- Power BI forums

- Updates

- News & Announcements

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Power Platform Integration - Better Together!

- Power Platform Integrations (Read-only)

- Power Platform and Dynamics 365 Integrations (Read-only)

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Community Connections & How-To Videos

- COVID-19 Data Stories Gallery

- Themes Gallery

- Data Stories Gallery

- R Script Showcase

- Webinars and Video Gallery

- Quick Measures Gallery

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas

- Issues

- Issues

- Events

- Upcoming Events

- Community Blog

- Power BI Community Blog

- Custom Visuals Community Blog

- Community Support

- Community Accounts & Registration

- Using the Community

- Community Feedback

Register now to learn Fabric in free live sessions led by the best Microsoft experts. From Apr 16 to May 9, in English and Spanish.

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- Re: Annual Returns

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Annual Returns

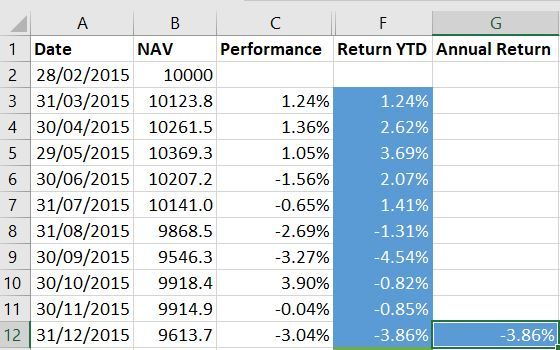

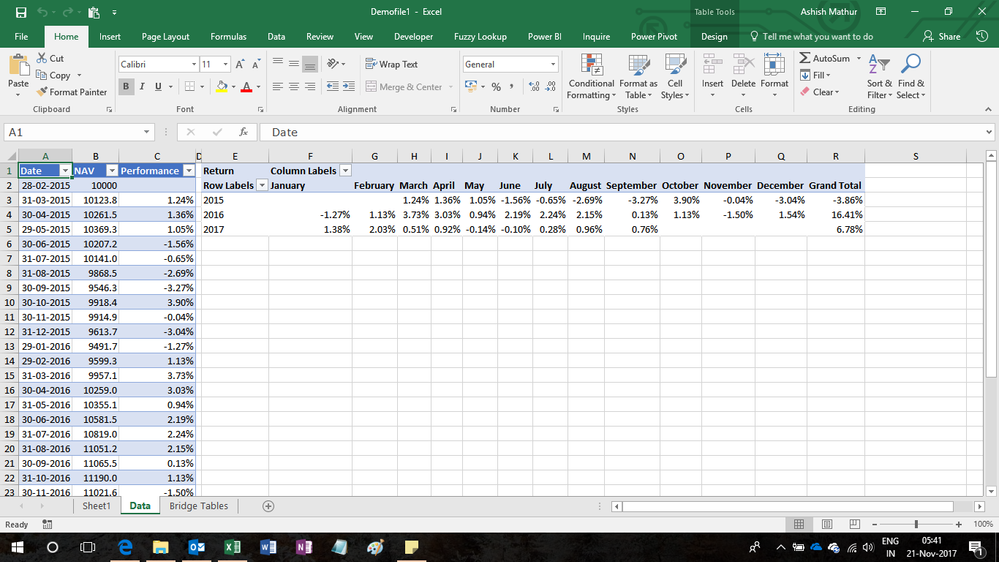

I am trying to calculate a fund's yearly performance based on monthly returns. In excel we calculate the yearly performance with the formula B12/B2-1 which gives us the total performance for 2015 of -3.86% (see attached photo). How would we calculate this formula in dax?

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Absalon29

HOw abou this one?

