- Power BI forums

- Updates

- News & Announcements

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Power Platform Integration - Better Together!

- Power Platform Integrations (Read-only)

- Power Platform and Dynamics 365 Integrations (Read-only)

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Community Connections & How-To Videos

- COVID-19 Data Stories Gallery

- Themes Gallery

- Data Stories Gallery

- R Script Showcase

- Webinars and Video Gallery

- Quick Measures Gallery

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas

- Issues

- Issues

- Events

- Upcoming Events

- Community Blog

- Power BI Community Blog

- Custom Visuals Community Blog

- Community Support

- Community Accounts & Registration

- Using the Community

- Community Feedback

Register now to learn Fabric in free live sessions led by the best Microsoft experts. From Apr 16 to May 9, in English and Spanish.

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- DAX Help - Accounts Receivable Aging: calculate mo...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DAX Help - Accounts Receivable Aging: calculate monthly closing balance for previous periods

Hi,

Newbie here, been trying to solve this for a while - appreciate any help: I have AR transaction table in following format:

| Document No | Date | Amount | Balance | Status | Closed ON |

| Invoice No. 16 | 31/01/2019 | 1,906 | 0 | CLOSED | 31/03/2019 |

| Invoice No. 18 | 01/02/2019 | 316 | 0 | CLOSED | 26/02/2019 |

| Invoice No. 22 | 10/02/2019 | 10,459 | 10458 | OPEN | |

| Invoice No. 23 | 10/02/2019 | 760 | 0 | CLOSED | 24/03/2019 |

| Invoice No. 45 | 06/03/2019 | 5,144 | 5143 | OPEN | |

| Payment No. 1 | 23/02/2019 | -6,861 | 0 | CLOSED | 26/02/2019 |

| Payment No. 3 | 26/03/2019 | -91,221 | 0 | CLOSED | 31/03/2019 |

Table is live connected to Power BI and is constantly updated. We need to find closing balance of each month as of today (report is always as of today's date) to show trend and for Days Sales Oustanding (DSO) calculation. How can this be achieved?

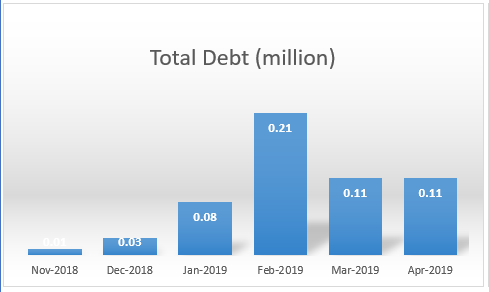

Result rendered in a graph: it shows total of open debt at end of each month, at that point in time when payment was not received and hence not closed.

Thank you in advance! I have tried to search for answer in forum and haven't come across any; in case if I have missed please point me to it. Have a great day!

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the assumption that there is no manual intervention and the outstanding against invoices are knocked-off based on payments on a FIFO basis, the following solution will work. Go through this and we will fine-tune it once again to suit the requirements.

Table: Transactions

| Document No | Date | Amount | Balance | Status | Closed ON |

| Invoice No. 16 | 31-01-2019 | 1,906 | 0 | CLOSED | 31-03-2019 |

| Invoice No. 18 | 01-02-2019 | 316 | 0 | CLOSED | 26-02-2019 |

| Invoice No. 22 | 10-02-2019 | 10,459 | 3914 | OPEN | |

| Invoice No. 23 | 10-02-2019 | 760 | 0 | CLOSED | 24-03-2019 |

| Payment No. 1 | 23-02-2019 | -6,861 | 0 | CLOSED | 26-02-2019 |

| Invoice No. 45 | 06-03-2019 | 5,144 | 5143 | OPEN | |

| Payment No. 3 | 26-03-2019 | -9,221 | OPEN | 31-03-2019 |

Step 1: Add a calendar table.

Calendar = CALENDAR(MIN(Transactions[Date]),MAX(Transactions[Date]))

Step 2: Add 3 calculated columns to the calendar table.

Year = YEAR('Calendar'[Date])

Month = FORMAT('Calendar'[Date],"mmm")

MonthNumber = MONTH('Calendar'[Date]) // for sorting the month namesStep 3: Create four measures

LastDate = MAX('Calendar'[Date])Credit =

SUMX (

FILTER (

Transactions,

Transactions[Amount] < 0

&& Transactions[Date] <= [LastDate]

),

Transactions[Amount]

)Debit =

SUMX (

FILTER (

Transactions,

Transactions[Amount] >= 0

&& Transactions[Date] <= [LastDate]

),

Transactions[Amount]

)Outstanding = [Debit]+[Credit]

Step 4: Add a Matrix Visual to the model.

Add Calendar[Month] on Rows of the Matrix Visual

Add Credit, Debit, Outstanding to the Values filed of the Matrix Visual.

