- Power BI forums

- Updates

- News & Announcements

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Power Platform Integration - Better Together!

- Power Platform Integrations (Read-only)

- Power Platform and Dynamics 365 Integrations (Read-only)

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Community Connections & How-To Videos

- COVID-19 Data Stories Gallery

- Themes Gallery

- Data Stories Gallery

- R Script Showcase

- Webinars and Video Gallery

- Quick Measures Gallery

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas

- Issues

- Issues

- Events

- Upcoming Events

- Community Blog

- Power BI Community Blog

- Custom Visuals Community Blog

- Community Support

- Community Accounts & Registration

- Using the Community

- Community Feedback

Register now to learn Fabric in free live sessions led by the best Microsoft experts. From Apr 16 to May 9, in English and Spanish.

- Power BI forums

- Forums

- Get Help with Power BI

- DAX Commands and Tips

- Average of beginning and ending total assets

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Average of beginning and ending total assets

Hi,

I need a formula to pull the values for 12/31 of the prior year based on the selected month end date. I'm trying to do a formula for return on assets and the denominator requires the average of the beginning and ending total assets. So if I select August 2021, the formula should pull in the total assets from August 2021 and December 2020 to do the average. If I select June 2020, the formula should pull in June 2020's total assets and December 2019's. I have the following but that is only pulling in the balance from last year based on the date selected and not December. Please let me know. Thanks.

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @rwong1

Try this:

Average of Total Assets =

VAR _MSD =

MAX ( 'Date'[MonthID] )

VAR _YSD =

MAX ( 'Date'[Year] )

VAR _LYED = _YSD - 1

VAR _MED = 12

VAR _A =

CALCULATE (

AVERAGEX ( VALUES ( 'Date'[Mo Cal Yr] ), [Total Assets] ),

FILTER ( ALL ( 'Date' ), 'Date'[MonthID] = 12 && 'Date'[Year] = _LYED )

)

VAR _B =

CALCULATE (

AVERAGEX ( VALUES ( 'Date'[Mo Cal Yr] ), [Total Assets] ),

FILTER ( ALL ( 'Date' ), 'Date'[MonthID] = _MSD && 'Date'[Year] = _YSD )

)

RETURN

_A + _B

If this post helps, please consider accepting it as the solution to help the other members find it more quickly.

Appreciate your Kudos!!

LinkedIn: www.linkedin.com/in/vahid-dm/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi,

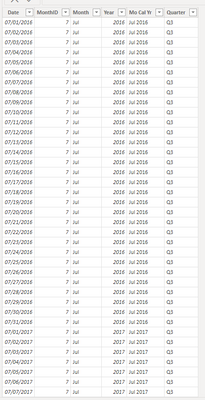

Yes I do. Please see below a screenshot:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @rwong1

Try this:

Average of Total Assets =

VAR _SD =

MAX ( 'Date'[Date] )

VAR _LYED =

DATE ( YEAR ( _SD ) - 1, 12, 31 )

RETURN

CALCULATE (

AVERAGEX ( VALUES ( 'Date'[Mo Cal Yr] ), [Total Assets] ),

FILTER ( ALL ( 'Date' ), 'Date'[Date] > _LYED && 'Date'[Date] <= _SD )

)

If this post helps, please consider accepting it as the solution to help the other members find it more quickly.

Appreciate your Kudos!!

LinkedIn: www.linkedin.com/in/vahid-dm/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @rwong1

Try this:

Average of Total Assets =

VAR _MSD =

MAX ( 'Date'[MonthID] )

VAR _YSD =

MAX ( 'Date'[Year] )

VAR _LYED = _YSD - 1

VAR _MED = 12

VAR _A =

CALCULATE (

AVERAGEX ( VALUES ( 'Date'[Mo Cal Yr] ), [Total Assets] ),

FILTER ( ALL ( 'Date' ), 'Date'[MonthID] = 12 && 'Date'[Year] = _LYED )

)

VAR _B =

CALCULATE (

AVERAGEX ( VALUES ( 'Date'[Mo Cal Yr] ), [Total Assets] ),

FILTER ( ALL ( 'Date' ), 'Date'[MonthID] = _MSD && 'Date'[Year] = _YSD )

)

RETURN

_A + _B

If this post helps, please consider accepting it as the solution to help the other members find it more quickly.

Appreciate your Kudos!!

LinkedIn: www.linkedin.com/in/vahid-dm/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thanks. This was correct. I just needed to divide the sum by 2.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi

I just tried that and it's still calculating incorrectly. Is it because I have another measure that is the below?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can you post sample data as text and expected output?

The most important parts are:

1. Sample data as text, use the table tool in the editing bar

2. Expected output from sample data

3. Explanation in words of how to get from 1. to 2.

4. Relation between your tables

Appreciate your Kudos!!

LinkedIn:www.linkedin.com/in/vahid-dm/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

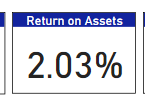

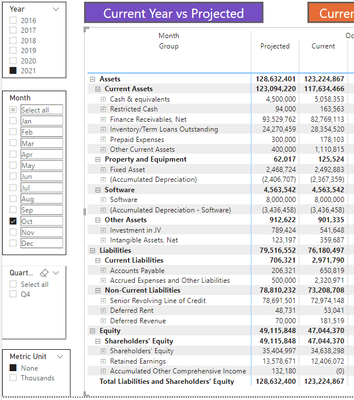

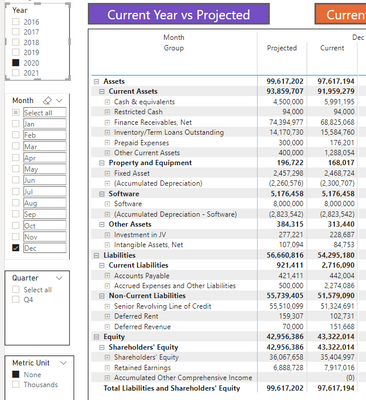

Ok. My total assets at 12/31/20 was 97,617,194. My total assets at 10/31/21 was 123,224,867. If I take the average of the 2, it comes out to 110,421,004. The net income from Jan to Oct of 2021 was 4,491,961. The return on assets should then be net income divided by average of the total assets which comes out to 110,421,004. Therefore my return on assets should be 4.07%. When using what you gave me, it came up to 2.03%. The report I'm using is the one that formed the financials so I know it works.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thanks for that. I put that in there and it didn't give me the correct calculation. Is there something else that I have to tweak?

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to emphasize that the total assets should only be from those 2 months. I don't need anything pulled in between. So if I select August 2021 from the slicer, it should only pull in August 2021 and December 2020 total assets to do the average, not from December 2020 thru August 2021.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @rwong1

Do you have Month and Year columns in the Date table? Can you share a sample of your Date table here? I want to know the columns you have in that table to provide the better solution.

Appreciate your Kudos!!

LinkedIn: www.linkedin.com/in/vahid-dm/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I attached also the slicers that are in my model:

Helpful resources

Microsoft Fabric Learn Together

Covering the world! 9:00-10:30 AM Sydney, 4:00-5:30 PM CET (Paris/Berlin), 7:00-8:30 PM Mexico City

Power BI Monthly Update - April 2024

Check out the April 2024 Power BI update to learn about new features.

| User | Count |

|---|---|

| 49 | |

| 26 | |

| 21 | |

| 15 | |

| 12 |

| User | Count |

|---|---|

| 57 | |

| 49 | |

| 44 | |

| 19 | |

| 18 |