- Power BI forums

- Updates

- News & Announcements

- Get Help with Power BI

- Desktop

- Service

- Report Server

- Power Query

- Mobile Apps

- Developer

- DAX Commands and Tips

- Custom Visuals Development Discussion

- Health and Life Sciences

- Power BI Spanish forums

- Translated Spanish Desktop

- Power Platform Integration - Better Together!

- Power Platform Integrations (Read-only)

- Power Platform and Dynamics 365 Integrations (Read-only)

- Training and Consulting

- Instructor Led Training

- Dashboard in a Day for Women, by Women

- Galleries

- Community Connections & How-To Videos

- COVID-19 Data Stories Gallery

- Themes Gallery

- Data Stories Gallery

- R Script Showcase

- Webinars and Video Gallery

- Quick Measures Gallery

- 2021 MSBizAppsSummit Gallery

- 2020 MSBizAppsSummit Gallery

- 2019 MSBizAppsSummit Gallery

- Events

- Ideas

- Custom Visuals Ideas

- Issues

- Issues

- Events

- Upcoming Events

- Community Blog

- Power BI Community Blog

- Custom Visuals Community Blog

- Community Support

- Community Accounts & Registration

- Using the Community

- Community Feedback

Register now to learn Fabric in free live sessions led by the best Microsoft experts. From Apr 16 to May 9, in English and Spanish.

- Power BI forums

- Forums

- Get Help with Power BI

- Desktop

- Measure Cumulated future Gain

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Measure Cumulated future Gain

Hello guys,

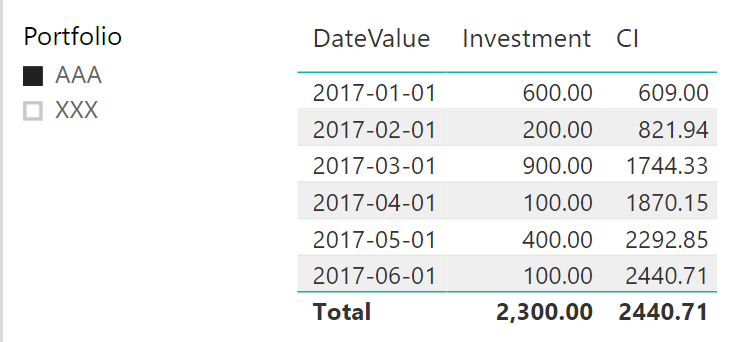

I need to Create a Measure (VLR TOTAL) according to the image below:

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hey,

some things moved faster as assumed, and here you will find my solution that now considers also the portfolio if filtered. If the portfolio is not filtered, the calculation is also executed on the level of detail, this is to avoid using wrong interest rates and investments.

Here is an Excel file that helped me to cross check the measure, set the cell c2 to FALSE if the interest rate should not be applied in the first period of the investment.

What happens within in the measure CI is basically this

Create a table that is used in SUMX

- Iterate over the level of detail (the portfolio)

- Find all investments for each level of detail

- create the product of all interest rates for each investment using PRODUCTX

- check if the interest rate has to be used in period the investment was take, yes interest rate no 1

- multiply the investment with the result of PRODUCTX

- add the result to a virtual table in a column called Inv_Compound

- create the product of all interest rates for each investment using PRODUCTX

- Find all investments for each level of detail

The check I mentioned above looks like this

IF (

DATEDIFF (

DATE ( YEAR ( vInvDate ), MONTH ( vInvDate ), 1 ),

'Interest'[DateValue],

MONTH

)

= 0,

// use just 1 if no interest rate should be applied in the period of the investment

1 + 'Interest'[InterestRate],

1 + 'Interest'[InterestRate]

)Finally use SUMX(the table described above, Inv_Compound)

Hope this is what you were looking for

Did I answer your question? Mark my post as a solution, this will help others!

Proud to be a Super User!

I accept Kudos 😉

Hamburg, Germany

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hey,

some things moved faster as assumed, and here you will find my solution that now considers also the portfolio if filtered. If the portfolio is not filtered, the calculation is also executed on the level of detail, this is to avoid using wrong interest rates and investments.

Here is an Excel file that helped me to cross check the measure, set the cell c2 to FALSE if the interest rate should not be applied in the first period of the investment.

