- Power BI forums

- Updates

- News & Announcements

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Power Platform Integration - Better Together!

- Power Platform Integrations (Read-only)

- Power Platform and Dynamics 365 Integrations (Read-only)

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Community Connections & How-To Videos

- COVID-19 Data Stories Gallery

- Themes Gallery

- Data Stories Gallery

- R Script Showcase

- Webinars and Video Gallery

- Quick Measures Gallery

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas

- Issues

- Issues

- Events

- Upcoming Events

- Community Blog

- Power BI Community Blog

- Custom Visuals Community Blog

- Community Support

- Community Accounts & Registration

- Using the Community

- Community Feedback

Register now to learn Fabric in free live sessions led by the best Microsoft experts. From Apr 16 to May 9, in English and Spanish.

- Power BI forums

- Forums

- Get Help with Power BI

- DAX Commands and Tips

- Re: Accumulated yield bonds changing the date rang...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accumulated yield bonds changing the date range analysis

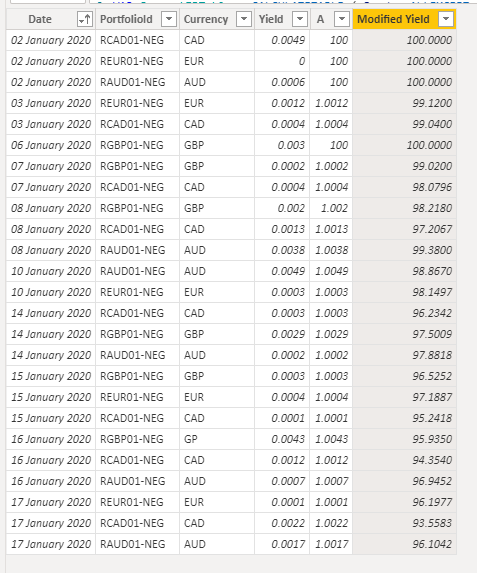

Good morning everybody, I need to get the accumulated yield for each bond shown in the Portfolioid Column for for a date range. The start and end date of analysis is variable using a slicer.

The Accumulated Yield is based on the following rule:

Time Date Yield R (Acum Yield)

0 04/01/2020 0,06% R0 = 100

1 05/01/2020 0,12% R1 = R0 * (1 + Yield Time 1) - 1

2 06/01/2020 0,04% R2 = R1 * (1 + Yield Time 2) - 1

3 07/01/2020 0,30% R3 = R2 * (1 + Yield Time 3) - 1

4 08/01/2020 0,02% R4 = R3 * (1 + Yield Time 4) - 1

In another analysis the initial date could be 06/01/2020, and for this date Ro = 100 (always the first value must be 100).

Thanks in advance for the help

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Anonymous

Here is the solution with dynamic measure https://we.tl/t-Dyjketthon

Yet there is a minor bug which I could not fix but hopfully will not cause any issue

Acum Yield =

VAR CurrentIDTable = CALCULATETABLE ( Bonds, ALLEXCEPT ( Bonds, Bonds[PortfolioId] ) )

VAR FirstDateSelected = CALCULATE ( MIN ( Bonds[Date] ), ALLSELECTED ( Bonds[Date] ) )

VAR FirstSelectedYield = MAXX ( FILTER ( CurrentIDTable, Bonds[Date] = FirstDateSelected ), Bonds[Yield] )

VAR CurrentDate = SELECTEDVALUE ( Bonds[Date] )

VAR T1 = FILTER ( CurrentIDTable, Bonds[Date] <= CurrentDate && Bonds[Date] >= FirstDateSelected )

VAR T2 = ADDCOLUMNS ( T1, "@A", IF ( Bonds[Date] = FirstDateSelected, 1, Bonds[Yield] + 1 ) )

VAR Result = PRODUCTX ( T2, [@A] )

RETURN

Result

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, @tamerj1 , I tried the solution and it works great, the only bug it´s giving me is with the last value of the RGBP01-NEG Bond. The accumulated of the last date should be 100.97, in the table it shows 100, however, if I make a line chart, the value is shown correctly. Thank you very much for the solution. I will continue working with the data, around 15 thousand rows.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@Anonymous

I woulder why despite the fact that the code removes all filters except the one from the name. I believe this has to do with Autoexist feature.

however, the first version has another bug. In case any Yield that equals to the first selected Yield will be converted to "1". The 2nd version eliminates this problem.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@Anonymous

You are right this is the but that I was talking about. Iwill have a chance to work on it tomorrow. I'll let you know if I was able to fix it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please refer to the updated code in the marked solution

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I think the bug (or problem) with the last value of the RGBP01-NEG bond, that places it as 100% is because the currency appears as GP and not as GBP, so the dynamic measure treats it as if it were a first value (100%). Thank you again for your solution. It´s very helpfull

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Anonymous

Here is the solution with dynamic measure https://we.tl/t-Dyjketthon

Yet there is a minor bug which I could not fix but hopfully will not cause any issue

Acum Yield =

VAR CurrentIDTable = CALCULATETABLE ( Bonds, ALLEXCEPT ( Bonds, Bonds[PortfolioId] ) )

VAR FirstDateSelected = CALCULATE ( MIN ( Bonds[Date] ), ALLSELECTED ( Bonds[Date] ) )

