- Power BI forums

- Updates

- News & Announcements

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Power Platform Integration - Better Together!

- Power Platform Integrations (Read-only)

- Power Platform and Dynamics 365 Integrations (Read-only)

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Community Connections & How-To Videos

- COVID-19 Data Stories Gallery

- Themes Gallery

- Data Stories Gallery

- R Script Showcase

- Webinars and Video Gallery

- Quick Measures Gallery

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas

- Issues

- Issues

- Events

- Upcoming Events

- Community Blog

- Power BI Community Blog

- Custom Visuals Community Blog

- Community Support

- Community Accounts & Registration

- Using the Community

- Community Feedback

Register now to learn Fabric in free live sessions led by the best Microsoft experts. From Apr 16 to May 9, in English and Spanish.

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- Balance Sheet in Matrix format with time period dr...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Balance Sheet in Matrix format with time period drilldown?

Excel file is here with two tabs, data, and Desired Output: https://drive.google.com/open?id=1s7lSQ15dhHeIJryeQ2Op6h2-lzLqPvo6

Data is also posted below. The problem I'm running into on a few different fronts. The MAXX measure I use is effective at the lowest level of the hierarchy:

MAXX Measure =

CALCULATE(

MAXX(

GROUPBY('Management Company Balance Sheet','Management Company Balance Sheet'[Month],'Management Company Balance Sheet'[Value - Items]),

'Management Company Balance Sheet'[Value - Items])

)

but then doesn't subtotal. SUMX was problematic, which is why I switched to MAXX. I'm not that familiar with SWITCH(TRUE(). . .) but think that could be the solution.

| Category | Group | Sub-Category | Item Description | Balance Sheet Item | Calendar Quarter | Calendar Year | Table Value | SUM Measure | MAXX Measure |

| Assets | Current Assets | Cash and Cash Equivalents | Item | Bank2 | Q3 | 2019 | $585,559 | $585,559 | $585,559 |

| Assets | Current Assets | Cash and Cash Equivalents | Item | Bank1 | Q1 | 2019 | $1,220,050 | $1,220,050 | $435,017 |

| Assets | Current Assets | Cash and Cash Equivalents | Item | Bank1 | Q2 | 2019 | $1,305,050 | $1,305,050 | $435,017 |

| Assets | Current Assets | Cash and Cash Equivalents | Item | Bank1 | Q3 | 2019 | $435,017 | $435,017 | $435,017 |

| Equity | Shareholders' Equity | Net Income | Item | Net Income - Balance Sheet | Q3 | 2019 | $427,060 | $427,060 | $427,060 |

| Equity | Shareholders' Equity | Owners' Equity | Item | Owner1 - Equity | Q1 | 2019 | $1,050,000 | $1,050,000 | $350,000 |

| Equity | Shareholders' Equity | Owners' Equity | Item | Owner1 - Equity | Q2 | 2019 | $1,050,000 | $1,050,000 | $350,000 |

| Equity | Shareholders' Equity | Owners' Equity | Item | Owner1 - Equity | Q3 | 2019 | $350,000 | $350,000 | $350,000 |

| Assets | Current Assets | Cash and Cash Equivalents | Item | Bank1 | Q4 | 2018 | $850,050 | $850,050 | $300,017 |

| Equity | Shareholders' Equity | Owners' Equity | Item | Owner1 - Equity | Q4 | 2018 | $850,000 | $850,000 | $300,000 |

| Assets | Current Assets | Cash and Cash Equivalents | Item | Bank1 | Q2 | 2018 | $450,047 | $450,047 | $250,017 |

| Assets | Current Assets | Cash and Cash Equivalents | Item | Bank1 | Q3 | 2018 | $750,050 | $750,050 | $250,017 |

| Equity | Shareholders' Equity | Owners' Equity | Item | Owner1 - Equity | Q2 | 2018 | $450,000 | $450,000 | $250,000 |

| Equity | Shareholders' Equity | Owners' Equity | Item | Owner1 - Equity | Q3 | 2018 | $750,000 | $750,000 | $250,000 |