What happens within in the measure CI is basically this

Create a table that is used in SUMX

- Iterate over the level of detail (the portfolio)

- Find all investments for each level of detail

- create the product of all interest rates for each investment using PRODUCTX

- check if the interest rate has to be used in period the investment was take, yes interest rate no 1

- multiply the investment with the result of PRODUCTX

- add the result to a virtual table in a column called Inv_Compound

- create the product of all interest rates for each investment using PRODUCTX

- Find all investments for each level of detail

The check I mentioned above looks like this

IF (

DATEDIFF (

DATE ( YEAR ( vInvDate ), MONTH ( vInvDate ), 1 ),

'Interest'[DateValue],

MONTH

)

= 0,

// use just 1 if no interest rate should be applied in the period of the investment

1 + 'Interest'[InterestRate],

1 + 'Interest'[InterestRate]

)Finally use SUMX(the table described above, Inv_Compound)

Hope this is what you were looking for

Did I answer your question? Mark my post as a solution, this will help others!

Proud to be a Super User!

I accept Kudos 😉

Hamburg, Germany

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thank you very much!

Worked perfectly.

I will study deeply the logic that compose this measure.

Thank you so much!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did I answer your question? Mark my post as a solution, this will help others!

Proud to be a Super User!

I accept Kudos 😉

Hamburg, Germany

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @fjjohann,

Following from other replies, you basically need to calculate the cumulative product of your 'growth factors'.

Gerhard Brueckl's blog (link here) had a method using summing logarithms, then mentioned that you can now use PRODUCTX.

According to your description above, you may need to do a Recursive Calculations in Power BI using DAX. Here is a similar thread, could you go to check if it helps in your scenario? ![]()

Regards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thank you very much for your reply @v-ljerr-msft.

I analyzed the link and a following formula served me in parts:

Sales ForeCast PRODUCTX: = IF (ISBLANK ([Sales]), CALCULATE (

PRODUCTX (

VALUES ('Date'),

[MultiplyBy]),

DATESBETWEEN ('Date' [DateValue], BLANK (), MAX ('Data' [DateValue]))

),

[Sales]

)

I need to consider a monthly deposit amount to be aggregated into the calculation.

I could not find a way to do that.

You would know?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hey,

maybe this can be of some helps, I "translate" your monthly deposit into my "investments" that I described some days ago:

https://docs.com/minceddata/3687/dax-using-table-iterators-to-calculate-a-future?c=B13yYP

Hope this is what you are looking for

Did I answer your question? Mark my post as a solution, this will help others!

Proud to be a Super User!

I accept Kudos 😉

Hamburg, Germany

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thank you very much @TomMartens

Your measurements work very well.

However, I am not able to take into account the following:

I have a column named Portfolio in both the InterestRates Table and the Investment Table.

I can not put Porfolio as a panel filter. The CI measure calculates all table values independent of the filter.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hey,

can you please prepare an EXCEL, that contain a minimum timeseries to show your requirement. And share the link to the Excel file, preferrable on OneDrive or Dropbox, because I've encountered problems with other fileshares.

Cheers

Did I answer your question? Mark my post as a solution, this will help others!

Proud to be a Super User!

I accept Kudos 😉

Hamburg, Germany

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hey,

thanks for sharing some data, I will have a closer look in the evening today, but I'm quite busy the next days.

So it can take until the weekend

Can you please add the expected result to your excel file.

And one question: I assume that the interestrate is a monthly one?

Cheers

Did I answer your question? Mark my post as a solution, this will help others!

Proud to be a Super User!

I accept Kudos 😉

Hamburg, Germany

Helpful resources

Microsoft Fabric Learn Together

Covering the world! 9:00-10:30 AM Sydney, 4:00-5:30 PM CET (Paris/Berlin), 7:00-8:30 PM Mexico City

Power BI Monthly Update - April 2024

Check out the April 2024 Power BI update to learn about new features.

| User | Count |

|---|---|

| 113 | |

| 99 | |

| 82 | |

| 70 | |

| 60 |

| User | Count |

|---|---|

| 149 | |

| 114 | |

| 107 | |

| 89 | |

| 67 |