- Power BI forums

- Updates

- News & Announcements

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Power Platform Integration - Better Together!

- Power Platform Integrations (Read-only)

- Power Platform and Dynamics 365 Integrations (Read-only)

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Community Connections & How-To Videos

- COVID-19 Data Stories Gallery

- Themes Gallery

- Data Stories Gallery

- R Script Showcase

- Webinars and Video Gallery

- Quick Measures Gallery

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas

- Issues

- Issues

- Events

- Upcoming Events

- Community Blog

- Power BI Community Blog

- Custom Visuals Community Blog

- Community Support

- Community Accounts & Registration

- Using the Community

- Community Feedback

Register now to learn Fabric in free live sessions led by the best Microsoft experts. From Apr 16 to May 9, in English and Spanish.

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- Balance Sheet Running Balance sheet type/Account/Y...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Balance Sheet Running Balance sheet type/Account/Year/period

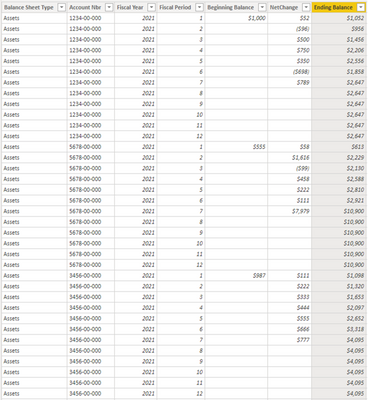

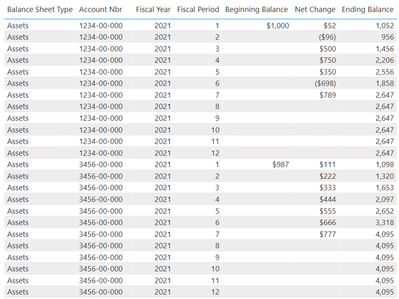

I have searched and cant find something that works for me. I have a table im calling balance sheet data and it is structured kind of like the paste below. I am trying to calculate the ending balance for each balancesheettype/Account/Fiscalyear/fiscalperiod

The pseudo code would be the following:

1. If Fiscal period = 1 then ending balance = beginning balance + Net change

2. If fiscal period is > 1 then ending balance = ending balance from previous + netchange

Not sure if this is enough information to make my question clear. But I am struggling with how to get this done in Mcode.

Thanks for your help

Then when i have the ending balances for all the individuals, I will want to do visuals that can pull it for the month, QTR and year.

| Balance Sheet Type | Account Nbr | Fiscal Year | Fiscal Period | Beginning Balance | NetChange | Ending Balance |