| Equity | Shareholders' Equity | Net Income | Item | Net Income - Balance Sheet | Q2 | 2019 | ($21,456) | ($21,456) | $51,042 |

| Assets | Current Assets | Cash and Cash Equivalents | Item | Bank2 | Q2 | 2019 | $150,003 | $150,003 | $50,001 |

| Equity | Shareholders' Equity | Net Income | Item | Net Income - Balance Sheet | Q1 | 2019 | $56,241 | $56,241 | $47,071 |

| Assets | Current Assets | Cash and Cash Equivalents | Item | Bank2 | Q1 | 2019 | $0 | $0 | $0 |

| Assets | Current Assets | Cash and Cash Equivalents | Item | Bank2 | Q2 | 2018 | $0 | $0 | $0 |

| Assets | Current Assets | Cash and Cash Equivalents | Item | Bank2 | Q3 | 2018 | $0 | $0 | $0 |

| Assets | Current Assets | Cash and Cash Equivalents | Item | Bank2 | Q4 | 2018 | $0 | $0 | $0 |

| Equity | Shareholders' Equity | Owners' Equity | Item | Owner2 - Equity | Q1 | 2019 | $0 | $0 | $0 |

| Equity | Shareholders' Equity | Owners' Equity | Item | Owner2 - Equity | Q2 | 2018 | $0 | $0 | $0 |

| Equity | Shareholders' Equity | Owners' Equity | Item | Owner2 - Equity | Q2 | 2019 | $0 | $0 | $0 |

| Equity | Shareholders' Equity | Owners' Equity | Item | Owner2 - Equity | Q3 | 2018 | $0 | $0 | $0 |

| Equity | Shareholders' Equity | Owners' Equity | Item | Owner2 - Equity | Q3 | 2019 | $0 | $0 | $0 |

| Equity | Shareholders' Equity | Owners' Equity | Item | Owner2 - Equity | Q4 | 2018 | $0 | $0 | $0 |

| Equity | Shareholders' Equity | Owners' Equity | Item | Retained Earnings | Q2 | 2018 | $0 | $0 | $0 |

| Equity | Shareholders' Equity | Owners' Equity | Item | Retained Earnings | Q3 | 2018 | $0 | $0 | $0 |

| Equity | Shareholders' Equity | Owners' Equity | Item | Retained Earnings | Q4 | 2018 | $0 | $0 | $0 |

| Category total | Summary | Total | Total Assets | Q1 | 2019 | $1,220,050 | |||

| Category total | Summary | Total | Total Assets | Q2 | 2018 | $450,047 | |||

| Category total | Summary | Total | Total Assets | Q2 | 2019 | $1,455,053 | |||

| Category total | Summary | Total | Total Assets | Q3 | 2018 | $750,050 | |||

| Category total | Summary | Total | Total Assets | Q3 | 2019 | $1,020,575 | |||

| Category total | Summary | Total | Total Assets | Q4 | 2018 | $850,050 | |||

| Category total | Summary | Total | Total Liabilities and Equity | Q1 | 2019 | $534,346 | |||

| Category total | Summary | Total | Total Liabilities and Equity | Q2 | 2018 | $324,746 | |||

| Category total | Summary | Total | Total Liabilities and Equity | Q2 | 2019 | $456,650 | |||

| Category total | Summary | Total | Total Liabilities and Equity | Q3 | 2018 | $487,005 | |||

| Category total | Summary | Total | Total Liabilities and Equity | Q3 | 2019 | $586,428 | |||

| Category total | Summary | Total | Total Liabilities and Equity | Q4 | 2018 | $345,334 | |||

| Group total | Summary | Sub-Total | Total Current Assets | Q1 | 2019 | $1,220,050 | |||

| Group total | Summary | Sub-Total | Total Current Assets | Q2 | 2018 | $450,047 | |||

| Group total | Summary | Sub-Total | Total Current Assets | Q2 | 2019 | $1,455,053 | |||

