- Power BI forums

- Updates

- News & Announcements

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Power Platform Integration - Better Together!

- Power Platform Integrations (Read-only)

- Power Platform and Dynamics 365 Integrations (Read-only)

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Community Connections & How-To Videos

- COVID-19 Data Stories Gallery

- Themes Gallery

- Data Stories Gallery

- R Script Showcase

- Webinars and Video Gallery

- Quick Measures Gallery

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas

- Issues

- Issues

- Events

- Upcoming Events

- Community Blog

- Power BI Community Blog

- Custom Visuals Community Blog

- Community Support

- Community Accounts & Registration

- Using the Community

- Community Feedback

Register now to learn Fabric in free live sessions led by the best Microsoft experts. From Apr 16 to May 9, in English and Spanish.

- Power BI forums

- Forums

- Get Help with Power BI

- DAX Commands and Tips

- Re: Dynamic P&L fiscal year time intelligence for ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dynamic P&L fiscal year time intelligence for actual vs forecast vs budget vs same period last year

Hi Community,

I am trying to create a dynamic time intelligent profit and loss statement comparing actuals to forecast, budget, and the same period last year for each line item. I am using a fiscal year calendar which means the standard time intelligence measures will not work. The comparison amount (column) needs to be the variance between the two and not the amount. For example, net sales, the actual amount is 10,000 and the forecast amount is 12,000. The P&L matrix/table should show 10,000 for the actual amount and (2,000) for the forecast amount. Below is a quick picture of what I am trying to achieve:

| Line-Item | Actual | vs Forecast | vs Budget | vs SPLY |

| Net Sales | 10,000 | (2,000) | (1,000) | (3,000) |

| COGS | 4,000 | 2,000 | 1,000 | 500 |

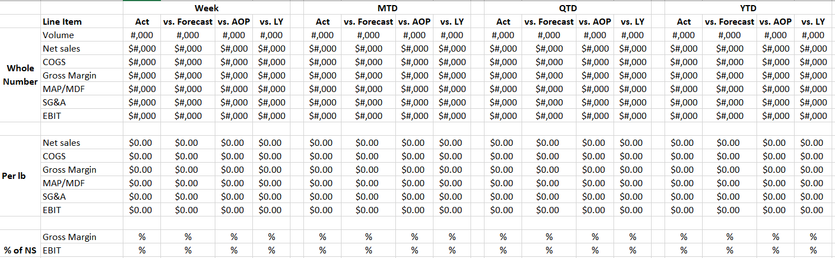

Additionally, I would like to see this on a WTD, MTD, QTD, and YTD basis in one matrix/table. Below is a screenshot of the final product I am trying to create along with the format strings:

As you can see, we have four different format strings: whole numbers, whole number dollars, decimal, and percentages.

My data model is pictured below:

Below is a picture of what I currently have:

I have created all the individual line-item measures for actuals, forecast, and budget using the measure branching technique. However, I know this is not the best way to do this because I have three measures for each line item. For example, I have a measure for actual net sales, forecast net sales, and budgeted net sales. As you can see, the forecast, budget, and SPLY measures are not variance amounts.

The actual, forecast and budget measures use the SWITCH technique which prevents me from calculating the variance because of the four different format strings and a custom time intelligence function. Below is an example of my Actuals measure:

Act HL =

SWITCH(

[Selected Account],

1, FORMAT([Volume], "#,#;(#,#);-"),

2, FORMAT([Net Sales], "$#,#;($#,#);-"),

3, FORMAT([COGS], "$#,#;($#,#);-"),

4, FORMAT([Gross Margin], "$#,#;($#,#);-"),

5, FORMAT([MAP/MDF], "$#,#;($#,#);-"),

6, FORMAT([SG&A], "$#,#;($#,#);-"),

7, FORMAT([Combined EBIT], "$#,#;($#,#);-"),

9, FORMAT([Net Sales Rate], "$#,0.00;($#,0.00);-"),

10, FORMAT([COGS Rate], "$#,0.00;($#,0.00);-"),

11, FORMAT([Gross Margin Rate], "$#,0.00;($#,0.00);-"),

12, FORMAT([MAP/MDF Rate], "$#,0.00;($#,0.00);-"),

13, FORMAT([SG&A Rate], "$#,0.00;($#,0.00);-"),

14, FORMAT([Combined EBIT Rate], "$#,0.00;($#,0.00);-"),

16, FORMAT([GM as % of Net Sales], "0.0%;-0.0%;-"),

17, FORMAT([Combined EBIT as % of Net Sales], "0.0%;-0.0%;-")

)

This measure above is then placed into a time intelligence pattern using the SQLBI DAX Patterns for Week-related calculations. As previously mentioned, I am using a fiscal year calendar so the standard time intelligence measures will not work. For example, the Act WTD column in my matrix above is:

Act WTD =

IF (

[ShowValueForDates],

VAR LastDayOfWeekAvailable = MAX ( 'Date'[Day of Week Number] )

VAR LastFiscalYearWeekAvailable = MAX ( 'Date'[Fiscal Year Week Number] )

VAR Result =

CALCULATE (

[Act HL],

ALLEXCEPT ( 'Date', 'Date'[Working Day], 'Date'[Day of Week] ),

'Date'[Day of Week Number] <= LastDayOfWeekAvailable,

'Date'[Fiscal Year Week Number] = LastFiscalYearWeekAvailable

)

RETURN

Result

)

The matrix has 16 measures like you see above (actual + forecast + budget + SPLY = 4 x 4 = 16 measures)

Obviously this not an efficent or sustainable way to create this. I have a feeling Calculation Groups might help solve the problem. Additionally, when slicers are placed on the page, the query is slow because of the number of measures and the size of the data tables.

So community, how can I achieve the above? Thank you for taking the time to read through my question.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @lbendlin

Thank you for the response. Could you provide an example of what that would look like?

I'm only able to achieve the WTD, MTD, QTD, and YTD using one calculation group. I've never tried using more than one calculation group in a matrix before.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

yes, give calculation groups a try. They can also solve the formatting for you.

Helpful resources

Microsoft Fabric Learn Together

Covering the world! 9:00-10:30 AM Sydney, 4:00-5:30 PM CET (Paris/Berlin), 7:00-8:30 PM Mexico City

Power BI Monthly Update - April 2024

Check out the April 2024 Power BI update to learn about new features.

| User | Count |

|---|---|

| 43 | |

| 21 | |

| 20 | |

| 15 | |

| 13 |

| User | Count |

|---|---|

| 45 | |

| 41 | |

| 39 | |

| 19 | |

| 19 |