YTD_Zubair =

VAR Previous_YEAR_Closing =

CALCULATE (

MAX ( EMCD[Date] ),

EMCD[Date] < EARLIER ( EMCD[Date] )

&& YEAR ( EMCD[Date] )

= YEAR ( EARLIER ( EMCD[Date] ) ) - 1

)

RETURN

DIVIDE (

EMCD[Absalon EM Corporate Debt SICAV NAV],

CALCULATE (

SUM ( EMCD[Absalon EM Corporate Debt SICAV NAV] ),

EMCD[Date] = Previous_YEAR_Closing

)

)

- 1

Regards

Zubair

Please try my custom visuals

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Absalon29

Try this calculated Column to get YTD return.

=

VAR Beginning_Value =

CALCULATE (

VALUES ( Table1[NAV] ),

FILTER ( ALL ( Table1 ), Table1[Date] = MIN ( Table1[Date] ) )

)

RETURN

DIVIDE ( Table1[NAV], Beginning_Value ) - 1

Regards

Zubair

Please try my custom visuals

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

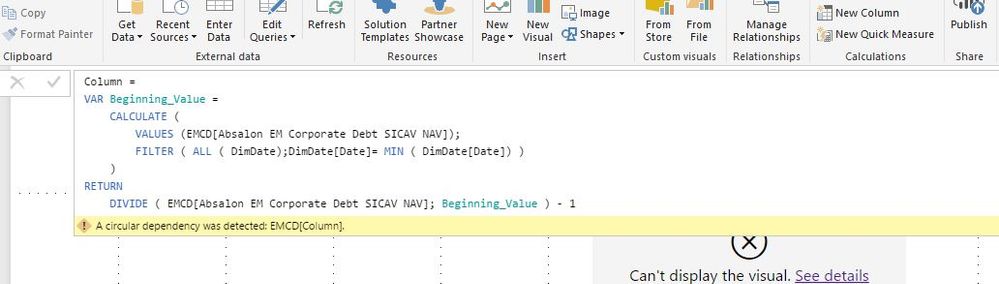

Thanks Zubair,

I'm clearly doing something wrong as I get the following error. What is causing the circular dependency? Can you point me in the right direction please?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Absalon29

Please could you share your file via Onedrive or GoogleDrive?

Regards

Zubair

Please try my custom visuals

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sorry the last one didn't seem to work hopefully this does https://1drv.ms/x/s!AiRs1BCuVWhM6EfOsWkw52AbDaq-

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Absalon29

This is an Excel file.

The problem (i believe) is in your PBIX file (the image you shared) which uses mutliple tables. I was looking for that file.

Regards

Zubair

Please try my custom visuals

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Absalon29

Please see the file attached here

The earliest month of 2015 is empty so I filtered the year 2015 out

YTD_Zub =

VAR Previous_Date =

CALCULATE (

MIN ( EMCD[Date] ),

EMCD[Date] < EARLIER ( EMCD[Date] )

&& YEAR ( EMCD[Date] ) = YEAR ( EARLIER ( EMCD[Date] ) )

)

RETURN

DIVIDE (

EMCD[Absalon EM Corporate Debt SICAV NAV],

CALCULATE (

SUM ( EMCD[Absalon EM Corporate Debt SICAV NAV] ),

EMCD[Date] = Previous_Date

)

)

- 1

Regards

Zubair

Please try my custom visuals

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thanks, that is very helpful. The answer is though not quite right because the YTD return for 2016 should be 16.41%. That is calculated by taking the nav on 30/12/2016 (the closing price for 2016) 11191.0 dividing it by the nav on 31/12/2015 9613.7 (the closing price for 2015) minus 1 . So I am looking for a variable that calculates the nav at the end of a year and divide that number by the nav at the end of previous year -1

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I thought its beginning of the year....![]()

I will fix it in a while hopefully

Regards

Zubair

Please try my custom visuals

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Absalon29

HOw abou this one?

YTD_Zubair =

VAR Previous_YEAR_Closing =

CALCULATE (

MAX ( EMCD[Date] ),

EMCD[Date] < EARLIER ( EMCD[Date] )

&& YEAR ( EMCD[Date] )

= YEAR ( EARLIER ( EMCD[Date] ) ) - 1

)

RETURN

DIVIDE (

EMCD[Absalon EM Corporate Debt SICAV NAV],

CALCULATE (

SUM ( EMCD[Absalon EM Corporate Debt SICAV NAV] ),

EMCD[Date] = Previous_YEAR_Closing

)

)

- 1

Regards

Zubair

Please try my custom visuals

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi Zubair,

Thanks so much for all your help, that worked just as I hoped. I now need to understand exactly how you have done it. The path to learning Dax is full of ups and downs!

