- Power BI forums

- Updates

- News & Announcements

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Power Platform Integration - Better Together!

- Power Platform Integrations (Read-only)

- Power Platform and Dynamics 365 Integrations (Read-only)

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Community Connections & How-To Videos

- COVID-19 Data Stories Gallery

- Themes Gallery

- Data Stories Gallery

- R Script Showcase

- Webinars and Video Gallery

- Quick Measures Gallery

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas

- Issues

- Issues

- Events

- Upcoming Events

- Community Blog

- Power BI Community Blog

- Custom Visuals Community Blog

- Community Support

- Community Accounts & Registration

- Using the Community

- Community Feedback

Register now to learn Fabric in free live sessions led by the best Microsoft experts. From Apr 16 to May 9, in English and Spanish.

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- Re: VALUES() equivalent for multiple selection in ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

VALUES() equivalent for multiple selection in a slicer

Hi,

I am currently working on a portfolio analysis model where I need to do a specific operation on multiple selected deals.

My goal here is to be able to run the CALCULATE() on more than one selection. Currently I can do it with one selection in my slicer using the VALUES() formula. It doesn't look like VALUES() can handle more than one selection because I keep getting the error: " A table of multiple values was supplied where value was expected"

In the filter of my CALCULATE I want the DimDeals table to find the selected deals and then do the calculation only for those selected deals. What should I do to be able to CALCULATE on more than one selection? Can it be achieved in Power BI?

See below a quick example of what I am trying to do:

Sensies_MultipleDEALS =

CALCULATE(SUM([NCF]),

DimDeals[DealName]=VALUES(DimDeals_Sensies[DealName_Sensies]))

where DimDeals_Sensies is a table with all the name of the deals. I want to be able to select more than one deal.

The "real" formula is longer than that. The other deals that are not selected with have their own calculation.

DimDeals_Sensies slicer

Deal 1 Selected

Deal 2

Deal 3

Deal 4 Selected

Deal 5

By selecting the Deal 1 and the Deal 4 my measure should return the sum of the NCF only for those deals.

Thank you!

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @gLB,

I modify your formula, perhaps you can try it if suitable for your requirement.

Calculate column:

DealName = LOOKUPVALUE(DimDeals[DealName],[Deal_Index],[Deal_Index])

Measures:

Date_Loss_Select = IF(HASONEVALUE(Date_Loss[Date]),VALUES(Date_Loss[Date]),BLANK()) Loss_Select = IF(HASONEVALUE(Loss[Loss]),VALUES(Loss[Loss]),BLANK()) Before Loss Date = CALCULATE(SUM(CashFlows[CashFlow]),FILTER(ALL(CashFlows),[Deal_Index]=MAX([Deal_Index])&&CashFlows[Date]<=[Date_Loss_Select])) After Loss Date = CALCULATE(SUM(CashFlows[CashFlow])*(1-[Loss_Select]), FILTER(ALLSELECTED(CashFlows),CONTAINS(ALLSELECTED(DimDeals),DimDeals[Deal_Index],CashFlows[Deal_Index])), FILTER(ALL(CashFlows),[Deal_Index]=MAX([Deal_Index])&&CashFlows[Date]>[Date_Loss_Select])) Except Selected Loss = CALCULATE(SUM(CashFlows[CashFlow]), FILTER(ALL(CashFlows),NOT(CONTAINS(DimDeals_Loss,DimDeals_Loss[Index_Loss],CashFlows[Deal_Index]))), FILTER(ALL(CashFlows),[Deal_Index]=MAX([Deal_Index])&&CashFlows[Date]>[Date_Loss_Select])) Portfolio_Deals_Loss_Analysis = [Before Loss Date]+[After Loss Date]+[Except Selected Loss]