(Remember, you should not have any relationship between the calendar table and the transaction table.)

You will get the following output.

| Month | Debit | Credit | Outstanding |

| Jan | 1906 | 0 | 1906 |

| Feb | 13441 | -6861 | 6580 |

| Mar | 18585 | -16082 | 2503 |

| Total | 18585 | -16082 | 2503 |

The debit and credit are the running totals of the debit and credit up to the last day of the month in the current context.

Remember to sort the Month using the MonthNumber field. If you want the year, you may add Calendar[Year] field also to the visual.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi,

Based on the Table that you have shared, please show the exact expected result in a simple Table format. Once we get the correct numbers in a Table, creating a column chart will not be a problem.

Regards,

Ashish Mathur

http://www.ashishmathur.com

https://www.linkedin.com/in/excelenthusiasts/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thank you @Ashish_Mathur . Please consider below table (tweaked earlier table to fit in):

| Document No | Date | Amount | Balance | Status | Closed ON |

| Invoice No. 16 | 31/01/2019 | 1,906 | 0 | CLOSED | 31/03/2019 |

| Invoice No. 18 | 01/02/2019 | 316 | 0 | CLOSED | 26/02/2019 |

| Invoice No. 22 | 10/02/2019 | 10,459 | 3914 | OPEN | |

| Invoice No. 23 | 10/02/2019 | 760 | 0 | CLOSED | 24/03/2019 |

| Payment No. 1 | 23/02/2019 | -6,861 | 0 | CLOSED | 26/02/2019 |

| Invoice No. 45 | 06/03/2019 | 5,144 | 5143 | OPEN | |

| Payment No. 3 | 26/03/2019 | -9,221 | OPEN | 31/03/2019 |

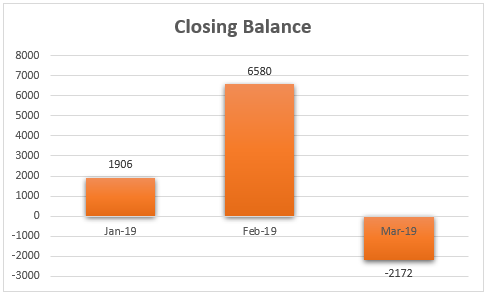

Expected results:

| Month | Closing Balance | Remark |

| Jan-19 | 1906 | Invoice No.16 open balance |

| Feb-19 | 6580 | Payment No.1 offset against Invoice No.18 & partially offset with invoice 22 + new invoice 23 + old invoice 16 (1906 + 316 + 10459 + 760 - 6861) |

| Mar-19 | -2172 | Payment No.3 partially offset against Invoice No.45, fully offset 16, add new invoice 45 (1906 + 1 + 5144 - 9221) |

Expected outcome in monthly context:

Thank you in advance!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi,

What is the relevance of the Balance column? For Feb, why is invoice 16 not offset before invoice 18? What is the relevance of the last 2 columns?

Regards,

Ashish Mathur

http://www.ashishmathur.com

https://www.linkedin.com/in/excelenthusiasts/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1. Balance column is amount not offset, or "open" as of today (In our example 26-Mar-2019)

2. For Feb, offsetting is done based on business reasons (hence could be partial or non-chronological).

3. "Status" is "Closed" when full value of invoice or payment that is offset. Any residual value is indicated as "Open". This status is as of today.

4. Closed ON: This is date of full offset.

Included an additional column to indicate amounts that are offset. Balance as of 26-Mar-19 is 6390 (Excuse, -2172 was wrong in last table)

| Document No | Date | Amount | Offset | Balance | Status | Closed ON |

| Invoice No. 16 | 31/01/2019 | 1,906 | 1,906 | 0 | CLOSED | 31/03/2019 |

| Invoice No. 18 | 01/02/2019 | 316 | 316 | 0 | CLOSED | 26/02/2019 |

| Invoice No. 22 | 10/02/2019 | 10,459 | 6,861 | 3,914 | OPEN | |

| Invoice No. 23 | 10/02/2019 | 760 | 0 | CLOSED | 26/03/2019 | |

| Payment No. 1 | 23/02/2019 | -6,861 | -6,861 | 0 | CLOSED | 26/02/2019 |

| Invoice No. 45 | 06/03/2019 | 5,144 | 1 | 5143 | OPEN | |

| Payment No. 3 | 26/03/2019 | -9,221 | -6,554 | -2,667 | OPEN | 31/03/2019 |

| 6390 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi,

I don't think i can help you with this. Someone else would pitch in.