VAR FirstSelectedYield = MAXX ( FILTER ( CurrentIDTable, Bonds[Date] = FirstDateSelected ), Bonds[Yield] )

VAR CurrentDate = SELECTEDVALUE ( Bonds[Date] )

VAR T1 = FILTER ( CurrentIDTable, Bonds[Date] <= CurrentDate && Bonds[Date] >= FirstDateSelected )

VAR T2 = ADDCOLUMNS ( T1, "@A", IF ( Bonds[Date] = FirstDateSelected, 1, Bonds[Yield] + 1 ) )

VAR Result = PRODUCTX ( T2, [@A] )

RETURN

Result

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

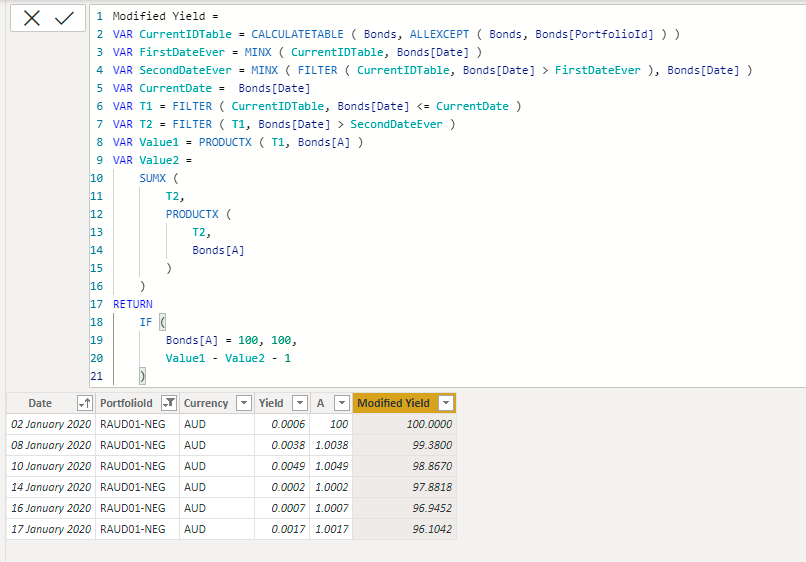

Hi @Anonymous

You did not answer my question. Therefore, I proceeded and assumed this shall be for each protfolio seperately.

Here is the sample file with the solution. https://we.tl/t-H4OhS1Eh5Q

The code is not long but for your information this is the most complex code I've ever written. I checked results and it complies to your requirement as per my undestanding.

A =

VAR CurrentIDTable = CALCULATETABLE ( Bonds, ALLEXCEPT ( Bonds, Bonds[PortfolioId] ) )

VAR FirstDateEver = MINX ( CurrentIDTable, Bonds[Date] )

RETURN

IF ( Bonds[Date] = FirstDateEver, 100, Bonds[Yield] + 1 )Modified Yield =

VAR CurrentIDTable = CALCULATETABLE ( Bonds, ALLEXCEPT ( Bonds, Bonds[PortfolioId] ) )

VAR FirstDateEver = MINX ( CurrentIDTable, Bonds[Date] )

VAR SecondDateEver = MINX ( FILTER ( CurrentIDTable, Bonds[Date] > FirstDateEver ), Bonds[Date] )

VAR CurrentDate = Bonds[Date]

VAR T1 = FILTER ( CurrentIDTable, Bonds[Date] <= CurrentDate )

VAR T2 = FILTER ( T1, Bonds[Date] > SecondDateEver )

VAR Value1 = PRODUCTX ( T1, Bonds[A] )

VAR Value2 =

SUMX (

T2,

PRODUCTX (

T2,

Bonds[A]

)

)

RETURN

IF (

Bonds[A] = 100, 100,

Value1 - Value2 - 1

)- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I really appreciate your help. Thank you.

This is the result I am tryng to get: https://docs.google.com/spreadsheets/d/1K2h5tt2oZHsEGNpGqMyZrO6i7FwpPI6PUHDL_Qo2EAk/edit?usp=sharing

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This is a sample of data

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Anonymous

wold you please just copy pate the cslues of the same in a reply so I don't have to type them manually? Or otherwise please provide a sample file. Download link would be a good option. Thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, I´ve put the link to a file in Google Drive, I hope it works.

Thank you very much

https://docs.google.com/spreadsheets/d/1K2h5tt2oZHsEGNpGqMyZrO6i7FwpPI6PUHDL_Qo2EAk/edit?usp=sharing

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@Anonymous

Please confirm the calculation shall be done for each potfolioId separately.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sorry for the delay. Yes, the calculation shall be done for each potfolioId separately. Thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@Anonymous

Did you check my solution?

Helpful resources

Microsoft Fabric Learn Together

Covering the world! 9:00-10:30 AM Sydney, 4:00-5:30 PM CET (Paris/Berlin), 7:00-8:30 PM Mexico City

Power BI Monthly Update - April 2024

Check out the April 2024 Power BI update to learn about new features.

| User | Count |

|---|---|

| 47 | |

| 26 | |

| 19 | |

| 14 | |

| 10 |

| User | Count |

|---|---|

| 57 | |

| 49 | |

| 44 | |

| 18 | |

| 18 |