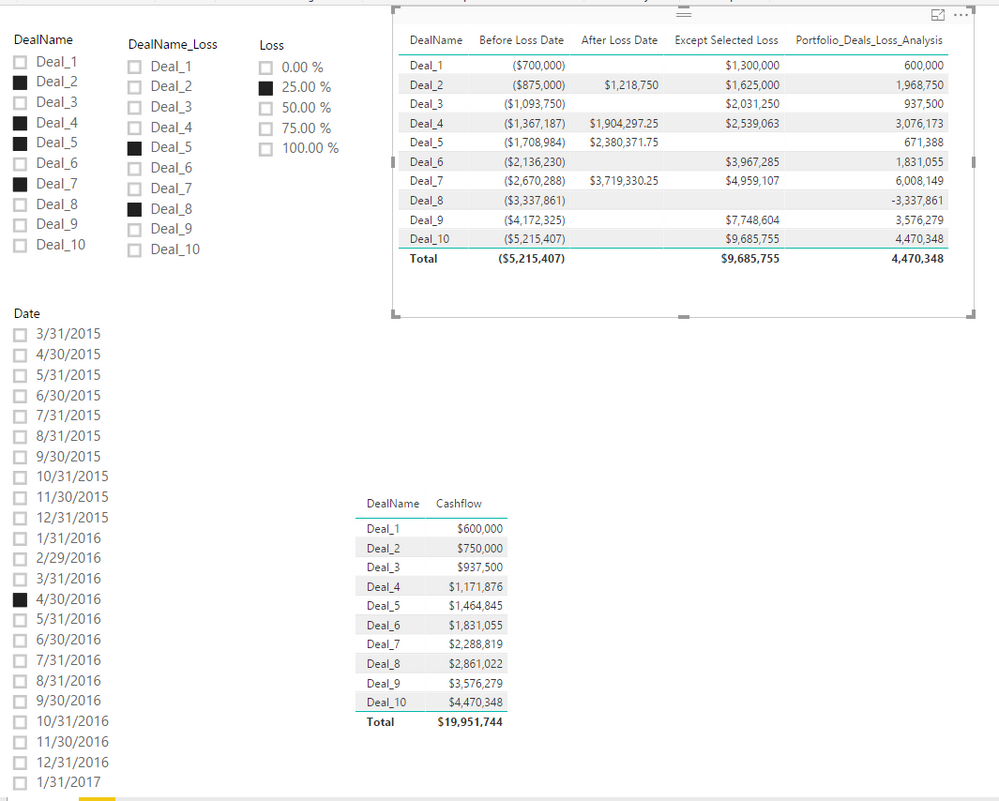

Result:

Regards,

Xiaoxin Sheng

If this post helps, please consider accept as solution to help other members find it more quickly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @gLB,

You can try to use the source table of slicer as the filter on the measure.

For example:

Sensies_MultipleDEALS = CALCULATE(SUM([NCF]),FILTER(ALL(DimDeals),CONTAINS(ALLSELECTED(DimDeals_Sensies),DimDeals_Sensies[DealName_Sensies],DimDeals[DealName])))

Regards,

Xiaoxin Sheng

If this post helps, please consider accept as solution to help other members find it more quickly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hey Xiaoxin,

Thanks for the swift reply.

It looks like the CONTAINS is good to identify more than one selection in a slicer but there is a probem.

Instead of displaying the sum of each selected deals individually, it is displaying the sum of both deals on every deals. Example below:

Deal 1 - Selected sum of cash flows is 2,000

Deal 2 - Not Selected

Deal 3 - Not Selected

Deal 4 - Selected sum of cash flows is 3,000

Deal 5 - Not Selected

What is currently displayed using your formula:

Deal 1 - 5,000

Deal 2 - 5,000

Deal 3 - 5,000

Deal 4 - 5,000

Deal 5 - 5,000

What I would like to get:

Deal 1 - 2,000

Deal 2 - 0

Deal 3 - 0

Deal 4 - 3,000

Deal 5 - 0

I really need the non-selected deals to be displayed because my next step is to do a different calculation on the non-selected deals vs selected deals.

