- Power BI forums

- Updates

- News & Announcements

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Power Platform Integration - Better Together!

- Power Platform Integrations (Read-only)

- Power Platform and Dynamics 365 Integrations (Read-only)

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Community Connections & How-To Videos

- COVID-19 Data Stories Gallery

- Themes Gallery

- Data Stories Gallery

- R Script Showcase

- Webinars and Video Gallery

- Quick Measures Gallery

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas

- Issues

- Issues

- Events

- Upcoming Events

- Community Blog

- Power BI Community Blog

- Custom Visuals Community Blog

- Community Support

- Community Accounts & Registration

- Using the Community

- Community Feedback

Register now to learn Fabric in free live sessions led by the best Microsoft experts. From Apr 16 to May 9, in English and Spanish.

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- Mortgage Payment Calculation

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Payment Calculation

Hi, I've checked the forums....It doesn't appear it's possible to do mortgage amortization, but I'm wondering if it's possible just to calculate a simple monthly payment based on # years, rate, and price? I can't believe there's nothing in Power BI to do this--or so it appears (or DAX).

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

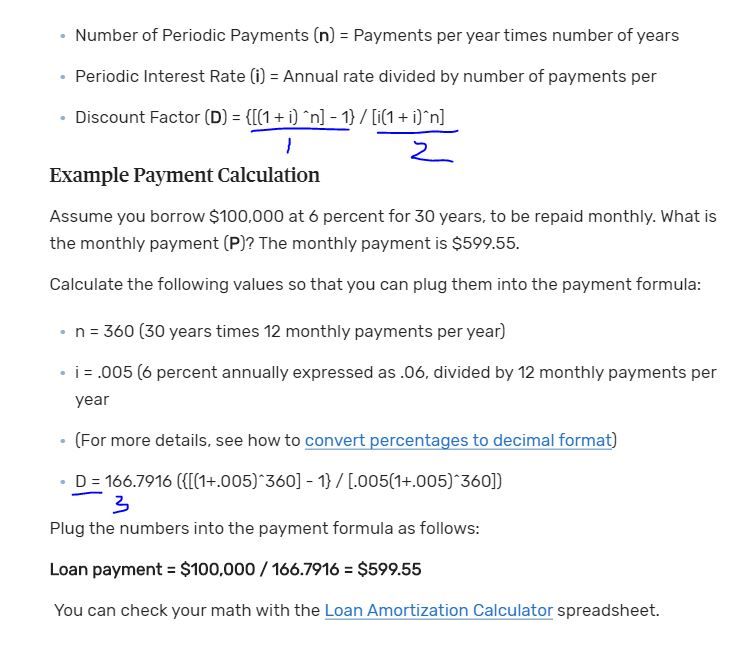

I modify my formula according to this article.

Assume the second line is :

you borrow 25000 at 0.0425 rate for 30 years,

then formula for part1-part3 are as follows:

monthly rate = [yearly rate]/12

part1 = POWER(1+[monthly rate],[years]*12)-1

part2 = [monthly rate]*POWER(1+[monthly rate],[years]*12)

part3 = [part1]/[part2]

Loan payment monthly = [loan amt]/[part3]

Maggie

If this post helps, then please consider Accept it as the solution to help the other members find it more quickly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @saturation

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @saturation

Could you show some data example or details of your requirement?

There are some examples of Mortgage Payment Calculation in Power BI:

https://community.powerbi.com/t5/Data-Stories-Gallery/Loan-Calculator/td-p/242585

https://www.youtube.com/watch?v=H65PLeAglBM

Maggie

If this post helps, then please consider Accept it as the solution to help the other members find it more quickly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The loan calculator is pretty close. Basically, here's what I've got (static data, no need for the sliders).

ID | Loan Amt | Years | Rate | Monthly Pymt | Interest

1 10000 5 .0375 | 150 | 20

2 25000 30 .0425 | 250 | 35

The Monthly Pymt and Interest columns are the data that I need....Thoughts?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @saturation

If i understand the Mortgage Payment Calculation correctly,

And your [rate] is monthly rate,

You could create calculated columns in Power BI Desktop

monthly pymt =

VAR power1 =

POWER ( ( 1 + [rate] ), [years] * 12 )

RETURN

[loan amt]

* DIVIDE ( [rate] * power1, power1 + 1 )

total interest = [monthly pymt]*[years]*12-[loan amt]

Maggie

If this post helps, then please consider Accept it as the solution to help the other members find it more quickly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thanks @v-juanli-msft . I think your formula is very close, although there's a miscalculation somewhere, and I can't seem to locate it. Basically if I do mortgage calculator for the 2nd loan in the example (just googled it), the actualy monthly payment should come out to $123. I'm struggling to figure out where in the formula needs to be corrected...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@v-juanli-msft Any thoughts on the monthly payment results provided from the Google mortgage calculator vs what your results look like in the example? Just trying to figure out where the formula needs to be corrected. Any help is appreciated!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I modify my formula according to this article.

Assume the second line is :

you borrow 25000 at 0.0425 rate for 30 years,

then formula for part1-part3 are as follows:

monthly rate = [yearly rate]/12

part1 = POWER(1+[monthly rate],[years]*12)-1

part2 = [monthly rate]*POWER(1+[monthly rate],[years]*12)

part3 = [part1]/[part2]

Loan payment monthly = [loan amt]/[part3]

Maggie

If this post helps, then please consider Accept it as the solution to help the other members find it more quickly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@saturation I calculated them as following. Can you please advise how did you arrive on those numbers for those two columns?

| ID | Loan Amt | Years | Rate | FV | # Months | Monthly PMT |

| 1 | 10000 | 5 | 0.0375 | $12,021.00 | 60 | $200.35 |

| 2 | 25000 | 30 | 0.0425 | $87,140.88 | 360 | $242.06 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@smpa01 They're not real, only for display only purposes....I'm just looking to see how to get them to calculate properly (the last 2 columns), whatever they may be....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@saturation DAX (faster)/ M (slower) query can aboslutely cater to your need to prepare a dynamic amortization schedule, once you figure out how you can replicate excel CUMIPMT and CUMPRINC

Helpful resources

Microsoft Fabric Learn Together

Covering the world! 9:00-10:30 AM Sydney, 4:00-5:30 PM CET (Paris/Berlin), 7:00-8:30 PM Mexico City

Power BI Monthly Update - April 2024

Check out the April 2024 Power BI update to learn about new features.

| User | Count |

|---|---|

| 110 | |

| 95 | |

| 76 | |

| 65 | |

| 51 |

| User | Count |

|---|---|

| 146 | |

| 109 | |

| 106 | |

| 88 | |

| 61 |