- Power BI forums

- Updates

- News & Announcements

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Power Platform Integration - Better Together!

- Power Platform Integrations (Read-only)

- Power Platform and Dynamics 365 Integrations (Read-only)

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Community Connections & How-To Videos

- COVID-19 Data Stories Gallery

- Themes Gallery

- Data Stories Gallery

- R Script Showcase

- Webinars and Video Gallery

- Quick Measures Gallery

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas

- Issues

- Issues

- Events

- Upcoming Events

- Community Blog

- Power BI Community Blog

- Custom Visuals Community Blog

- Community Support

- Community Accounts & Registration

- Using the Community

- Community Feedback

Register now to learn Fabric in free live sessions led by the best Microsoft experts. From Apr 16 to May 9, in English and Spanish.

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- Re: Measure that don't considering zero/blank

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Measure that don't considering zero/blank

Hi everyone,

I need your help to solve my problem.

I created two columns:

ZZ. cTMI = IF(SYS_CREDEB_PARTITAC[Data_Fattura]<DATE(2000;01;01);0;SYS_CREDEB_PARTITAC[Importo_Incassato]*IF(SYS_CREDEB_PARTITAC[Data_Pagamento]=DATE(1900;01;01);0;SYS_CREDEB_PARTITAC[Data_Pagamento]-SYS_CREDEB_PARTITAC[Data_Fattura])) ZZ. cRMI = IF(SYS_CREDEB_PARTITAC[Data_Fattura]<DATE(2000;01;01);0;SYS_CREDEB_PARTITAC[Importo_Incassato]*IF(SYS_CREDEB_PARTITAC[Data_Pagamento]=DATE(1900;01;01);0;SYS_CREDEB_PARTITAC[Data_Pagamento]-SYS_CREDEB_PARTITAC[Data_Scad_Orig]))

and two measures:

1. TMI = IFERROR(SUM(SYS_CREDEB_PARTITAC[ZZ. cTMI])/SUM(SYS_CREDEB_PARTITAC[Importo_Incassato]);0) 1. RMI = IFERROR(SUM(SYS_CREDEB_PARTITAC[ZZ. cRMI])/SUM(SYS_CREDEB_PARTITAC[Importo_Incassato]);0)

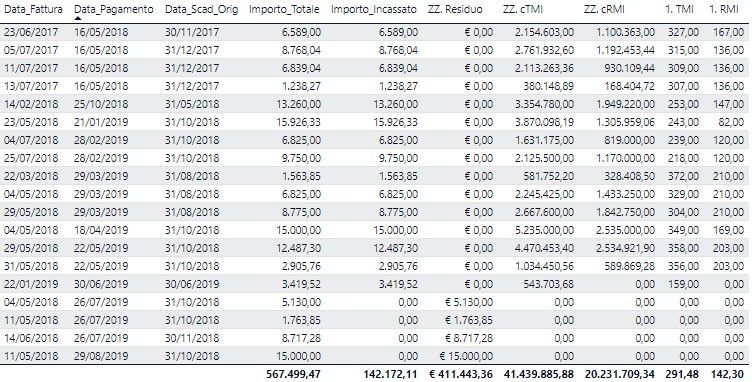

here an exlaple:

now i link you a table:

| Numero_Doc | Data_Fattura | Data_Pagamento | Data_Scad_Orig | Importo_Totale | Importo_Incassato | ZZ. Residuo | ZZ. cTMI | ZZ. cRMI | 1. TMI | 1. RMI |

| 44 | 05/07/2019 | 01/01/1900 | 31/12/2019 | € 966,90 | € - | € 966,90 | - | - | 0 | 0 |

| 45 | 08/08/2018 | 01/01/1900 | 31/01/2019 | € 5.541,80 | € - | € 5.541,80 | - | - | 0 | 0 |

| 46 | 23/08/2018 | 01/01/1900 | 31/01/2019 | € 5.813,72 | € - | € 5.813,72 | - | - | 0 | 0 |

| 47 | 31/08/2018 | 01/01/1900 | 31/01/2019 | € 2.367,75 | € - | € 2.367,75 | - | - | 0 | 0 |

| 48 | 20/09/2018 | 01/01/1900 | 28/02/2019 | € 4.583,00 | € - | € 4.583,00 | - | - | 0 | 0 |

| 49 | 12/10/2018 | 01/01/1900 | 31/03/2019 | € 1.186,68 | € - | € 1.186,68 | - | - | 0 | 0 |

| 50 | 31/10/2018 | 01/01/1900 | 31/03/2019 | € 3.108,49 | € - | € 3.108,49 | - | - | 0 | 0 |

| 51 | 05/07/2017 | 16/04/2018 | 31/12/2017 | € 22.000,00 | € 22.000,00 | € 0,00 | 6.270.000,00 | 2.332.000,00 | 285 | 106 |

| 52 | 23/06/2017 | 16/05/2018 | 30/11/2017 | € 6.589,00 | € 6.589,00 | € 0,00 | 2.154.603,00 | 1.100.363,00 | 327 | 167 |

| 53 | 05/07/2017 | 16/05/2018 | 31/12/2017 | € 8.768,04 | € 8.768,04 | € 0,00 | 2.761.932,60 | 1.192.453,44 | 315 | 136 |

| 54 | 11/07/2017 | 16/05/2018 | 31/12/2017 | € 6.839,04 | € 6.839,04 | € 0,00 | 2.113.263,36 | 930.109,44 | 309 | 136 |

| 55 | 13/07/2017 | 16/05/2018 | 31/12/2017 | € 1.238,27 | € 1.238,27 | € 0,00 | 380.148,89 | 168.404,72 | 307 | 136 |

