can you sketch on paper what you expect the end result to be? This will help someone assist you.

Thank you

Helpful resources

Microsoft Fabric Learn Together

Covering the world! 9:00-10:30 AM Sydney, 4:00-5:30 PM CET (Paris/Berlin), 7:00-8:30 PM Mexico City

Power BI Monthly Update - April 2024

Check out the April 2024 Power BI update to learn about new features.

| User | Count |

|---|---|

| 109 | |

| 95 | |

| 77 | |

| 65 | |

| 53 |

| User | Count |

|---|---|

| 144 | |

| 105 | |

| 102 | |

| 89 | |

| 63 |