| Assets | 1234-00-000 | 2021 | 1 | $1,000.00 | $52.00 | |

| Assets | 1234-00-000 | 2021 | 2 | -$96.00 | ||

| Assets | 1234-00-000 | 2021 | 3 | $500.00 | ||

| Assets | 1234-00-000 | 2021 | 4 | $750.00 | ||

| Assets | 1234-00-000 | 2021 | 5 | $350.00 | ||

| Assets | 1234-00-000 | 2021 | 6 | -$698.00 | ||

| Assets | 1234-00-000 | 2021 | 7 | $789.00 | ||

| Assets | 1234-00-000 | 2021 | 8 | |||

| Assets | 1234-00-000 | 2021 | 9 | |||

| Assets | 1234-00-000 | 2021 | 10 | |||

| Assets | 1234-00-000 | 2021 | 11 | |||

| Assets | 1234-00-000 | 2021 | 12 | |||

| Assets | 5678-00-000 | 2021 | 1 | $555.00 | $58.00 | |

| Assets | 5678-00-000 | 2021 | 2 | $1,616.00 | ||

| Assets | 5678-00-000 | 2021 | 3 | -$99.00 | ||

| Assets | 5678-00-000 | 2021 | 4 | $458.00 | ||

| Assets | 5678-00-000 | 2021 | 5 | $222.00 | ||

| Assets | 5678-00-000 | 2021 | 6 | $111.00 | ||

| Assets | 5678-00-000 | 2021 | 7 | $7,979.00 | ||

| Assets | 5678-00-000 | 2021 | 8 | |||

| Assets | 5678-00-000 | 2021 | 9 | |||

| Assets | 5678-00-000 | 2021 | 10 | |||

| Assets | 5678-00-000 | 2021 | 11 | |||

| Assets | 5678-00-000 | 2021 | 12 | |||

| Assets | 3456-00-000 | 2021 | 1 | $987.00 | $111.00 | |

| Assets | 3456-00-000 | 2021 | 2 | $222.00 | ||

| Assets | 3456-00-000 | 2021 | 3 | $333.00 | ||

| Assets | 3456-00-000 | 2021 | 4 | $444.00 | ||

| Assets | 3456-00-000 | 2021 | 5 | $555.00 | ||

| Assets | 3456-00-000 | 2021 | 6 | $666.00 | ||

| Assets | 3456-00-000 | 2021 | 7 | $777.00 | ||

| Assets | 3456-00-000 | 2021 | 8 | |||

| Assets | 3456-00-000 | 2021 | 9 | |||

| Assets | 3456-00-000 | 2021 | 10 | |||

| Assets | 3456-00-000 | 2021 | 11 | |||

| Assets | 3456-00-000 | 2021 | 12 |

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Here's a DAX solution. Calculated column:

Ending Balance =

VAR vAccount = Table1[Account Nbr]

VAR vYear = Table1[Fiscal Year]

VAR vPeriod = Table1[Fiscal Period]

VAR vBegBal =

CALCULATE (

SUM ( Table1[Beginning Balance] ),

ALLEXCEPT ( Table1, Table1[Account Nbr], Table1[Fiscal Year] ),

Table1[Fiscal Period] = 1

)

VAR vTable =

FILTER (

Table1,

Table1[Account Nbr] = vAccount

&& Table1[Fiscal Year] = vYear

&& Table1[Fiscal Period] <= vPeriod

)

VAR vResult =

vBegBal + SUMX ( vTable, Table1[NetChange] )

RETURN

vResult

Did I answer your question? Mark my post as a solution!

Proud to be a Super User!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When using the DATESYTD function (or any time intelligence function), be sure to use a date table that has a relationship with the fact table. You can create a date column in the fact table and create a relationship using the date column. Here's the measure in case anyone is interested:

Ending Balance =

CALCULATE (

SUM ( Table1[Beginning Balance] ) + SUM ( Table1[Net Change] ),

DATESYTD ( DimDate[Date] )

)

In the visual, Fiscal Year and Fiscal Period should be from the date table.

Did I answer your question? Mark my post as a solution!

Proud to be a Super User!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thank you for your response. This is great. However, I had also found and used the DAYSYTD time intelligence function and that worked very easily. thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When using the DATESYTD function (or any time intelligence function), be sure to use a date table that has a relationship with the fact table. You can create a date column in the fact table and create a relationship using the date column. Here's the measure in case anyone is interested:

Ending Balance =

CALCULATE (

SUM ( Table1[Beginning Balance] ) + SUM ( Table1[Net Change] ),

DATESYTD ( DimDate[Date] )

)

In the visual, Fiscal Year and Fiscal Period should be from the date table.

Did I answer your question? Mark my post as a solution!

Proud to be a Super User!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Here's a DAX solution. Calculated column:

Ending Balance =

VAR vAccount = Table1[Account Nbr]

VAR vYear = Table1[Fiscal Year]

VAR vPeriod = Table1[Fiscal Period]

VAR vBegBal =

CALCULATE (

SUM ( Table1[Beginning Balance] ),

ALLEXCEPT ( Table1, Table1[Account Nbr], Table1[Fiscal Year] ),

Table1[Fiscal Period] = 1

)

VAR vTable =

FILTER (

Table1,

Table1[Account Nbr] = vAccount

&& Table1[Fiscal Year] = vYear

&& Table1[Fiscal Period] <= vPeriod

)

VAR vResult =

vBegBal + SUMX ( vTable, Table1[NetChange] )

RETURN

vResult

Did I answer your question? Mark my post as a solution!

Proud to be a Super User!

Helpful resources

Microsoft Fabric Learn Together

Covering the world! 9:00-10:30 AM Sydney, 4:00-5:30 PM CET (Paris/Berlin), 7:00-8:30 PM Mexico City

Power BI Monthly Update - April 2024

Check out the April 2024 Power BI update to learn about new features.

| User | Count |

|---|---|

| 109 | |

| 98 | |

| 77 | |

| 66 | |

| 54 |

| User | Count |

|---|---|

| 144 | |

| 104 | |

| 100 | |

| 86 | |

| 64 |