| 56 | 14/02/2018 | 25/10/2018 | 31/05/2018 | € 13.260,00 | € 13.260,00 | € 0,00 | 3.354.780,00 | 1.949.220,00 | 253 | 147 |

| 57 | 23/05/2018 | 21/01/2019 | 31/10/2018 | € 15.926,33 | € 15.926,33 | € 0,00 | 3.870.098,19 | 1.305.959,06 | 243 | 82 |

| 58 | 04/07/2018 | 28/02/2019 | 31/10/2018 | € 6.825,00 | € 6.825,00 | € 0,00 | 1.631.175,00 | 819.000,00 | 239 | 120 |

| 59 | 25/07/2018 | 28/02/2019 | 31/10/2018 | € 9.750,00 | € 9.750,00 | € 0,00 | 2.125.500,00 | 1.170.000,00 | 218 | 120 |

| 60 | 22/03/2018 | 29/03/2019 | 31/08/2018 | € 1.563,85 | € 1.563,85 | € 0,00 | 581.752,20 | 328.408,50 | 372 | 210 |

| 61 | 04/05/2018 | 29/03/2019 | 31/08/2018 | € 6.825,00 | € 6.825,00 | € 0,00 | 2.245.425,00 | 1.433.250,00 | 329 | 210 |

| 62 | 29/05/2018 | 29/03/2019 | 31/08/2018 | € 8.775,00 | € 8.775,00 | € 0,00 | 2.667.600,00 | 1.842.750,00 | 304 | 210 |

| 63 | 04/05/2018 | 18/04/2019 | 31/10/2018 | € 15.000,00 | € 15.000,00 | € 0,00 | 5.235.000,00 | 2.535.000,00 | 349 | 169 |

| 64 | 29/05/2018 | 22/05/2019 | 31/10/2018 | € 12.487,30 | € 12.487,30 | € 0,00 | 4.470.453,40 | 2.534.921,90 | 358 | 203 |

| 65 | 31/05/2018 | 22/05/2019 | 31/10/2018 | € 2.905,76 | € 2.905,76 | € 0,00 | 1.034.450,56 | 589.869,28 | 356 | 203 |

| 66 | 22/01/2019 | 30/06/2019 | 30/06/2019 | € 3.419,52 | € 3.419,52 | € 0,00 | 543.703,68 | - | 159 | 0 |

| 67 | 04/05/2018 | 26/07/2019 | 31/10/2018 | € 5.130,00 | € - | € 5.130,00 | - | - | 0 | 0 |

| 68 | 11/05/2018 | 26/07/2019 | 31/10/2018 | € 1.763,85 | € - | € 1.763,85 | - | - | 0 | 0 |

| 69 | 14/06/2018 | 26/07/2019 | 30/11/2018 | € 8.717,28 | € - | € 8.717,28 | - | - | 0 | 0 |

| 70 | 11/05/2018 | 29/08/2019 | 31/10/2018 | € 15.000,00 | € - | € 15.000,00 | - | - | 0 | 0 |

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

You need to apply the following filter to both you measures:

TMI = IFERROR(CALCULATE(SUM(SYS_CREDEB_PARTITAC[ZZ. cTMI])/SUM(SYS_CREDEB_PARTITAC[Importo_Incassato]) ,

SYS_CREDEB_PARTITAC[ZZ. cTMI] <> 0 ,

SYS_CREDEB_PARTITAC[Importo_Incassato] <> 0

);0) RMI = IFERROR(CALCULATE(SUM(SYS_CREDEB_PARTITAC[ZZ. cRMI])/SUM(SYS_CREDEB_PARTITAC[Importo_Incassato]) ,

SYS_CREDEB_PARTITAC[ZZ. cRMI] <> 0 ,

SYS_CREDEB_PARTITAC[Importo_Incassato] <> 0

);0)

Connect on LinkedIn

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @nannimora ,

It's sorry that I can't understand your requirement well, what's problem did you meet, how do you want to handle the zero and blank?

Best Regards,

Teige

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @TeigeGao ,

I would like that when i calculate the measure TMI, it doesn't count the zero and the blank.

I'll try to explain myself better.

For example:

if u look the image, the total of the measure 1. TMI is 291,48. beacouse it count also the zero.

If i filter the table without 0, the total of 1.TMI change.

I want the total of TMI without 0 or blanks. and I don't know how I have to fix my measure.

I hope now you understand my problem.

And sorry for my english.

Regards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

You need to apply the following filter to both you measures:

TMI = IFERROR(CALCULATE(SUM(SYS_CREDEB_PARTITAC[ZZ. cTMI])/SUM(SYS_CREDEB_PARTITAC[Importo_Incassato]) ,

SYS_CREDEB_PARTITAC[ZZ. cTMI] <> 0 ,

SYS_CREDEB_PARTITAC[Importo_Incassato] <> 0

);0) RMI = IFERROR(CALCULATE(SUM(SYS_CREDEB_PARTITAC[ZZ. cRMI])/SUM(SYS_CREDEB_PARTITAC[Importo_Incassato]) ,

SYS_CREDEB_PARTITAC[ZZ. cRMI] <> 0 ,

SYS_CREDEB_PARTITAC[Importo_Incassato] <> 0

);0)

Connect on LinkedIn

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Helpful resources

Microsoft Fabric Learn Together

Covering the world! 9:00-10:30 AM Sydney, 4:00-5:30 PM CET (Paris/Berlin), 7:00-8:30 PM Mexico City

Power BI Monthly Update - April 2024

Check out the April 2024 Power BI update to learn about new features.

| User | Count |

|---|---|

| 113 | |

| 97 | |

| 85 | |

| 70 | |

| 61 |

| User | Count |

|---|---|

| 151 | |

| 121 | |

| 104 | |

| 87 | |

| 67 |