| Group total | Summary | Sub-Total | Total Current Assets | Q3 | 2018 | $750,050 | |||

| Group total | Summary | Sub-Total | Total Current Assets | Q3 | 2019 | $1,020,575 | |||

| Group total | Summary | Sub-Total | Total Current Assets | Q4 | 2018 | $850,050 | |||

| Group total | Summary | Sub-Total | Total Equity | Q1 | 2019 | $534,346 | |||

| Group total | Summary | Sub-Total | Total Equity | Q2 | 2018 | $324,746 | |||

| Group total | Summary | Sub-Total | Total Equity | Q2 | 2019 | $456,650 | |||

| Group total | Summary | Sub-Total | Total Equity | Q3 | 2018 | $487,005 | |||

| Group total | Summary | Sub-Total | Total Equity | Q3 | 2019 | $586,428 | |||

| Group total | Summary | Sub-Total | Total Equity | Q4 | 2018 | $345,334 | |||

| Sub-category total | Summary | Sub-Sub-Total | Total Bank Accounts | Q1 | 2019 | $1,220,050 | |||

| Sub-category total | Summary | Sub-Sub-Total | Total Bank Accounts | Q2 | 2018 | $450,047 | |||

| Sub-category total | Summary | Sub-Sub-Total | Total Bank Accounts | Q2 | 2019 | $1,455,053 | |||

| Sub-category total | Summary | Sub-Sub-Total | Total Bank Accounts | Q3 | 2018 | $750,050 | |||

| Sub-category total | Summary | Sub-Sub-Total | Total Bank Accounts | Q3 | 2019 | $1,020,575 | |||

| Sub-category total | Summary | Sub-Sub-Total | Total Bank Accounts | Q4 | 2018 | $850,050 | |||

| Equity | Shareholders' Equity | Net Income | Item | Net Income - Balance Sheet | Q2 | 2018 | ($125,254) | ($125,254) | ($31,494) |

| Equity | Shareholders' Equity | Net Income | Item | Net Income - Balance Sheet | Q3 | 2018 | ($262,995) | ($262,995) | ($60,230) |

| Equity | Shareholders' Equity | Net Income | Item | Net Income - Balance Sheet | Q4 | 2018 | ($504,666) | ($504,666) | ($147,541) |

| Equity | Shareholders' Equity | Owners' Equity | Item | Retained Earnings | Q1 | 2019 | ($571,895) | ($571,895) | ($190,632) |

| Equity | Shareholders' Equity | Owners' Equity | Item | Retained Earnings | Q2 | 2019 | ($571,895) | ($571,895) | ($190,632) |

| Equity | Shareholders' Equity | Owners' Equity | Item | Retained Earnings | Q3 | 2019 | ($190,632) | ($190,632) | ($190,632) |

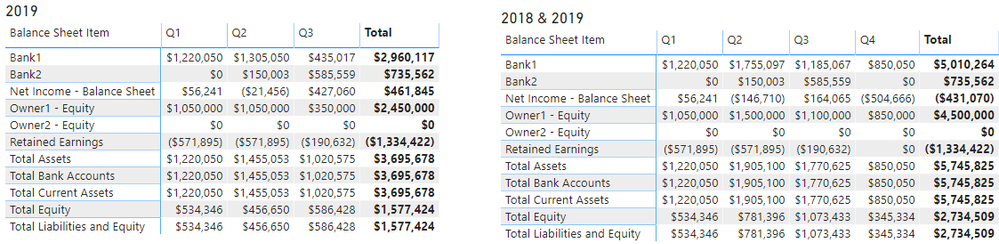

Desired output when time period is drilled down to Quarters:

| Balance Sheet Item | 2019-Q1 | 2019-Q2 | 2019-Q3 |

| Bank1 | 435,017 | 435,017 | 435,017 |

| Bank2 | - | 50,001 | 585,559 |

| Cash & Cash Equivalents | 435,017 | 485,018 | 1,020,575 |

| Current Assets | 435,017 | 485,018 | 1,020,575 |

| Total Assets | 435,017 | 485,018 | 1,020,575 |

| Liabilities | - | - | - |

| Total Liabilities | - | - | - |

| Owner1 - Equity | 350,000 | 350,000 | 350,000 |

| Owner2 - Equity | - | - | - |

| Owner's Equity | 350,000 | 350,000 | 350,000 |

| Retained Earnings | (190,632) | (190,632) | (190,632) |

| Net Income - Balance Sheet | 28,147 | (74,268) | 427,060 |

| Total Equity | 187,515 | 85,100 | 586,428 |

Desired output when drilled up to Year:

| Balance Sheet Item | 2019 |

| Bank1 | 435,017 |

| Bank2 | 585,559 |

| Cash & Cash Equivalents | 1,020,575 |

| Current Assets | 1,020,575 |

| Total Assets | 1,020,575 |

| Liabilities | - |

| Total Liabilities | - |

| Owner1 - Equity | 350,000 |

| Owner2 - Equity | - |

| Owner's Equity | 350,000 |

| Retained Earnings | (190,632) |

| Net Income - Balance Sheet | 427,060 |

| Total Equity | 586,428 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @mrothschild ,

I don't get you. I find that some values of Balance Sheet Items in the expected output table is not in the original table, like "Cash & Cash Equivalents" and "Owner's Equity". They are in the "Sub-category" column. And in the Matrix, it will sum the values based on the values in the "Row" field automatically. So you want to re-create the vaules? Or you want to show the values for 2019?

I create a sample to calculate total values in 2019.

Measure = CALCULATE(SUM('Management Company Balance Sheet'[Table Value]),FILTER('Management Company Balance Sheet','Management Company Balance Sheet'[Calendar Year] = 2019))Best Regards,

Xue Ding

If this post helps, then please consider Accept it as the solution to help the other members find it more quickly.

Xue Ding

If this post helps, then please consider Accept it as the solution to help the other members find it more quickly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

These are "stock" numbers, as opposed to "flow" numbers. They are a snapshot of what's in the account(s) at a given time, so they do not sum across columns.

So to simplify, imagine you had $100 in one bank and $50 in another bank, and you owned $100 of art in Q3. In Q4, you received $75, and you put it in all three accounts equally. So you're totals for Q4 are $125, $75, and $100, respectively - note that Total Assets shown below cannot be GRAND TOTAL, because you'll have liabilities/equity also, so say, $25 in outstanding credit card balance

The desired format in Quarterly drill down would be the table below. For a yearly drill up, Q4 = last period of the year, so it would just show those totals, with the column header showing 2019.

But, I also want to be able to drill up/down by rows, so that I show only Total Assets, Total Liabilities, and Total Equity. But I'm guessing in your matrix, if one were to drill up by rows that would result in double-counting of total assets, which is probably the most significant problem I'm facing.

| TIME | Q3 | Q4 |

| Assets Header | ||

| Bank1 | $100 | $125 |

| Bank2 | $50 | $75 |

| Sub-total Cash | $150 | $200 |

| Art | $75 | $100 |

| Total Assets | $225 | $300 |

| Liabilities Header | ||

| Credit Card balances | $25 | $25 |

| Total Liabilities | $25 | $25 |

| Equity Header | ||

| Spouse1 Equity | $100 | $137.5 |

| Spouse2 Equity | $100 | $137.5 |

| Total Spouse Equity | $200 | $275 |

| Total Equity | $200 | $275 |

| Total Liabilites and Equity | $225 | $300 |

Helpful resources

Microsoft Fabric Learn Together

Covering the world! 9:00-10:30 AM Sydney, 4:00-5:30 PM CET (Paris/Berlin), 7:00-8:30 PM Mexico City

Power BI Monthly Update - April 2024

Check out the April 2024 Power BI update to learn about new features.

| User | Count |

|---|---|

| 111 | |

| 100 | |

| 80 | |

| 64 | |

| 58 |

| User | Count |

|---|---|

| 148 | |

| 111 | |

| 93 | |

| 84 | |

| 66 |