Please let me know if you need more info to help me on this matter.

Thank you for your help!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @gLB

Is it possible to share the data and the output expected. Please load the dat and requirement to one drive and share the link.

Cheers

CheenuSing

Proud to be a Datanaut!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi CheenuSing,

Unfortunately I can't share the data because my question is related to my job and the company I work for doesn't allow to share data outside the corp.

Is there any other way I could give you more details to exactly explain what I would like my Power BI to do?

Thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hey,

sharing your data, does not necessarily mean, put your company into the hands of us data afficinados 😉

It can also mean, honor the time of all the great community members who are willing to help and create " fake sample data", but be precise enough that your data is able to support your requirement.

If your not allowed to use a public cloud like onedrive or dropbox, cust copy your fake data from Excel into the "Insert Code" object.

Regards

Tom

Did I answer your question? Mark my post as a solution, this will help others!

Proud to be a Super User!

I accept Kudos 😉

Hamburg, Germany

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CashFlows table Deal_Index Date Cashflow 1 1/31/2014 (1,000,000) 1 2/28/2014 - 1 3/31/2014 - 1 4/30/2014 - 1 5/31/2014 - 1 6/30/2014 - 1 7/31/2014 - 1 8/31/2014 - 1 9/30/2014 - 1 10/31/2014 - 1 11/30/2014 - 1 12/31/2014 - 1 1/31/2015 - 1 2/28/2015 - 1 3/31/2015 100,000 1 4/30/2015 - 1 5/31/2015 - 1 6/30/2015 - 1 7/31/2015 1 8/31/2015 - 1 9/30/2015 200,000 1 10/31/2015 - 1 11/30/2015 - 1 12/31/2015 - 1 1/31/2016 - 1 2/29/2016 - 1 3/31/2016 - 1 4/30/2016 - 1 5/31/2016 - 1 6/30/2016 400,000 1 7/31/2016 - 1 8/31/2016 - 1 9/30/2016 - 1 10/31/2016 - 1 11/30/2016 - 1 12/31/2016 - 1 1/31/2017 900,000 2 1/31/2014 (1,250,000) 2 2/28/2014 - 2 3/31/2014 - 2 4/30/2014 - 2 5/31/2014 - 2 6/30/2014 - 2 7/31/2014 - 2 8/31/2014 - 2 9/30/2014 - 2 10/31/2014 - 2 11/30/2014 - 2 12/31/2014 - 2 1/31/2015 - 2 2/28/2015 - 2 3/31/2015 125,000 2 4/30/2015 - 2 5/31/2015 - 2 6/30/2015 - 2 7/31/2015 - 2 8/31/2015 - 2 9/30/2015 250,000 2 10/31/2015 - 2 11/30/2015 - 2 12/31/2015 - 2 1/31/2016 - 2 2/29/2016 - 2 3/31/2016 - 2 4/30/2016 - 2 5/31/2016 - 2 6/30/2016 500,000 2 7/31/2016 - 2 8/31/2016 - 2 9/30/2016 - 2 10/31/2016 - 2 11/30/2016 - 2 12/31/2016 - 2 1/31/2017 1,125,000 3 1/31/2014 (1,562,500) 3 2/28/2014 - 3 3/31/2014 - 3 4/30/2014 - 