Regards,

Ashish Mathur

http://www.ashishmathur.com

https://www.linkedin.com/in/excelenthusiasts/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thank you @Ashish_Mathur for trying, appreciate it. Hope I get a solution soon...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refer to the table below...

| Document No | Date | Amount | Offset | Balance | Status | Closed ON |

| Invoice No. 16 | 31/01/2019 | 1,906 | 1,906 | 0 | CLOSED | 31/03/2019 |

| Invoice No. 18 | 01/02/2019 | 316 | 316 | 0 | CLOSED | 26/02/2019 |

| Invoice No. 22 | 10/02/2019 | 10,459 | 6,861 | 3,914 | OPEN | |

| Invoice No. 23 | 10/02/2019 | 760 | 0 | CLOSED | 26/03/2019 | |

| Payment No. 1 | 23/02/2019 | -6,861 | -6,861 | 0 | CLOSED | 26/02/2019 |

| Invoice No. 45 | 06/03/2019 | 5,144 | 1 | 5143 | OPEN | |

| Payment No. 3 | 26/03/2019 | -9,221 | -6,554 | -2,667 | OPEN | 31/03/2019 |

| 6390 |

Against Invoice No 22, there is a balance of 3914 and offset of 6861. How will you determine if the offset has been done in February or March? Based on that decision, the reported outstanding of Feb & March could vary. I am asking this question because you said it's not FIFO based.

Is it possible for you to include an offset date? To accurately calculate the figures, we need to know when an invoice's outstanding has been offset.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the assumption that there is no manual intervention and the outstanding against invoices are knocked-off based on payments on a FIFO basis, the following solution will work. Go through this and we will fine-tune it once again to suit the requirements.

Table: Transactions

| Document No | Date | Amount | Balance | Status | Closed ON |

| Invoice No. 16 | 31-01-2019 | 1,906 | 0 | CLOSED | 31-03-2019 |

| Invoice No. 18 | 01-02-2019 | 316 | 0 | CLOSED | 26-02-2019 |

| Invoice No. 22 | 10-02-2019 | 10,459 | 3914 | OPEN | |

| Invoice No. 23 | 10-02-2019 | 760 | 0 | CLOSED | 24-03-2019 |

| Payment No. 1 | 23-02-2019 | -6,861 | 0 | CLOSED | 26-02-2019 |

| Invoice No. 45 | 06-03-2019 | 5,144 | 5143 | OPEN | |

| Payment No. 3 | 26-03-2019 | -9,221 | OPEN | 31-03-2019 |

Step 1: Add a calendar table.

Calendar = CALENDAR(MIN(Transactions[Date]),MAX(Transactions[Date]))

Step 2: Add 3 calculated columns to the calendar table.

Year = YEAR('Calendar'[Date])

Month = FORMAT('Calendar'[Date],"mmm")

MonthNumber = MONTH('Calendar'[Date]) // for sorting the month namesStep 3: Create four measures

LastDate = MAX('Calendar'[Date])Credit =

SUMX (

FILTER (

Transactions,

Transactions[Amount] < 0

&& Transactions[Date] <= [LastDate]

),

Transactions[Amount]

)Debit =

SUMX (

FILTER (

Transactions,

Transactions[Amount] >= 0

&& Transactions[Date] <= [LastDate]

),

Transactions[Amount]

)Outstanding = [Debit]+[Credit]

Step 4: Add a Matrix Visual to the model.

Add Calendar[Month] on Rows of the Matrix Visual

Add Credit, Debit, Outstanding to the Values filed of the Matrix Visual.

(Remember, you should not have any relationship between the calendar table and the transaction table.)

You will get the following output.

| Month | Debit | Credit | Outstanding |

| Jan | 1906 | 0 | 1906 |

| Feb | 13441 | -6861 | 6580 |

| Mar | 18585 | -16082 | 2503 |

| Total | 18585 | -16082 | 2503 |

The debit and credit are the running totals of the debit and credit up to the last day of the month in the current context.

Remember to sort the Month using the MonthNumber field. If you want the year, you may add Calendar[Year] field also to the visual.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@Anonymous what an elegant and unexpected solution! Thank you thank you - made my whole week! Kudos to you and this community, marvelous...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi,

If you don't want to see Debit and Credit separately in your visuals, then you can directly calculate the outstanding...

Outstanding =

SUMX (

FILTER (

Transactions,

Transactions[Date] <= [LastDate]

),

Transactions[Amount]

)You can avoid the other two measures that calculate Debit and Credit separately and adding them together to arrive at the Outstanding. Those measures are required only if you want to see the Debit and Credit in the visuals separately. So when you apply this solution to your final model, it's better to reduce the number of measures.

Helpful resources

Microsoft Fabric Learn Together

Covering the world! 9:00-10:30 AM Sydney, 4:00-5:30 PM CET (Paris/Berlin), 7:00-8:30 PM Mexico City

Power BI Monthly Update - April 2024

Check out the April 2024 Power BI update to learn about new features.

| User | Count |

|---|---|

| 111 | |

| 95 | |

| 80 | |

| 68 | |

| 59 |

| User | Count |

|---|---|

| 150 | |

| 119 | |

| 104 | |

| 87 | |

| 67 |