Many thanks again.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Absalon29,

Here's another solution

Monthly NAV opening

= if(ISBLANK(LASTNONBLANK(EMCD[Date],Sum(EMCD[Absalon EM Corporate Debt SICAV NAV]))),BLANK(),if(HASONEVALUE(DimDate[MonthsofYr]),Sum(EMCD[Absalon EM Corporate Debt SICAV NAV]),CALCULATE(Sum(EMCD[Absalon EM Corporate Debt SICAV NAV]),DATESBETWEEN(DimDate[Date],FIRSTNONBLANK(EMCD[Date],Sum(EMCD[Absalon EM Corporate Debt SICAV NAV])),EOMONTH(FIRSTNONBLANK(EMCD[Date],Sum(EMCD[Absalon EM Corporate Debt SICAV NAV])),0)))))

Monthly NAV closing

=if(ISBLANK(LASTNONBLANK(EMCD[Date],Sum(EMCD[Absalon EM Corporate Debt SICAV NAV]))),BLANK(),if(HASONEVALUE(DimDate[MonthsofYr]),Sum(EMCD[Absalon EM Corporate Debt SICAV NAV]),CALCULATE(Sum(EMCD[Absalon EM Corporate Debt SICAV NAV]),DATESBETWEEN(DimDate[Date],EOMONTH(LASTNONBLANK(EMCD[Date],Sum(EMCD[Absalon EM Corporate Debt SICAV NAV])),-1)+1,LASTNONBLANK(EMCD[Date],Sum(EMCD[Absalon EM Corporate Debt SICAV NAV]))))))

MonthlyRtn

= if(HASONEVALUE(DimDate[MonthsofYr]),IF(COUNTROWS(EMCD)>0, DIVIDE([MonthlyNAV opening],[PriorMonthNAV],BLANK())-1),if(ISBLANK([MonthlyNAV opening]),BLANK(),[MonthlyNAV closing]/[MonthlyNAV opening]-1))

Regards,

Ashish Mathur

http://www.ashishmathur.com

https://www.linkedin.com/in/excelenthusiasts/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi Ashish,

Thanks. From the monthly NAV figure I am looking to calculate the cumulative yearly return which in 2015 would be 9613 /10000 -1. The calculation sadly doesn't match the correct answer I'm looking for. The Yearly figures in 2015 should be -3.86%, 2016 16.41%, YTD 2017 6.78% see attached spreadsheet which shows the calculation in excel https://1drv.ms/x/s!AiRs1BCuVWhM6FxhfrjpXpf5kU-H Also I should highlight that I am using a seperate date file and am not relying on the date in the EMCD model.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi,

You may refer to my solution in this workbook.

Hope this helps.

Regards,

Ashish Mathur

http://www.ashishmathur.com

https://www.linkedin.com/in/excelenthusiasts/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HI @Absalon29

With time and practise, you will be a master in DAX soon.

This book by Rob Collie and Avi Singh is very good as well

https://www.amazon.com/Power-Pivot-BI-Excel-2010-2016/dp/1615470395

Regards

Zubair

Please try my custom visuals

Helpful resources

Microsoft Fabric Learn Together

Covering the world! 9:00-10:30 AM Sydney, 4:00-5:30 PM CET (Paris/Berlin), 7:00-8:30 PM Mexico City

Power BI Monthly Update - April 2024

Check out the April 2024 Power BI update to learn about new features.

| User | Count |

|---|---|

| 112 | |

| 100 | |

| 76 | |

| 74 | |

| 49 |

| User | Count |

|---|---|

| 146 | |

| 108 | |

| 106 | |

| 90 | |

| 62 |