3 5/31/2014 - 3 6/30/2014 - 3 7/31/2014 - 3 8/31/2014 - 3 9/30/2014 - 3 10/31/2014 - 3 11/30/2014 - 3 12/31/2014 - 3 1/31/2015 - 3 2/28/2015 - 3 3/31/2015 156,250 3 4/30/2015 - 3 5/31/2015 - 3 6/30/2015 - 3 7/31/2015 - 3 8/31/2015 - 3 9/30/2015 312,500 3 10/31/2015 - 3 11/30/2015 - 3 12/31/2015 - 3 1/31/2016 - 3 2/29/2016 - 3 3/31/2016 - 3 4/30/2016 - 3 5/31/2016 - 3 6/30/2016 625,000 3 7/31/2016 - 3 8/31/2016 - 3 9/30/2016 - 3 10/31/2016 - 3 11/30/2016 - 3 12/31/2016 - 3 1/31/2017 1,406,250 4 1/31/2014 (1,953,125) 4 2/28/2014 - 4 3/31/2014 - 4 4/30/2014 - 4 5/31/2014 - 4 6/30/2014 - 4 7/31/2014 - 4 8/31/2014 - 4 9/30/2014 - 4 10/31/2014 - 4 11/30/2014 - 4 12/31/2014 - 4 1/31/2015 - 4 2/28/2015 - 4 3/31/2015 195,313 4 4/30/2015 - 4 5/31/2015 - 4 6/30/2015 - 4 7/31/2015 - 4 8/31/2015 - 4 9/30/2015 390,625 4 10/31/2015 - 4 11/30/2015 - 4 12/31/2015 - 4 1/31/2016 - 4 2/29/2016 - 4 3/31/2016 - 4 4/30/2016 - 4 5/31/2016 - 4 6/30/2016 781,250 4 7/31/2016 - 4 8/31/2016 - 4 9/30/2016 - 4 10/31/2016 - 4 11/30/2016 - 4 12/31/2016 - 4 1/31/2017 1,757,813 5 1/31/2014 (2,441,406) 5 2/28/2014 - 5 3/31/2014 - 5 4/30/2014 - 5 5/31/2014 - 5 6/30/2014 - 5 7/31/2014 - 5 8/31/2014 - 5 9/30/2014 - 5 10/31/2014 - 5 11/30/2014 - 5 12/31/2014 - 5 1/31/2015 - 5 2/28/2015 - 5 3/31/2015 244,141 5 4/30/2015 - 5 5/31/2015 - 5 6/30/2015 - 5 7/31/2015 - 5 8/31/2015 - 5 9/30/2015 488,281 5 10/31/2015 - 5 11/30/2015 - 5 12/31/2015 - 5 1/31/2016 - 5 2/29/2016 - 5 3/31/2016 - 5 4/30/2016 - 5 5/31/2016 - 5 6/30/2016 976,563 5 7/31/2016 - 5 8/31/2016 - 5 9/30/2016 - 5 10/31/2016 - 5 11/30/2016 - 5 12/31/2016 - 5 1/31/2017 2,197,266 6 1/31/2014 (3,051,758) 6 2/28/2014 - 6 3/31/2014 - 6 4/30/2014 - 6 5/31/2014 - 6 6/30/2014 - 6 7/31/2014 - 6 8/31/2014 - 6 9/30/2014 - 6 10/31/2014 - 6 11/30/2014 - 6 12/31/2014 - 6 1/31/2015 - 6 2/28/2015 - 6 3/31/2015 305,176 6 4/30/2015 - 6 5/31/2015 - 6 6/30/2015 - 6 7/31/2015 - 6 8/31/2015 - 6 9/30/2015 610,352 6 10/31/2015 - 6 11/30/2015 - 6 12/31/2015 - 6 1/31/2016 - 6 2/29/2016 - 6 3/31/2016 - 6 4/30/2016 - 6 5/31/2016 - 6 6/30/2016 1,220,703 6 7/31/2016 - 6 8/31/2016 - 6 9/30/2016 - 6 10/31/2016 - 6 11/30/2016 - 6 12/31/2016 - 6 1/31/2017 2,746,582 7 1/31/2014 (3,814,697) 7 2/28/2014 - 7 3/31/2014 - 7 4/30/2014 - 7 5/31/2014 - 7 6/30/2014 - 7 7/31/2014 - 7 8/31/2014 - 7 9/30/2014 - 7 10/31/2014 - 7 11/30/2014 - 7 12/31/2014 - 7 1/31/2015 - 7 2/28/2015 - 7 3/31/2015 381,470 7 4/30/2015 - 7 5/31/2015 - 7 6/30/2015 - 7 7/31/2015 - 7 8/31/2015 - 7 9/30/2015 762,939 7 10/31/2015 - 7 11/30/2015 - 7 12/31/2015 - 7 1/31/2016 - 7 2/29/2016 - 7 3/31/2016 - 7 4/30/2016 - 7 5/31/2016 - 7 6/30/2016 1,525,879 7 7/31/2016 - 7 8/31/2016 - 7 9/30/2016 - 7 10/31/2016 - 7 11/30/2016 - 7 12/31/2016 - 7 1/31/2017 3,433,228 8 1/31/2014 (4,768,372) 8 2/28/2014 - 8 3/31/2014 - 8 4/30/2014 - 8 5/31/2014 - 8 6/30/2014 - 8 7/31/2014 - 8 8/31/2014 - 8 9/30/2014 - 8 10/31/2014 - 8 11/30/2014 - 8 12/31/2014 - 8 1/31/2015 - 8 2/28/2015 - 8 3/31/2015 476,837 8 4/30/2015 - 8 5/31/2015 - 8 6/30/2015 - 8 7/31/2015 - 8 8/31/2015 - 8 9/30/2015 953,674 8 10/31/2015 - 8 11/30/2015 - 8 12/31/2015 - 8 1/31/2016 - 8 2/29/2016 - 8 3/31/2016 - 8 4/30/2016 - 8 5/31/2016 - 8 6/30/2016 1,907,349 8 7/31/2016 - 8 8/31/2016 - 8 9/30/2016 - 8 10/31/2016 - 8 11/30/2016 - 8 12/31/2016 - 8 1/31/2017 4,291,534 9 1/31/2014 (5,960,464) 9 2/28/2014 - 9 3/31/2014 - 9 4/30/2014 - 9 5/31/2014 - 9 6/30/2014 - 9 7/31/2014 - 9 8/31/2014 - 9 9/30/2014 - 9 10/31/2014 - 9 11/30/2014 - 9 12/31/2014 - 9 1/31/2015 - 9 2/28/2015 - 9 3/31/2015 596,046 9 4/30/2015 - 9 5/31/2015 - 9 6/30/2015 - 9 7/31/2015 - 9 8/31/2015 - 9 9/30/2015 1,192,093 9 10/31/2015 - 9 11/30/2015 - 9 12/31/2015 - 9 1/31/2016 - 9 2/29/2016 - 9 3/31/2016 - 9 4/30/2016 - 9 5/31/2016 - 9 6/30/2016 2,384,186 9 7/31/2016 - 9 8/31/2016 - 9 9/30/2016 - 9 10/31/2016 - 9 11/30/2016 - 9 12/31/2016 - 9 1/31/2017 5,364,418 10 1/31/2014 (7,450,581) 10 2/28/2014 - 10 3/31/2014 - 10 4/30/2014 - 10 5/31/2014 - 10 6/30/2014 - 10 7/31/2014 - 10 8/31/2014 - 10 9/30/2014 - 10 10/31/2014 - 10 11/30/2014 - 10 12/31/2014 - 10 1/31/2015 - 10 2/28/2015 - 10 3/31/2015 745,058 10 4/30/2015 - 10 5/31/2015 - 10 6/30/2015 - 10 7/31/2015 - 10 8/31/2015 - 10 9/30/2015 1,490,116 10 10/31/2015 - 10 11/30/2015 - 10 12/31/2015 - 10 1/31/2016 - 10 2/29/2016 - 10 3/31/2016 - 10 4/30/2016 - 10 5/31/2016 - 10 6/30/2016 2,980,232 10 7/31/2016 - 10 8/31/2016 - 10 9/30/2016 - 10 10/31/2016 - 10 11/30/2016 - 10 12/31/2016 - 10 1/31/2017 6,705,523 DimDeals table Deal_Index DealName 1 Deal_1 2 Deal_2 3 Deal_3 4 Deal_4 5 Deal_5 6 Deal_6 7 Deal_7 8 Deal_8 9 Deal_9 10 Deal_10 DimDeals_Loss Index_Loss DealName_Loss 1 Deal_1 2 Deal_2 3 Deal_3 4 Deal_4 5 Deal_5 6 Deal_6 7 Deal_7 8 Deal_8 9 Deal_9 10 Deal_10 Date_Loss table Date 1/31/2014 2/28/2014 3/31/2014 4/30/2014 5/31/2014 6/30/2014 7/31/2014 8/31/2014 9/30/2014 10/31/2014 11/30/2014 12/31/2014 1/31/2015 2/28/2015 3/31/2015 4/30/2015 5/31/2015 6/30/2015 7/31/2015 8/31/2015 9/30/2015 10/31/2015 11/30/2015 12/31/2015 1/31/2016 2/29/2016 3/31/2016 4/30/2016 5/31/2016 6/30/2016 7/31/2016 8/31/2016 9/30/2016 10/31/2016 11/30/2016 12/31/2016 1/31/2017 Loss table Loss 0% 25% 50% 75% 100%

