- Power BI forums

- Updates

- News & Announcements

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Power Platform Integration - Better Together!

- Power Platform Integrations (Read-only)

- Power Platform and Dynamics 365 Integrations (Read-only)

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Community Connections & How-To Videos

- COVID-19 Data Stories Gallery

- Themes Gallery

- Data Stories Gallery

- R Script Showcase

- Webinars and Video Gallery

- Quick Measures Gallery

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas

- Issues

- Issues

- Events

- Upcoming Events

- Community Blog

- Power BI Community Blog

- Custom Visuals Community Blog

- Community Support

- Community Accounts & Registration

- Using the Community

- Community Feedback

Register now to learn Fabric in free live sessions led by the best Microsoft experts. From Apr 16 to May 9, in English and Spanish.

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- Re: Circular reference calculation

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Circular reference calculation

Column A: Initial stock

Column B: Production

Column C: Market

Column 😧 Min(A+B,C)

Column E: A+B - D

This all works ok, but the opening stock for each row in Column A needs to be Column E from the previous period.

So Column A (row n) = Column E (row n-1)

Of course when I try to create this I land up with a circular error( E is dependant on A)

This is of course a trivial excel calculation - the question is ... can it be done in powerbi in some way ?

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Generally recursive calculations can be replicated non-recursively using a combination of cumulative measures, as measures and calculated columns can't self-reference.

See sample model here:

https://www.dropbox.com/s/9zqbq4gvhsg9bba/Circular%20reference%20calculation.pbix?dl=0

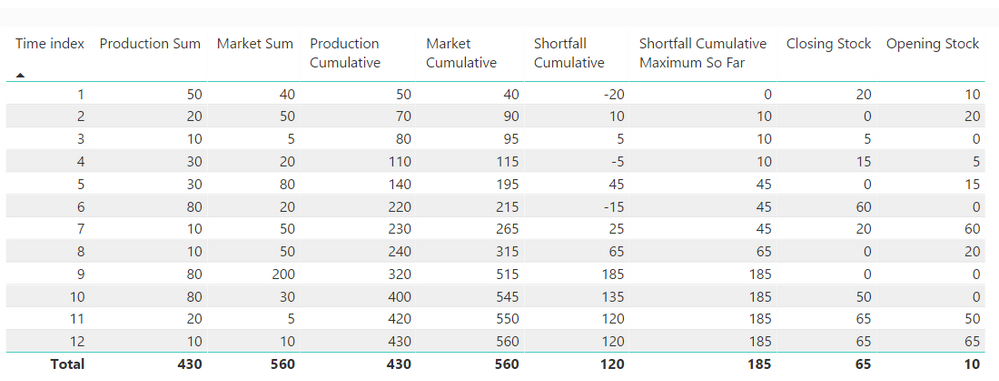

This is the output:

To produce this, let's suppose these are your two source tables:

'Initial Stock' table

Data table

Then this series of measures will produce your closing and opening stock by period:

Initial Stock Measure = SUM ( 'Initial Stock'[Intial Stock] ) // This measure should be constant over time and represents Stock at time zero Production Sum = SUM ( Data[Production] ) Market Sum = SUM ( Data[Market] ) Production Cumulative = CALCULATE ( [Production Sum], FILTER ( ALL ( Data[Time index] ), Data[Time index] <= MAX ( Data[Time index] ) ) ) Market Cumulative = CALCULATE ( [Market Sum], FILTER ( ALL ( Data[Time index] ), Data[Time index] <= MAX ( Data[Time index] ) ) ) Shortfall Cumulative = [Market Cumulative] - ( [Initial Stock Measure] + [Production Cumulative] ) Shortfall Cumulative Maximum So Far = MAX ( MAXX ( FILTER ( ALL ( Data[Time index] ), Data[Time index] <= MAX ( Data[Time index] ) ), [Shortfall Cumulative] ), 0 ) Closing Stock = [Initial Stock Measure] + [Production Cumulative] - [Market Cumulative] + [Shortfall Cumulative Maximum So Far] Opening Stock = CALCULATE ( [Closing Stock], FILTER ( ALL ( Data[Time index] ), Data[Time index] = MIN ( Data[Time index] ) - 1 ) )

Anyway, this is just an example to illustrate it can be done 🙂

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Generally recursive calculations can be replicated non-recursively using a combination of cumulative measures, as measures and calculated columns can't self-reference.

See sample model here:

https://www.dropbox.com/s/9zqbq4gvhsg9bba/Circular%20reference%20calculation.pbix?dl=0

This is the output:

To produce this, let's suppose these are your two source tables:

'Initial Stock' table

Data table

Then this series of measures will produce your closing and opening stock by period:

Initial Stock Measure = SUM ( 'Initial Stock'[Intial Stock] ) // This measure should be constant over time and represents Stock at time zero Production Sum = SUM ( Data[Production] ) Market Sum = SUM ( Data[Market] ) Production Cumulative = CALCULATE ( [Production Sum], FILTER ( ALL ( Data[Time index] ), Data[Time index] <= MAX ( Data[Time index] ) ) ) Market Cumulative = CALCULATE ( [Market Sum], FILTER ( ALL ( Data[Time index] ), Data[Time index] <= MAX ( Data[Time index] ) ) ) Shortfall Cumulative = [Market Cumulative] - ( [Initial Stock Measure] + [Production Cumulative] ) Shortfall Cumulative Maximum So Far = MAX ( MAXX ( FILTER ( ALL ( Data[Time index] ), Data[Time index] <= MAX ( Data[Time index] ) ), [Shortfall Cumulative] ), 0 ) Closing Stock = [Initial Stock Measure] + [Production Cumulative] - [Market Cumulative] + [Shortfall Cumulative Maximum So Far] Opening Stock = CALCULATE ( [Closing Stock], FILTER ( ALL ( Data[Time index] ), Data[Time index] = MIN ( Data[Time index] ) - 1 ) )

Anyway, this is just an example to illustrate it can be done 🙂

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Awesome approach !!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Great approach. However, I see that the "back order" are shortshipped, therefore some orders (market) are lost and we have 65 units at the end. What do we need to change in the formulas to allow stock to be shipped at a later date when available ? (therefore end with a zero closing stock). Tks

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Much appreciated!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

You should not write these as columns - use measures instead. Do you have some way to identify the order of the rows? E.g. A date? You will need this - power pivot is a database, not a spreadsheet and hence there's is no Implied order of the rows.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

And yes the table has a date column. I could also generate an index.

Helpful resources

Microsoft Fabric Learn Together

Covering the world! 9:00-10:30 AM Sydney, 4:00-5:30 PM CET (Paris/Berlin), 7:00-8:30 PM Mexico City

Power BI Monthly Update - April 2024

Check out the April 2024 Power BI update to learn about new features.

| User | Count |

|---|---|

| 114 | |

| 99 | |

| 82 | |

| 70 | |

| 60 |

| User | Count |

|---|---|

| 149 | |

| 114 | |

| 107 | |

| 89 | |

| 67 |