- Power BI forums

- Updates

- News & Announcements

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Power Platform Integration - Better Together!

- Power Platform Integrations (Read-only)

- Power Platform and Dynamics 365 Integrations (Read-only)

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Community Connections & How-To Videos

- COVID-19 Data Stories Gallery

- Themes Gallery

- Data Stories Gallery

- R Script Showcase

- Webinars and Video Gallery

- Quick Measures Gallery

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas

- Issues

- Issues

- Events

- Upcoming Events

- Community Blog

- Power BI Community Blog

- Custom Visuals Community Blog

- Community Support

- Community Accounts & Registration

- Using the Community

- Community Feedback

Register now to learn Fabric in free live sessions led by the best Microsoft experts. From Apr 16 to May 9, in English and Spanish.

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- Historical Stock Data Concept

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Historical Stock Data Concept

Hi Everyone,

I am currently working on building out a Historical Stock Market analysis.

Currently I am pulling in a parametered function that brings in the entire history of each of the symbols I am looking for. This is great (Obviously at some point I will need to find a more cost-efficient solution, but for now this is a good concept).

I have all the data pulled in and I am looking to calculate Simple Moving Averages

For those of you unfamiliar this is simple just (SUM(Close Price of the STock)) / Amount of days)

Example and I will show you what I am running into :

Date - Close Price

4/17/19 - $11

4/18/19 - $11

4/19/19 - $10

4/20/19 - (No Data -- Stock Market Closed)

4/21/19 - (No Data -- Stock Market Closed)

4/22/19 - $12

The 4 day moving average for 4/22 should include 4/22, 4/19, 4/18, 4/17

AND NOT include 4/20, 4/21

So:

($11 + $11 + 10 + 12) / 4 (days) = $44/4 = $11 4 day Simple Moving Average

And not:

($10 + No Data + No Data + $12)/ 4 (days) = $22/4 = $5.50 4 day Simple Moving Average

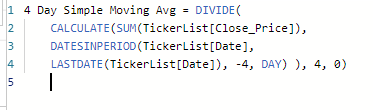

Here is my calculation for this:

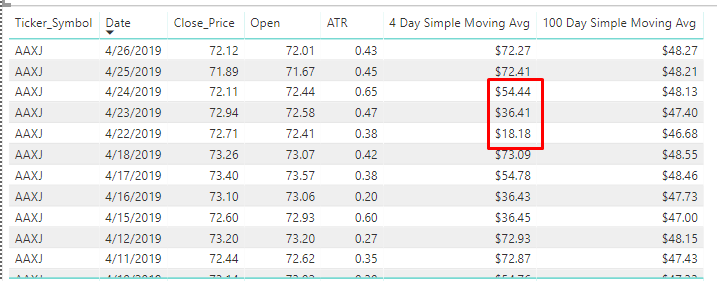

The problem is that LASTDATE() appears to be pulling in 4/20 and 4/21 even though those days dont exist.

Below you can see what this 4 day moving average is calculating as

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @chrisB13,

Please see the below.

4 Day Moving Avg =

VAR __maxDateInCurrentSelection =

MAX ( TickerList[Date] )

VAR __top4DaysWithValues =

TOPN (

4,

FILTER ( ALL ( TickerList ), TickerList[Date] <= __maxDateInCurrentSelection ),

TickerList[Date], DESC

)

RETURN

AVERAGEX ( __top4DaysWithValues , TickerList[Close_Price] )

Hope this helps.

Mariusz

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @chrisB13 ,

Try the below and let me know if it performs any better.

4 Day Simple Moving Avg =

VAR d = MAX(TickerList[Date])

VAR t = TOPN(

4,

FILTER(

ALL(TickerList[Date]),

TickerList[Date] <= d),

TickerList[Date],

DESC

)

RETURN

AVERAGEX(t, CALCULATE(SUM(TickerList[Close_Price])))Hope this helps

Mariusz

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @chrisB13,

Please see the below.

4 Day Moving Avg =

VAR __maxDateInCurrentSelection =

MAX ( TickerList[Date] )

VAR __top4DaysWithValues =

TOPN (

4,

FILTER ( ALL ( TickerList ), TickerList[Date] <= __maxDateInCurrentSelection ),

TickerList[Date], DESC

)

RETURN

AVERAGEX ( __top4DaysWithValues , TickerList[Close_Price] )

Hope this helps.

Mariusz

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thank you, slightly worried about the performance of it though. Looks like it hits performance pretty heavily, even trying a 3 day moving average is taking a few minutes to load.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It actually failed to load, ran out of RAM (32 GB)

Not sure why, but I would have to assume it has to do with the ORDER BY portion of the DAX. If we have 3000-4000 rows, it will need to do each row individually and forced to rebuild the Descending order every time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @chrisB13 ,

Try the below and let me know if it performs any better.

4 Day Simple Moving Avg =

VAR d = MAX(TickerList[Date])

VAR t = TOPN(

4,

FILTER(

ALL(TickerList[Date]),

TickerList[Date] <= d),

TickerList[Date],

DESC

)

RETURN

AVERAGEX(t, CALCULATE(SUM(TickerList[Close_Price])))Hope this helps

Mariusz

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thank you, that works much quicker!!

I may be coming back on here for some other calculations, that was the easiest of the calculations so far.

RSI, Stochastics, MACD, Variance, etc... all need to be done

Helpful resources

Microsoft Fabric Learn Together

Covering the world! 9:00-10:30 AM Sydney, 4:00-5:30 PM CET (Paris/Berlin), 7:00-8:30 PM Mexico City

Power BI Monthly Update - April 2024

Check out the April 2024 Power BI update to learn about new features.

| User | Count |

|---|---|

| 110 | |

| 95 | |

| 76 | |

| 65 | |

| 51 |

| User | Count |

|---|---|

| 146 | |

| 109 | |

| 106 | |

| 88 | |

| 61 |