The goal of my measure is to simulate a future loss (Loss table) of the future cash flows after a specific date (Month-Year_Loss) for specific deals (DimDeals_Loss) in a portfolio and see the impact on the whole portfolio performance.

See below at the bottom of the post the expected results if I select Deal_3 and Deal_6 (multiple selection) in the DimDeals_Loss, select 9/30/2016 as the Date in Date_Loss table and if I select 50% Loss in the Loss table.

The results of the measure for the Deals EXCEPT Deal_3 and Deal_6 should simply be the sum of the cash flows of all the periods.

The results of the measure the Deal_3 and Deal_6 should be the sum of the cash flows prior to 9/30/2016 and HALF (50%) of the sum of the cash flows after 9/30/2016.

Portfolio_Deals_Loss_Analysis =

CALCULATE(SUM(CashFlows[CashFlow]),CashFlows[Date]<=VALUES(Date_Loss[Date]),

+

CALCULATE(SUM(CashFlows[CashFlow])*(1-VALUES(Loss[Loss])),

DimDeals[DealName]=VALUES(DimDeals_Loss[DealName_Loss]),

FILTER(CashFlows, CashFlows[Date]>VALUES(Date_Loss[Date])))

+

CALCULATE(SUM(CashFlows[CashFlow]),

DimDeals[DealName]<>VALUES(DimDeals_Loss[DealName_Loss]),

FILTER(CashFlows, CashFlows[Date]>VALUES(Date_Loss[Date])))

Expected results using the fake data sample:

Deal_1 600,000

Deal_2 750,000

Deal_3 234,375

Deal_4 1,171,875

Deal_5 1,464,844

Deal_6 457,764

Deal_7 2,288,818

Deal_8 2,861,023

Deal_9 3,576,279

Deal_10 4,470,348

Please let me know if this was clear enough and if the fake data sample inserted via the "Insert Code" object is OK.

Thanks a lot for your help guys. I appreciate it.

gLB

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @gLB,

I modify your formula, perhaps you can try it if suitable for your requirement.

Calculate column:

DealName = LOOKUPVALUE(DimDeals[DealName],[Deal_Index],[Deal_Index])

Measures:

Date_Loss_Select = IF(HASONEVALUE(Date_Loss[Date]),VALUES(Date_Loss[Date]),BLANK()) Loss_Select = IF(HASONEVALUE(Loss[Loss]),VALUES(Loss[Loss]),BLANK()) Before Loss Date = CALCULATE(SUM(CashFlows[CashFlow]),FILTER(ALL(CashFlows),[Deal_Index]=MAX([Deal_Index])&&CashFlows[Date]<=[Date_Loss_Select])) After Loss Date = CALCULATE(SUM(CashFlows[CashFlow])*(1-[Loss_Select]), FILTER(ALLSELECTED(CashFlows),CONTAINS(ALLSELECTED(DimDeals),DimDeals[Deal_Index],CashFlows[Deal_Index])), FILTER(ALL(CashFlows),[Deal_Index]=MAX([Deal_Index])&&CashFlows[Date]>[Date_Loss_Select])) Except Selected Loss = CALCULATE(SUM(CashFlows[CashFlow]), FILTER(ALL(CashFlows),NOT(CONTAINS(DimDeals_Loss,DimDeals_Loss[Index_Loss],CashFlows[Deal_Index]))), FILTER(ALL(CashFlows),[Deal_Index]=MAX([Deal_Index])&&CashFlows[Date]>[Date_Loss_Select])) Portfolio_Deals_Loss_Analysis = [Before Loss Date]+[After Loss Date]+[Except Selected Loss]

Result:

Regards,

Xiaoxin Sheng

If this post helps, please consider accept as solution to help other members find it more quickly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hey @v-shex-msft,

That did exactly what I wanted to do, you are a Power BI genius!

I did one small tweak. See below in bold. This way only the selected deals that I want to analyse with a loss get the loss calculation. Wth that the sum make sense for each deal.

After Loss Date = CALCULATE(SUM(CashFlows[CashFlow])*(1-[Loss_Select]), FILTER(ALLSELECTED(CashFlows),CONTAINS(ALLSELECTED(DimDeals_Loss),DimDeals_Loss[Index_Loss],CashFlows[Deal_Index])), FILTER(ALL(CashFlows),[Deal_Index]=MAX([Deal_Index])&&CashFlows[Date]>[Date_Loss_Select]))

My next step is to calculate a XIRR on the DealName_Loss deals to get the final XIRR impact on the portfolio while also having the individual deals XIRR.

I'll let you know if I'm also having problem with this one...

Again, thanks a lot for your help! I really appreciate it.

gLB

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The expected results of the XIRR with the sample posted earlier would be as follows.

Deal_1 20.32%

Deal_2 20.32%

Deal_3 6.01%

Deal_4 20.32%

Deal_5 20.32%

Deal_6 6.01%

Deal_7 20.32%

Deal_8 20.32%

Deal_9 20.32%

Deal_10 20.32%

Thanks,

gLB

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @v-shex-msft I have been trying to create a measure to add a column with the XIRR of the cash flows like I mentionned in my previous post. I am unable to get something out of it. The formula is different because you have to work directly with columns (values and dates) instead of measures.

Is there any way we could convert the Portfolio_Deals_Loss_Analysis into a temporary column to the table and then calculate XIRR on it?

I really don't know how to approach the XIRR scenario instead of the sum of cash flows scenario because it has a lot of steps.

Thanks!

gLB

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HI @gLB,

>>The formula is different because you have to work directly with columns (values and dates) instead of measures.

Current power bi not support to create a dynamic calculate column/table based on chosen of slicer.

Notice: slicer works on data view level(visual/measure), calculate column/table store at data model level, so slicer won't affect the calculate column/table.

Regards,

Xiaoxin Sheng

If this post helps, please consider accept as solution to help other members find it more quickly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got it. I will create a fake sample of data with the desired outputs and find a way to share it with you.

I should be able to send someting tomorrow.

Thanks a lot for your help on this,

gLB

Helpful resources

Microsoft Fabric Learn Together

Covering the world! 9:00-10:30 AM Sydney, 4:00-5:30 PM CET (Paris/Berlin), 7:00-8:30 PM Mexico City

Power BI Monthly Update - April 2024

Check out the April 2024 Power BI update to learn about new features.

| User | Count |

|---|---|

| 109 | |

| 98 | |

| 77 | |

| 66 | |

| 54 |

| User | Count |

|---|---|

| 144 | |

| 104 | |

| 100 | |

| 86 | |

| 64 |